Revenue €1,78 bil., 16,3 mil. passengers, EBITDA of €405,3 mil., and Net Income of €129,9 mil. in FY 2024.

Solid Revenue trends and high levels of operating profitability in the seasonally weak Q4. Proposed Dividend 0,80 Euro per share.

Athens, March 17th, 2025

AEGEAN announces its operating and financial results for fiscal year 2024.

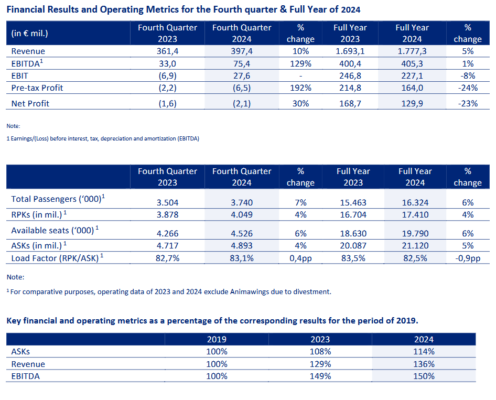

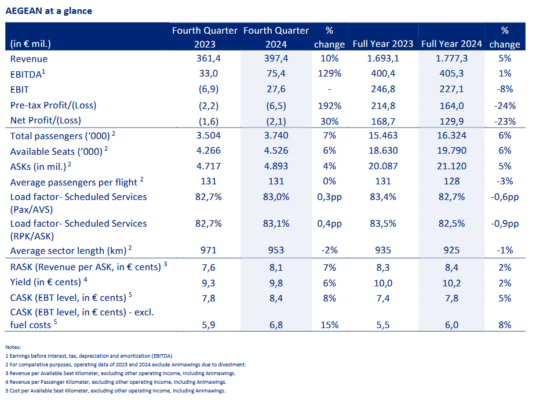

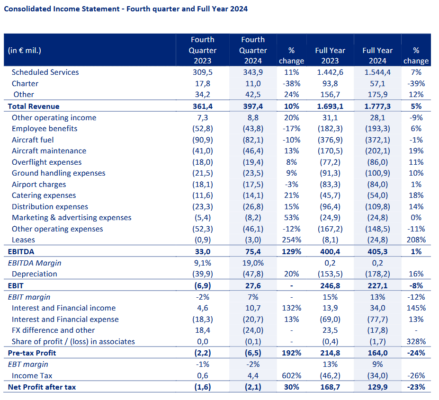

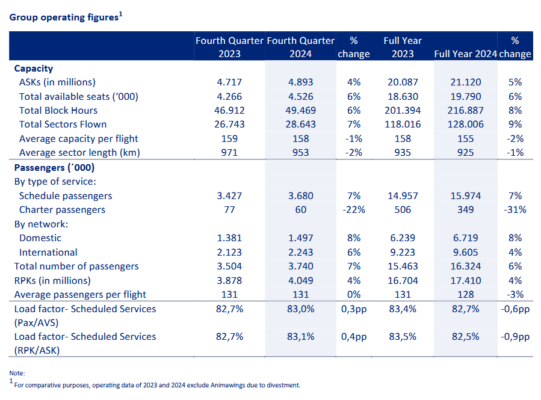

Consolidated revenue in 2024 reached €1,78 bil., up 5% compared to 2023. AEGEAN welcomed 16,3 mil. passengers, recording a 6% increase within a strong demand environment from both Greek customers and visitors to the country but also against significant challenges. AEGEAN offered 19,8 mil. available seats, 1,2 mil. more than in 2023, expanding its network reach and coverage with more frequencies, particularly during off-peak months. The load factor stood at 82,5%. For the full year EBITDA reached €405,3 mil. increased by 1% while operating profit EBIT reached €227,1 reduced by 8%. Pre-tax profits reached €164,0 mil., while net profits to €129,9 mil., 23% lower compared to 2023.

In the fourth quarter, AEGEAN welcomed 7% more passengers and reached significantly improved levels of operating profitability confirming the gradual strengthening of demand in the seasonally weaker months and validating its insistence in investing in winter development.

Revenues grew by 10% during Q4 while operating profit EBIT reached a new historical high at €27,6 mil. for the quarter. The full effect of the improved operating profitability did not reach earnings after tax as the euro slide from 1,12 vs the USD on 30/09/2024 to only 1,04 by 31/12/2024 created momentary valuation losses from forward years lease obligations. Including the contribution of the excellent 4th quarter, 2024 annual results amount to a new all-time high in revenues and passenger traffic and the second highest result in terms of earnings after tax despite the significant restrictions and challenges faced. More specifically, the mandatory early inspections of the Pratt and Whitney GTF engines on the A320/321neos grounded between 8-10 aircraft in H2 of 2024 restricted capacity growth particularly during the peak season, reduced the cost benefits from their use and created the need for additional leases. The compensation received by the company from the manufacturers is significant but not sufficient to offset all effects from the groundings. Furthermore, the geopolitical crisis in the Middle East and the resulting cancelation of service (as of late July) to Tel Aviv, Beirut and Aman brought a material reduction to international traffic during the 3rd and 4th quarter (until mid-December).

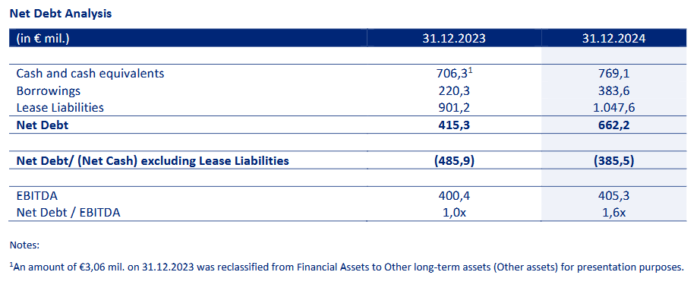

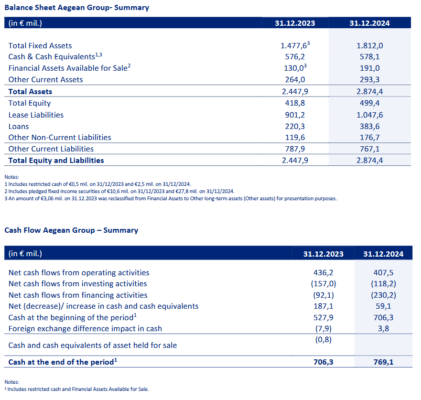

As of December 31, 2024, the company’s cash, cash equivalents, and other financial investments stood at €769,1 mil.1, higher than previous year despite the €85,4 mil. spent for the repurchase of the warrants from the Hellenic Republic. Furthermore, net debt (including IFRS 16 accounting for operating leases) amounted to €662,2 mil., following the investment in 7 new aircraft in 2024, five A320/321neo and two ATR 72-600.

The Board will recommend to the AGM a dividend of 0,80 euro per share for 2024.

Mr. Dimitris Gerogiannis, AEGEAN’s CEO, commented:

“The successful execution of our strategy to increase capacity during off-peak months and the desirability of our services for both Greeks and visitors to the country contributed to this excellent performance. Challenges from the restrictions to the Middle East and the continuing effect of the GTF inspection cycle to our costs were and will remain significant for some time. The strong results of 2024 reconfirm both our competitiveness and solid position within our market.

We remain committed to our investment plan focused on fleet renewal and service upgrades to further enhance our competitiveness and overall position. To this effect we have placed an additional order for eight A321neo aircraft, while we remain committed to invest and develop our new Maintenance & Training Center to increase locally generated added value for the company, our people and our country. Indeed, we are happy to report that we have already gradually started to serve, beyond our own needs, those of significant other carriers in our new facility.

For 2025, AEGEAN will offer circa 21,5 mil. seats, 1,8 mil. seats more than 2024. Specifically, 13 mil. seats will be allocated to the international network, 1,4 mil. more than in 2024, while 8,5 mil. seats will be available in the domestic network, marking a 6% increase compared to the previous year.”

AEGEAN’s management will host a conference call to present and discuss Full Year 2024 Financial Results on Tuesday, 18th March 2025 at 16:00 Athens time/ 14:00 UK time.

Details are available at: http://en.about.aegeanair.com/investor-relations/announcements/announcements/

Source : Aegean

Be the first to comment on "AEGEAN publie ses résultats du quatrième trimestre et de l’année 2024"