Overview

Improving international travel volumes along with the constrained availability of both new and used widebody aircraft is supporting an accelerating recovery in both the utilization and values in the widebody aircraft market with the emphasis being on newer technology, mid-size aircraft. In addition, rising interest rates are also supporting improving lease rates, while valuations for the most in-demand mid-size widebody aircraft nearing pre-pandemic levels. These trends are positives for aircraft lessors with widebody aircraft in their portfolios as well as lessors with firm orders for new technology widebody aircraft from both Airbus and Boeing.

Long-Haul Passenger Volumes Recover Supporting Demand

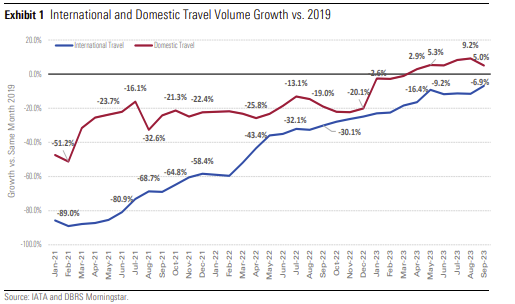

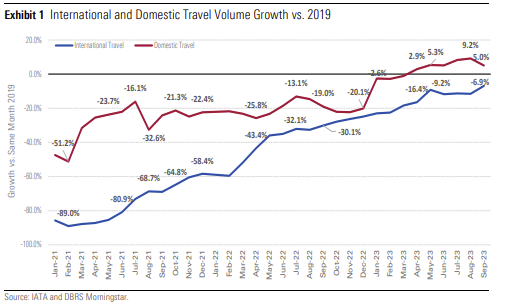

Following a three month stall, September saw the recovery of international passenger volumes (revenues per kilometers (RPKs)) restart with strong growth. Indeed, international passenger volumes grew 29.2% year-on-year (YoY) in September 2023 with broad improvement across most routes. The robust expansion in travel led to international passenger volumes recovering to 93.1% of 2019 levels in September 2023, according to data from the International Air Transport Association (IATA) (see Exhibit 1). However, the recovery has varied by region with North America, the Middle East and Latin America exceeding 2019 pre-pandemic levels while, though improving somewhat, Asia Pacific remains below 2019 levels.

With U.S. consumers increasingly looking to travel abroad for vacations and business travel improving, North America was a leader in international travel relative to September 2019 with international passenger volumes growing 5.3% above pre-pandemic levels, according to IATA. The Middle East reported strong expansion in international travel with international passenger volumes also 5.3% higher than September 2019 levels with growth driven by Middle East – Europe routes. With international passenger volumes expanding a robust 26.8% YoY in September 2023, the Latin American region continued its strong recovery exceeding September 2019 levels by 2.0%.

The Asia Pacific region remains the region furthest from pre-pandemic levels at just 79.7% of September 2019 levels, according to IATA. With a slowing domestic economy causing more Chinese consumers to limit themselves to domestic vacations as well as rising tensions between China and the U.S. suppressing demand on trans-Pacific routes, passenger volumes on Asia – North America routes remain 28.6% below pre-pandemic levels. This represents the biggest contributor to the region’s lagging performance compared to the rest of the world.

The recovery in Europe continues with European international travel volumes just 6% below September 2019 levels. European routes broadly saw good growth in September, including the important EuropeNorth America pair as well as Europe-Middle East, Europe-Central America/Caribbean, and within Europe, all of which had reached or exceeded September 2019 levels.

Aircraft Values and Lease Rates Benefiting from Sound Demand and Tight Supply of Aircraft

There has been a meaningful boost in the demand for new and used widebody aircraft over the past 2 months. This growth in demand has resulted in a notable increase in asset values and lease rates across a range of widebody aircraft, though remaining below pre-pandemic 2019 values. In-demand model values are healthy overall, and have been gradually trending higher throughout 2023, with the most sought after new-tech widebody aircraft, Airbus A330neo, Airbus A350, and Boeing 787, being at or

near 2019 levels.

While production rates have slowly improved as 2023 has progressed, ongoing issues at Airbus and Boeing (the OEMs) have curtailed the supply of new widebody aircraft to both airlines and lessors, this trend is similar to narrowbody production issues plaguing the OEMs. Currently, airlines cannot obtain new widebody aircraft quickly enough to meet the strong customer demand, while the OEMs have not met delivery volume targets over the past three years. Extended delivery dates are resulting in a large buildup of backorders, with new order volumes currently sitting at 1,740 aircraft, according to data from Cirium Fleets Analyzer, which is approximately 10 years of production at current rates. We expect supply chain issues and resulting production delays to continue into 2025 likely resulting in OEMs not being able to meet expected delivery dates.

Turning to the used in-storage aircraft, widebody aircraft supply continues to trend down. According to data from Crium Fleets Analyzer, as of October 2023, there were more than 720 stored widebody aircraft. While stored inventory levels are still nearly double January 2020 pre-pandemic levels, the number of stored widebodies is 60% below the February 2021 peak of more than 1,800. We note that 34% of the stored widebody aircraft are already more than 20 years old; such aircraft are less likely to be returned to service, and thus also supportive of in-service aircraft value benefits.

Approaching Replacement Cycle to Support Improved Values of New Technology Aircraft

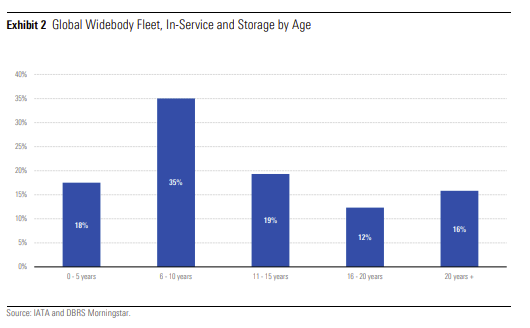

Upcoming retirement of aging existing widebodies is expected to support the tight supply and demand balance over the next decade (see Exhibit 2) as a significant portion of the new aircraft on order will be used for replacing the retired fleet. We expect that the demand created by the replacement cycle and the need to meet the anticipated air passenger volume growth and the opening of new routes has outpaced the supply and this trend will continue over the short-to-medium term. The current and ongoing imbalance in the supply-demand equilibrium is expected to put upward pressure on values and lease rates of the new technology widebody aircraft.

Lessors Maintain Modest Exposure to Widebody Aircraft

Among the 10 aircraft lessors followed by DBRS Morningstar, the aggregate share of widebody aircraft in their portfolios is modest at 12%, by count. The newest, most technologically advanced and efficient mid-size widebodies (the Airbus A330neo, A350 and Boeing 787 models) account for 60% of these lessors’ widebody fleets and 9% of their overall portfolios. Positively, the lessors we follow have no exposure to the out-of-production large four-engine widebody passenger aircraft, the Airbus A380 and Boeing 747.

Many aircraft lessors hold orders with the OEMs that suggest similar patterns going forward. For the lessors we follow (as of their most recent reporting periods), outstanding orders for new widebody aircraft totaled 120, focused on Airbus A330neo and Boeing 787. These widebody orders account for just 6% of these lessors’ overall orderbooks, by count. Amongst these lessors, there were no current orders for the forthcoming Boeing 777x aircraft and none for the current generation 777-300ER aircraft.

We anticipate that as Boeing starts delivering the new 777x aircraft certain lessors will have a limited exposure to this aircraft via sale-leaseback transactions. However, this aircraft variant is expected to be a niche, mission specific asset with limited production and will not reach the popularity of the current generation 777-300ER aircraft, which comprises 17% of the global operating widebody fleet.

While the lessors we follow account for 14% of the total delivery backlog at Airbus and Boeing combined, the lessors’ orders for widebody aircraft account for just 6% of the OEM widebody delivery backlog. We see this as a signal that the lessors we follow will continue to be disciplined regarding adding more expensive and less liquid widebody aircraft to their fleets which we consider a testament to their asset management capabilities and risk management frameworks, all of which are supportive of their credit profiles.

Conclusion

Airlines’ inability to purchase widebody aircraft due to reduced availability from OEMs, reduced used inventory, and high financing costs, have also resulted in aircraft lessors getting traction writing new leases and extending maturing leases across the global airline lease base with higher lease rates. We anticipate that these trends and resulting capacity pressures on airlines will persist through 2024 creating a favorable environment for aircraft lessors including continuing improvement in widebody aircraft values and lease rates in 2024.

We see the aircraft lessors we follow as continuing to be disciplined with respect to the portion of their fleets dedicated to widebody aircraft as well as the focus on the most in-demand and most efficient midsize widebody aircraft. With the upcoming replacement cycle and forecasted growth in air travel over the medium-term, we expect the larger lessors to continue to place orders for widebody aircraft. With the current modest level of orders for widebody aircraft, we see the potential for new orders to materialize as early as 2024.

Note: This information has been extracted from a Cirium product. Cirium has not seen or reviewed any conclusions, recommendations or other views that may appear in this document. Cirium makes no warranties, express or implied, as to the accuracy, adequacy, timeliness, or completeness of its data or its fitness for any particular purpose. Cirium disclaims any and all liability relating to or arising out of use of its data and other content or to the fullest extent permissible by law.

Source : DBRS Morningstar

Be the first to comment on "In It for the Long Haul – Widebody Aircraft Market Continues to Recover Benefiting Lessors"