- Adjusted revenue up 13.4% (3.9% organic) at Euro 17,414 million

- Adjusted recurring operating income grew 16.4% at Euro 2,432 million, or 14.0% of revenue

- Free cash flow increased 31.6% to Euro 974 million

- Adjusted net income – Group share – rose 18.8% at Euro 1,482 million

- Further organic growth and improvement in recurring operating margin in 2016

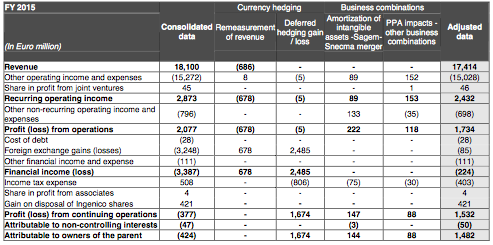

All figures in this press release represent Adjusted

definitions and reconciliation between 2015 consolidated income statement and adjusted income statement provided in the Notes on page 14 and following of this press release.

KEY FIGURES FOR FULL–YEAR 2015

Full-year 2015 adjusted revenue was Euro 17,414 million, up 13.4% (3.9% organic).

- Adjusted net income – Group share of Euro 1,482 million (Euro 3.55 per share), up 18.8% compared to Euro 1,248 million (Euro 3.00 per share) in 2014. 2015 adjusted net income included a post-tax capital gain of Euro 421 million (Euro 1.00 per share) from the sale of the residual stake in Ingenico Group.

- Consolidated (non-adjusted) net income – Group share at Euro (424) million, or Euro (1.02) per share included a non-cash charge of Euro (2,485) million, before the impact of related deferred tax items, resulting from the large adverse change in fair value of the portfolio of currency derivatives used to hedge future cash flows (see Note 1 on page 14).

- Safran generated Euro 974 million of free cash flow, amounting to 40% of adjusted recurring operating income and 31.6% higher than in 2014.

- Net debt amounted to Euro 748 million at December 31, 2015, Euro 755 million lower than a year ago.

- A dividend payment of Euro 1.38 per share (+15% year on year) will be proposed to the shareholders’ vote at the Annual General Meeting on May 19, 2016 (to include the Euro 0.60 per share interim dividend payment paid in December 2015).

- Full-year 2016 guidance: Safran expects adjusted revenue to increase by a percentage in the low single digits and adjusted recurring operating income likely to increase by around 5% with a further increase in margin rate. Free cash flow should represent more than 40 % of adjusted recurring operating income.

KEY BUSINESS HIGHLIGHTS

- CFM56 & LEAP: orders and commitments for 1,399 LEAP and 736 CFM56 engines were received in 2015 bringing the total CFM International (CFMI) order backlog to 13,252 engines (firm orders and commitments) at year end. After a good start to 2016, CFM announced in February that total LEAP orders had surpassed 10,000 engines. 1,612 CFM56 engines were delivered in 2015, setting a production record (up from 1,560 in 2014).

- Execution of the LEAP engine family development programme continues on track and on time. The LEAP-1A was certified in November 2015 by both the FAA and EASA. The flight test programme of the A320neo and A321neo is proceeding flawlessly to date with over 490 hours logged in 200 flights since May 19, 2015. Engine certification for the Leap-1B is on track. The flawless first flight of the 737 MAX on January 29, 2016 marked the start of a one-year flight test certification programme. The LEAP-1C engine certification continues on track. COMAC performed the roll-out of C919 on November 2, 2015 and the aircraft’s first flight is planned later in 2016.

Safran announced it will build a third plant for composite parts located in Queretaro, Mexico, in conjunction with Albany, to meet the rise in production rates requested by airframers, especially Boeing for the 737 MAX, and to enhance the efficiency of the global supply chain for the LEAP engine. The plant will start producing fan blades made of 3D woven composites at the end of 2017.

- Rafale exports: Egypt and Qatar each decided to acquire 24 aircraft. Safran supplies key equipment and systems for the aircraft, notably the M88 engines, the FADEC, the landing and braking systems, the wiring, the inertial navigation system and the gyros for the fly-by- wire flight control system. As part of the Rafale’s weapon suite, Safran also provides the AASM Hammer missile ordered by both nations.

- Helicopter turbine developments proceeding to plan: the Arrius 2R powering the Bell Jet Ranger 505 X was certified by EASA at the end of 2015, paving the way for first commercial deliveries in 2016. Furthermore, the Airbus Helicopters H160 powered by Safran’s Arrano 1A (sole source) completed its first flight successfully in January 2016 in line with schedule.

- Silvercrest engine: complementary developments to achieve desired specifications and a revised schedule have been agreed with Dassault Aviation. The revised schedule provides for engine certification 18 months later than the previous schedule, in line with the indication given in October 2015. On the basis of new programme assumptions, a one-off non-cash Euro (654) million charge has been taken related to the depreciation of programme-related tangible and intangible assets.

- Defence: the Patroller system, Safran’s long endurance tactical drone, was selected by the French defence procurement agency (DGA). Safran will supply 14 Patroller systems with deliveries starting in 2018, as well as the related support activities.

- The Security division maintained its leadership in civil identification thanks to its unique ability to deliver large-scale turnkey solutions as demonstrated in Albania or Chile. In 2015, Morpho commenced deployment of civil ID solutions to secure and ease elections in Ivory Coast, Chad and Egypt. Additionally, Morpho delivered more than 900 Itemizer 4DX trace detection systems to airports throughout Europe, allowing them to meet the requirements of new European legislation for enhanced screening of passengers.

- Paris, February 25, 2016 – The Board of Directors of Safran (Euronext Paris: SAF), under the Chairmanship of Ross McInnes, met in Paris on February 24, 2016 to approve the financial statements for the full year 2015.

EXECUTIVE COMMENTARY

- CEO Philippe Petitcolin commented:

- “Safran met all its targets in 2015. Commercial activity was strong, revenue grew, recurring operating income increased, self-funded R&D started to decline and free cash flow rose, all in line with guidance updated in July. Production rates escalated to record levels in many areas and group profit margin reached 14% of sales.

- The management transition has been seamless thanks to meticulous preparation.

- We scored significant successes across the board. Deliveries of CFM56 engines reached 1,612 units last year, another record for CFM. Production of aircraft equipment, notably wiring, landing gear and accessory gearboxes accelerated to accompany rising rates of the A350. In Defence, Patroller successfully competed for the supply and support of a tactical drone system to the French Army. Our Security activities recorded strongly growing sales and new long-term contract wins.

- After months of preparation, we are about to ramp up production of the LEAP and begin the transition. We are on schedule and have met all our milestones. We have full confidence in a successful product launch and in fulfilling customer commitments.

- These results are also the demonstration of a very strong commitment by the entire personnel.

- 2015 provided new evidence of Safran’s strengths. Our outlook for 2016 shows more improvement in all domains. Those solid fundamentals position Safran for more success in the longer term.”

FULL–YEAR 2015 RESULTS

- Safran delivered strong commercial and operational performance in full-year 2015.

- Record backlog. New order intake during 2015 was Euro 18 billion, providing evidence of robust and resilient demand. The backlog grew to Euro 68 billion compared to Euro 64 billion last year. This does not include future flows from CFM56 spares and services provided on a “time and materials” basis which will provide significant high-margin revenue streams in future decades.

- Strong revenue growth. For full-year 2015, Safran’s revenue was Euro 17,414 million, up 13.4%, compared to Euro 15,355 million in the same period a year ago. This Euro 2,059 million increase, which includes positive currency impacts amounting to Euro 1,399 million, reflects growth in Aerospace (Propulsion and Equipment), Security and Defence revenue.

- On an organic basis (excluding the effects of acquisitions, disposals and currency variations), Group revenue increased by 3.9%, or Euro 598 million. Organic revenue was determined by applying constant exchange rates and by excluding the effects of changes in scope. Hence, the following calculations were applied:

| · Reported growth | 13.4% | |

| Impact of acquisitions, Euro (62) million newly consolidated activities and disposals | (0.4)% | |

| Currency impact Euro (1,399) million | (9.1)% | |

| Organic growth | 3.9% |

The Euro 1,399 million favourable impact of currency variations reflect a globally positive translation effect on non-Euro revenues, notably on the portion of the USD-denominated revenue naturally hedged via USD-denominated procurements. The average USD/EUR spot rate was 1.11 to the Euro over 2015 compared to 1.33 over 2014. The Group’s hedge rate improved to USD 1.25 to the Euro for 2015 from USD 1.26 for 2014.

Recurring operating margin increased by 0.4pt to 14.0% of sales. Safran’s recurring operating income was Euro 2,432 million, up 16.4% compared to Euro 2,089 million in 2014 (13.6% of revenue). Excluding a positive currency impact of Euro 64 million, the improvement on an organic basis was Euro 283 million, representing 13.5% year-over-year growth. The impact of acquisitions, disposals and changes in the scope of consolidation was not significant.

The improvement was primarily driven by Aerospace aftermarket activities, landing gear and wheels & brakes businesses. Recurring operating income in Security businesses was slightly up while it was down in Defence activities compared to the year-ago period.

One-off items totalled Euro (698) million during 2015, including charges amounting to Euro (654) million related to Silvercrest for which all intangible assets and the programme-related tangible assets were depreciated.

| In Euro million | 2014 | 2015 |

| Adjusted recurring operating income % of revenue | 2,089 13.6% | 2,432 14.0% |

| Total one-off items Capital gain (loss) on disposals | (107) – (45) (62) | (698) – (641) (57) |

| Adjusted profit from operations % of revenue | 1,982 12.9% | 1,734 10.0% |

Adjusted net income – Group share attributable to holders of the parent of Euro 1,482 million (Euro 3.55 per share) included a post-tax capital gain of Euro 421 million from the sale of Ingenico Group shares. Net income in the year-ago period was 1,248 million (Euro 3.00 per share).

In addition to the rise in adjusted profit from recurring operations, this improved performance includes:

Net financial expense of Euro (224) million, including Euro (28) million of cost of debt.

Tax expense of Euro (403) million (26.7% apparent tax rate).

The reconciliation between 2015 consolidated income statement and adjusted income statement is provided and commented in the Notes on page 14.

CASH FLOW AND BALANCE SHEET

Operations generated Euro 974 million of Free Cash Flow (40% of recurring operating income), an increase of Euro 234 million compared to 2014. Net debt at December 31, 2015 was Euro 748 million, a fall of Euro 755 million compared to a year prior. Free cash flow generation of Euro 974 million was driven by cash from operations of Euro 2,813 million devoted to an increase of working capital of Euro 60 million – moderate as additional working capital requirements to sustain rising production rates were partially offset by advance payments – and by increased capital expenditures to prepare the transition to new programmes.

Dividend payments in the year amounted to Euro 540 million, including the distribution of the 2014 final dividend (€0.64 per share) and an 2015 interim dividend (€0.60 per share). The disposal of 5.5 million shares of Ingenico Group brought in net proceeds of Euro 606 million in the period. Following this disposal, Safran is no longer a shareholder of Ingenico Group.

As of December 31, 2015, Safran held cash & cash equivalents of Euro 1.8 billion and had Euro 2.5 billion of secured and undrawn facilities available.

RESEARCH & DEVELOPMENT

Total R&D expenditures, including customer funded R&D, reached Euro 2.1 billion in 2015.

The self-funded R&D effort before research tax credit was Euro 1,356 million or 7.8% of revenue, a decrease of Euro 108 million compared to 2014. Capitalised R&D fell by Euro 149 million to Euro 495 million, as expected, due mainly to lower expenditure on the Leap and the A350 programmes. After the R&D tax credit and capitalisation net of amortisation, the impact of R&D on adjusted recurring operating income was Euro 791 million, an increase of Euro 44 million compared to the prior year.

CAPITAL EXPENDITURES

Capital expenditure, including expansions, new production capacity and tooling amounted to Euro 758 million in 2015, an increase of Euro 84 million compared to 2014. The increase in capital expenditure is principally due to the preparation for the entry into service and ramp up of new programmes.

SILVERCREST ENGINE

As announced in October 2015, the Silvercrest programme has been reviewed in light of developments on both the Falcon 5X application at Dassault Aviation and the Citation Longitude programme at Cessna.

Complementary developments to achieve the targeted specifications and a revised schedule have been agreed with Dassault Aviation. The current schedule provides for engine certification early in 2018, 18 months later than the previous schedule and in line with the indication given in October 2015.

In November 2015, Cessna announced changes to its range of business jets, including a redefinition of the Longitude and a different choice of engine appropriate for the smaller design.

On the basis of revised programme assumptions, notably new development expenses, lower volumes and a later entry into service, Safran has decided to depreciate all programme- related intangible assets and other programme-specific assets resulting in a one-off, non-cash charge of Euro (654) million.

Furthermore, potential contractual penalties during the development phase are capped and entirely covered by provisions.

Safran is very confident that the technical solutions to obtaining the desired specifications have been identified. Once implemented, they ensure that it offers customers an engine which meets their requirements and remains the most competitive of its kind with respect to the market it addresses.

Safran confirms that the effect on the Group’s financial performance is expected to be limited and spread over several years.

SALE OF SHARES IN INGENICO GROUP

During 2015, Safran sold its entire remaining stake in Ingenico Group, amounting to 5.5 million shares representing 9.1% of Ingenico Group’s capital. The shares were held by the Group since the contribution to Ingenico Group of the Sagem Monetel assets in 2008. The sale was accomplished via an off market block trade with Bpifrance, announced on May 19, 2015, and the subsequent sale of the residual stake by a financial institution on behalf of Safran, which concluded on July 29, 2015. Safran received total proceeds of Euro 606 million and recorded a post-tax capital gain of Euro 421 million.

EQUITY SHAREHOLDING

The French state sold 2.6% of Safran’s share capital to institutional investors via a placing on December 1, 2015. At December 31, 2015 the French state held 15.4% of Safran share capital compared with 22.0% a year prior. Safran’s share thus benefits from a larger free float (70.9% of the shares outstanding at December 31, 2015) and greater liquidity.

Pursuant to current legislation, a further 1.2 million shares belonging to the French state will subsequently be offered to Safran employees and former employees.

DIVIDEND PROPOSAL

A dividend payment of Euro 1.38 per share, representing a 15% increase compared with 2014, will be proposed to the shareholders’ vote at the next Annual Shareholders’ Meeting on May 19, 2016. In line with customary practice, the dividend payout represents approximately 40% of Group adjusted net income. An interim payment having been made in December 2015 (Euro 0.60 per share), the final dividend payment would be Euro 0.78 per share (approximately Euro 326 million). This balance would be paid from May 25, 2016 (ex-dividend date: May 23, 2016).

EMPLOYEES

More than 7,700 people were hired in 2015 (of which more than 4,020 in France). Total headcount stood at 70,087 at end 2015, a net gain during the year of over 1,001 people, of which over 810 in France. Safran will continue to recruit in 2016, though at a lower rate than 2015, to ensure generational renewal and to stabilise the Group’s headcount in the coming years.

In 2015, the Group’s total contribution to employee profit-sharing and incentive schemes including social contributions totalled Euro 432 million, stable year-over-year.

BOARD OF DIRECTORS

By ministerial decree dated February 8, 2016, Lucie Muniesa is named to represent the French state on Safran’s board of directors. Lucie Muniesa replaces Astrid Milsan. Please refer to Safran’s website for more information.

AIRBUS SAFRAN LAUNCHERS

The initial phase of the integration of Safran’s and Airbus Group’s space launcher businesses was completed early in 2015.

Safran and Airbus Group are making progress on terms and conditions of the implementation of the second phase. Consultation of the relevant employee representative bodies has been completed. The finalisation of technical and administrative approvals and formalities is expected in the coming months.

Safran and Airbus Group will communicate as required.

ISSUANCE OF A CONVERTIBLE BOND MATURING 2020

On January 5, 2016, Safran launched an issuance of bonds convertible into or exchangeable for new and/or existing shares (OCEANE) with a zero coupon for a total of Euro 650 million. The issuance was successfully finalised on January 8, 2016.

The bonds were issued at a price of 104% of par, offering a negative yield of -0.79%, and the conversion price of Euro 89.32 reflects an issuance premium of 45% with respect to the reference share value, reflecting investors’ appetite for the quality of Safran’s signature.

Considering that the issuance comprises 7,277,205 bonds, each potentially convertible into one Safran share, the maximum dilution would be 1.7% if new shares were issued for the entire redemption.

2016 OUTLOOK

Safran’s 2016 outlook is applicable to the Group’s structure as of December 31, 2015 and does not take into account the impact in 2016 of the finalisation of the regrouping of its space launcher activities with those of Airbus Group in their joint venture, Airbus Safran Launchers (ASL). Guidance will be revised as necessary upon finalisation of Phase 2 of the operation. Safran expects the contribution of its space launchers activities to ASL to be accretive to adjusted recurring operating margin.

Safran expects on a full-year basis:

- Adjusted revenue to increase by a percentage rate in the low single digits compared to

2015 (at an estimated average rate of USD 1.11 to the Euro).

- Adjusted recurring operating income likely to increase by around 5% with a further

increase in margin rate compared to 2015 (at a hedged rate of USD 1.24 to the Euro). The hedging policy largely isolates adjusted recurring operating income from current EUR/USD variations except for the part generated in USD by activities located in the US, subject to the translation effect when converted into Euro.

- Free cash flow representing more than 40% of adjusted recurring operating income, an element of uncertainty being the rhythm of payments by state-clients.

The full-year 2016 outlook is based on the following underlying assumptions:

- Healthy increase in aerospace OE deliveries

- Civil aftermarket growth by a percentage in the high single digits

- Start up costs of series Leap production

- Reduction of self-funded R&D of the order of Euro 100 – 150 million with a greater drop in capitalised amounts as spending declines on Leap, A350, helicopter turbines as they come closer to certification and entry into service. As a result of decreasing capitalisation and increasing amortisation of R&D costs, expensed R&D is expected to rise by around Euro 100 million.

- Sustained level of tangible capex, including expansions, new production capacity and tooling, around Euro 850 million, as requested by production transitioning and ramp-up

- Profitable growth for the Security business

- Continued benefits from productivity improvement.

CURRENCY HEDGES

Safran expects annual net USD exposure for 2016-19 to range between USD 7.4 billion and USD 8.0 billion in line with the growth of businesses with exposed USD-denominated revenues. The Group took advantage of the stronger USD to secure the overall increased exposure at favourable rates.

2016: Exposure fully hedged at the improved rate of USD 1.24 (previously USD 1.25).

2017: Exposure fully hedged at the improved rate of USD 1.22 (previously USD 1.25)

2018: Coverage increased to USD 4.3 billion through forward sales and short-dated knock out option strategies. Accumulators and option strategies in place will allow hedging to grow to a total of USD 8.0 billion as long as €/$ remains below 1.25 up to end 2016. The target hedge rate is in the range USD 1.17 -1.20 (previously below 1.20). Knock out options barriers are set at various levels between USD 1.20 and USD 1.45 with maturities up to 2 years.

2019: Coverage initiated with USD 2.3 billion achieved through forward sales and short-dated knock out option strategies. Accumulators and option strategies in place will allow hedging to grow to a total of USD 8.0 billion as long as €/$ remains below 1.25 up to end 2017. The target hedge rate is in the range USD 1.15 – 1.20. Knock out options barriers are set at various levels between USD 1.19 and USD 1.45 with maturities up to one year.

Due to the use of knock out option strategies in 2018-2019 portfolios, effective coverage for the period will be secured in the course of 2016-17 depending on forex market conditions. If all or part of the options were to be knocked out the optional strategies would be adapted to new market conditions.

Hedged rates are now:

- 2016: targeted hedged rate at USD 1.24 to the Euro (previously USD 1.25)

- 2017: targeted hedged rate at USD 1.22 to the Euro (previously USD 1.25)

- 2018 targeted hedge rate between USD 1.17 and USD 1.20 to the Euro (previously

below USD 1.20)

- 2019 new targeted hedge rate between USD 1.15 and USD 1.20 to the Euro.

BUSINESS COMMENTARY

- Aerospace Propulsion

Commercial momentum in civil propulsion was strong as the outlook for growth in the air transport industry continued to fuel airlines’ investments. During 2015, orders and commitments were received for 1,399 LEAP engines. As of February 2016, the LEAP engine has now surpassed 10,000 total engine orders and commitments (excluding options). Demand for CFM56 engines continues to be robust: orders were placed for 736 engines in 2015 and the backlog stood at 3,391 engines at end-2015.

Aerospace Propulsion recorded revenue of Euro 9,319 million, an increase of 14.3% compared to revenue in the year-ago period of Euro 8,153 million. On an organic basis, revenue was up 6.0%.

Revenue growth was primarily driven by services (+22.2%) which represented 53.5% of total revenues. The civil aftermarket (measured in USD) increased 18.9% year on year and continues to be driven by overhauls of recent CFM56 and GE90 engines in the context of a favourable environment for airline customers. Helicopter turbines and military engines also contributed to overall service revenue growth.

Propulsion OE revenue increased 6.4%. Civil aircraft OE revenue grew slightly as production of CFM56 engines reached a record rate (1,612 deliveries, 52 units more than in 2014). Military OE sales were lower due primarily to Rafale production initially destined for the French military being diverted towards export customers. Softer demand affected helicopter turbine OE unit deliveries, which declined 25%. Revenue was less affected due to currency, mix and pricing.

Recurring operating income, at 19.7% of revenue, was Euro 1,833 million, up 12.2% compared to Euro 1,633 million (20.0% of revenue) in the year-ago period. This improvement resulted from healthy growth in services as well as from increased OE deliveries of CFM56 engines. The level of expensed R&D increased compared to 2014, primarily due to the Silvercrest programme, expenditure on which ceased to be capitalised from the second quarter 2014. The stronger USD and the improvement in the hedged rate had a positive impact on profitability.

- Aircraft Equipment

The Aircraft Equipment segment reported revenue of Euro 4,943 million, up 11.2%, or slightly down (-0.9%) on an organic basis, compared to Euro 4,446 million in the year-ago period. Service revenue grew by 15.6%, including the effect of the stronger USD, and accounts for 29.9% of sales.

Deliveries of wiring shipsets and landing gear to Airbus for the A350 programme grew in line with the programme production rate. Those for the 787 programme, which had driven strong OE growth throughout 2014, showed modest increases this year. Lower deliveries of A330 thrust reversers are the reflection of an announced assembly rate drop of that aircraft. 104 nacelles for A380 were delivered in 2015, compared to 112 in 2014.

Growth in services was driven primarily by carbon brakes and landing gear aftermarket. Safran is the world leader in carbon brakes for commercial aircraft over 100 seats with over 7,500 aircraft equipped worldwide.

Recurring operating income was Euro 466 million (9.4% of revenue), an increase of 9.4% compared to Euro 426 million (9.6% of revenue) in the year-ago period including a 1.2% organic improvement. The good performance in carbon brakes and landing gear aftermarket activities, as a result of a larger installed base and continued air traffic growth, continued to contribute to profit growth. In nacelles, a favourable pricing effect was offset by lighter overall OE volumes (increasing A320 and regional business jet nacelles did not entirely compensate for lower A380, A330) and a slight decline in support activities. In electrical systems, pricing pressure is temporarily weighing on margins. Strong cost reduction and productivity actions are now in place to mitigate the impacts and drive operating margin improvements.

- Defence

Full-year 2015 revenue of Euro 1,266 million was up 3.7%, or down (1.6)% on an organic basis, compared to revenue of Euro 1,221 million in 2014. Revenue was flattish in all activities, as expected. In optronics, the end of deliveries of FELIN equipment to the French Army was offset by the strong increase in sales of sighting systems for combat vehicles and naval applications. The slight decline in Avionics sales was driven by a drop in volumes of inertial navigation and flight control systems, partially compensated by the growing contribution of support activities and aircraft information systems revenue. Order intake was strong in 2015 and indicative of a positive future revenue trend.

Full-year 2015 recurring operating income at Euro 64 million (5.1% of revenue) was down (9.9)% compared to Euro 71 million (5.8% of revenue) in 2014. The decline is principally due to the run-off of the deliveries of FELIN equipment, not yet fully offset by new contracts, and to an unfavourable mix of products (mostly for infrared goggles). Additionally, investments to improve industrial performance and sustained R&D effort to maintain technological differentiation put temporary pressure on margins and will drive future profitability improvements.

- Security

The Security activities reported 2015 revenue of Euro 1,878 million, up 22.7% compared to revenue in the year-ago period of Euro 1,530 million. On an organic basis, revenue increased strongly by 11.0%.

All activities reported organic increases in revenue. Identification grew strongly, particularly Government Solutions activities in the South America, Europe and Middle-East Africa zones. Revenue also grew in the US (Federal and State enrolment contracts and driving licences). Smart chip sales increased thanks to higher volumes in banking and favourable mix in telco. Detection revenues were higher than a year ago due to the strong increase in CTX tomographic equipment shipments and to the success of the new trace detection system Itemiser 4DX.

Recurring operating income was up 12.7% at Euro 151 million (8.0% of revenue) compared to Euro 134 million (8.8% of revenue) in 2014. The growth results from the increased contribution of government ID contracts, principally in Europe, the Americas and Middle-East Africa region. Investments in new commercial offers to address new markets, notably in digital identity, were partially offset by the positive impact of cost reduction actions, particularly in the smart chip business.

- Holding and others

The reporting segment “Holding and others” includes costs of general management as well as transverse services provided for the Group and its subsidiaries including central finance, tax and foreign currency management, Group legal, communication and human resources. In addition, the holding invoices subsidiaries for shared services including administrative service centres (payroll, recruitment, IT, transaction accounting), a centralised training organisation and Safran’s R&T centre.

The strong decrease (Euro 93 million) of Holding and others’ impact on Group recurring operating income reflects cost reductions and a higher level of shared services provided on behalf of, and invoiced to, subsidiaries explaining their profit evolution.

- UPCOMING EVENTS

Capital Markets Day, London Q1 2016 revenue

Annual Shareholders’ Meeting H1 2016 results

March 14, 2016 April 26, 2016 May 19, 2016 July 29, 2016

*****

contact@safrancmd16.com

Safran will host today a conference call open to analysts and investors at 8:30 am CET which can be accessed at +33 (0)1 70 77 09 42 from France, +44 (0)207 107 1613 from the UK and +1 855 402 7763.

A webcast will be available via Safran’s website after registration using the following link:

https://event.onlineseminarsolutions.com/r.htm?e=1126491&s=1&k=D0508F6C71286CF79DD6729E9BB08482

A replay of the conference will be available until May 24, 2016 by using this same link.

Audience members will have access to the webcast 15 minutes before the start of the conference.

The press release, presentation and consolidated financial statements are available on the website at www.safran-group.com.

KEY FIGURES

| Adjusted income statement (In Euro million) | FY 2014 | FY 2015 | % change |

| Revenue Other recurring operating income and expenses Share in profit from joint ventures Recurring operating income % of revenue Other non-recurring operating income and expenses Profit from operations % of revenue Net financial income (expense) Profit for the period attributable to owners of the parent EPS (in €) | 15,355 (13,311) 45 2,089 13.6% (107) 1,982 12.9% (165) (522) 18 – (65) 1,248 3.00* | 17,414 (15,028) 46 2,432 14.0% (698) 1,734 10.0% (224) (403) 4 421 (50) 1,482 3.55** | 13.4% 16.4% +0.4 pt (12.5)% (2.9)pt 18.8% 18.3% |

(*) based on a weighted average number of shares of 416,413,368 as of December 31, 2014 (**) based on a weighted average number of shares of 417,569,031 as of December 31, 2015

| Balance sheet – Assets (In Euro million) | Dec. 31, 2014 | Dec.31, 2015 |

| Goodwill | 3,420 | 3,590 |

| Tangible & Intangible assets | 8,464 | 8,593 |

| Investments in joint ventures and associates | 771 | 765 |

| Other non-current assets | 674 | 1,403 |

| Derivatives assets | 406 | 408 |

| Inventories and WIP | 4,265 | 4,518 |

| Trade and other receivables | 5,827 | 6,515 |

| Cash and cash equivalents | 1,633 | 1,845 |

| Other current assets | 673 | 870 |

| Total Assets | 26,133 | 28,507 |

| Balance sheet – Liabilities (In Euro million) | Dec. 31, 2014 | Dec 31, 2015 |

| Equity | 6,491 | 5,893 |

| Provisions | 3,329 | 3,456 |

| Borrowings subject to sp. conditions | 713 | 708 |

| Interest bearing liabilities | 3,165 | 2,628 |

| Derivatives liabilities | 1,636 | 4,108 |

| Other non-current liabilities | 836 | 703 |

| Trade and other payables | 9,618 | 10,602 |

| Other current liabilities | 345 | 409 |

| Total Equity & Liabilities | 26,133 | 28,507 |

| Cash Flow Highlights (In Euro million) | FY 2014 | FY 2015 |

| Adjusted attributable net profit Depreciation, amortization and provisions Others Capex (tangible assets) | 1,248 906 314 2,468 (111) (674) (267) (676) 740 (511) (512) (283) | 1,482 1,688 (357) 2,813 (60) (758) (500) (521) 974 (540) 321 755 |

| Net debt at beginning of period | (1,220) | (1,503) |

| Net debt at end of period | (1,503) | (748) |

*Of which capitalised interest: Euro (26) million in 2015 and (32) million in 2014

| Segment breakdown of revenue (In Euro million) | FY 2014 | FY 2015 | % change | % change organic |

| Aerospace Propulsion | 8,153 | 9,319 | 14.3% | 6.0% |

| Aircraft Equipment | 4,446 | 4,943 | 11.2% | (0.9)% |

| Defence | 1,221 | 1,266 | 3.7% | (1.6)% |

| Security | 1,530 | 1,878 | 22.7% | 11.0% |

| Others | 5 | 8 | Na | Na |

| Total Group | 15,355 | 17,414 | 13.4% | 3.9% |

| Segment breakdown of recurring operating income (In Euro million) | FY 2014 | FY 2015 | % change |

| Aerospace Propulsion % of revenue | 1,633 20.0% | 1,833 19.7% | 12.2% |

| Aircraft Equipment % of revenue | 426 9.6% | 466 9.4% | 9.4% |

| Defence % of revenue | 71 5.8% | 64 5.1% | (9.9)% |

| Security % of revenue | 134 8.8% | 151 8.0% | 12.7% |

| Others | (175) | (82) | na |

| Total Group % of revenue | 2,089 13.6% | 2,432 14.0% | 16.4% |

| 2014 revenue by quarter (In Euro million) | Q1 2014 | Q2 2014 | Q3 2014 | Q4 2014 | FY 2014 |

| Aerospace Propulsion | 1,825 | 1,938 | 1,944 | 2,446 | 8,153 |

| Aircraft Equipment | 1,016 | 1,121 | 1,021 | 1,288 | 4,446 |

| Defence | 257 | 327 | 256 | 381 | 1,221 |

| Security | 345 | 377 | 368 | 440 | 1,530 |

| Others | – | 2 | – | 3 | 5 |

| Total revenue | 3,443 | 3,765 | 3,589 | 4,558 | 15,355 |

| 2015 revenue by quarter (In Euro million) | Q1 2015 | Q2 2015 | Q3 2015 | Q4 2015 | FY 2015 |

| Aerospace Propulsion | 2,070 | 2,416 | 2,220 | 2,613 | 9,319 |

| Aircraft Equipment | 1,172 | 1,242 | 1,180 | 1,349 | 4,943 |

| Defence | 278 | 338 | 266 | 384 | 1,266 |

| Security | 414 | 471 | 474 | 519 | 1,878 |

| Others | 1 | 1 | 1 | 5 | 8 |

| Total revenue | 3,935 | 4,468 | 4,141 | 4,870 | 17,414 |

| Euro/USD rate | FY 2014 | FY 2015 |

| Average spot rate | 1.33 | 1.11 |

| Spot rate (end of period) | 1.21 | 1.09 |

| Hedge rate | 1.26 | 1.25 |

NOTES

[1] Adjusted data

To reflect the Group’s actual economic performance and enable it to be monitored and benchmarked against competitors, Safran prepares an adjusted income statement alongside its consolidated financial statements.

Safran’s consolidated income statement has been adjusted for the impact of:

- purchase price allocations with respect to business combinations. Since 2005, this restatement concerns the amortization charged against intangible assets relating to aircraft programmes revalued at the time of the Sagem-Snecma merger. With effect from the first-half 2010 interim financial statements, the Group has decided to restate the impact of purchase price allocations for business combinations. In particular, this concerns the amortization of intangible assets recognized at the time of the acquisition, and amortized over extended periods, due to the length of the Group’s business cycles, along gains or losses remeasuring the Group’s previously held interests in an entity acquired in a step acquisition or assets contributed to a JV.

- themark-to-marketofforeigncurrencyderivatives,inordertobetterreflecttheeconomicsubstance of the Group’s overall foreign currency risk hedging strategy:

- – revenue net of purchases denominated in foreign currencies is measured using the effective hedged rate, i.e., including the costs of the hedging strategy,

- – all mark-to-market changes on foreign currency derivatives hedging future cash flows are neutralized.

The resulting changes in deferred tax have also been adjusted.

FY 2015 reconciliation between consolidated income statement and adjusted consolidated income statement:

2015 consolidated net income was a loss of Euro 424 million, highly impacted by the large adverse change in fair value of the portfolio of currency derivatives used to hedge future cash flows. The hedging instrument portfolio was marked to market using a EUR/USD exchange rate of 1.09 on December 31, 2015 compared to 1.21 on December 31, 2014.

Readers are reminded that only the consolidated financial statements are audited by the Group’s statutory auditors. The consolidated financial statements include “revenue” and “operating profit indicators” set out in the adjusted data in Note 5, “Segment information” of the consolidated financial statements.

Adjusted financial data other than the data provided in Note 5, “Segment information” of the consolidated financial statements, are subject to verification procedures applicable to all of the information provided in the Registration Document.

The audit procedures on the consolidated financial statements have been completed. An audit opinion will be issued after the Board of Directors’ meeting of March 24, 2016, once specific verifications and a review of events subsequent to February 24, 2016 have been performed.

[2] Recurring operating income

In order to better reflect the current economic performance, this subtotal named “recurring operating income” excludes income and expenses which are largely unpredictable because of their unusual, infrequent and/or material nature such as: impairment losses/reversals, capital gains/losses on disposals of operations and other unusual and/or material non-operational items.

[3] Civil aftermarket (expressed in USD)

This non-accounting indicator (non-audited) comprises spares and MRO (Maintenance, Repair & Overhaul) revenue for all civil aircraft engines for Snecma and its subsidiaries and reflects the Group’s performance in civil aircraft engines aftermarket compared to the market.

*****

Safran is a leading international high-technology group with three core businesses: Aerospace (propulsion and equipment), Defence and Security. Operating worldwide, the Group has 70,000 employees and generated sales of 17.4 billion euros in 2015. Working independently or in partnership, Safran holds world or European leadership positions in its core markets. The Group invests heavily in Research & Development to meet the requirements of changing markets, including expenditures of more than 2 billion euros in 2014. Safran is listed on Euronext Paris and is part of the CAC40 index, as well as the Euro Stoxx 50 European index.

For more information, www.safran-group.com / Follow @SAFRAN on Twitter

Be the first to comment on "Safran: record results in 2015"