EasyJet performs strongly delivering a record Q3 PBT

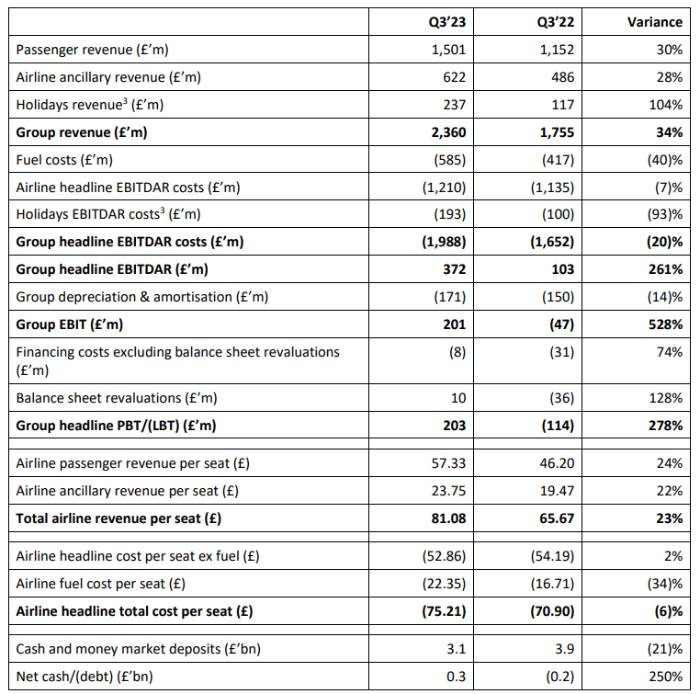

• Q3 headline profit before tax £203 million (£317 million improvement vs Q3’22)

o Passenger growth +7% YoY

o RPS +23% YoY

▪ Load factor +2 ppts YoY

▪ Ticket yield per passenger +22% YoY

▪ Ancillary yield per passenger +20% YoY (+87% vs Q3 FY19)

o easyJet holidays delivers £49 million PBT (Q3’22 £16 million)

o Headline CPS ex Fuel reduced by 2% YoY

o Fully crewed for pilots and cabin staff

• easyJet holidays continues to outperform and is expected to deliver £100m+ PBT in FY23

• Q4 FY23 RPS is expected to be around +10% YoY

• H2 Headline CPS ex fuel to be broadly flat YoY

• $950 million of debt repaid during Q3 – c.£1.2bn debt retired during this financial year

• Q1 FY24

o Capacity >15% YoY

o Yields and load factor ahead YoY

o Headline cost ex fuel expected to continue to reduce YoY

Summary

easyJet’s third quarter profit improved by £317 million, year on year, as demand for its network and

services continues to be strong. A revenue per seat increase of 23% year on year alongside headline cost

per seat ex fuel reducing by 2% and easyJet holidays PBT of £49 million is driving the Group towards a

strong outcome for FY23.

Based on current booking trends, easyJet expects Q4 to deliver another record PBT performance with RPS

up by around 10% year on year and cost per seat excluding fuel for H2’23 expected to remain broadly flat

year on year. This guidance is subject to the operational environment with the whole industry seeing

challenging conditions this summer. More constrained air space and flow rate restrictions are resulting in

unprecedented ATC disruption as well as increased ATC strike days up 40% year to date vs 2019.

Management have taken action to mitigate the impact of this on our customers.

Moving into this winter, easyJet is seeing good booking momentum, with sold ticket yields and load factors

ahead year on year, and planned capacity up over 15% for the December quarter. Headline cost ex fuel is

expected to reduce year on year and easyJet holidays continues to see demand growth, with winter

bookings up >100% year on year.

easyJet currently has 163 aircraft on order for delivery through to 2028. We are now running a process to

secure additional firm order positions for our longer term fleet plan. This would allow easyJet to replace

older aircraft with additional options to deliver future growth.

Outlook

- Q4 RPS up around +10% YoY

- H2 headline cost per seat ex fuel broadly flat year on year

- Q4 capacity c.29m

- Holidays to deliver medium term target of £100m+ PBT

- Booking momentum continues into Q1 FY24

Johan Lundgren, CEO of easyJet, said:

“Our Q3 performance has been underpinned by strong passenger demand for easyJet’s network and services. We

continue to provide great value to customers with around half of easyJet’s fares currently on sale still under £50.

“We are absolutely focused on mitigating the impact of the challenging external environment on our customers

and flying them on their well-earned holidays.

“We continue to see good momentum as we move into Q4 where we will be operating over 160,000 flights and

expect to deliver another record PBT performance. This winter we are adding more than 15% capacity and we

see bookings ahead of the same period last year.”

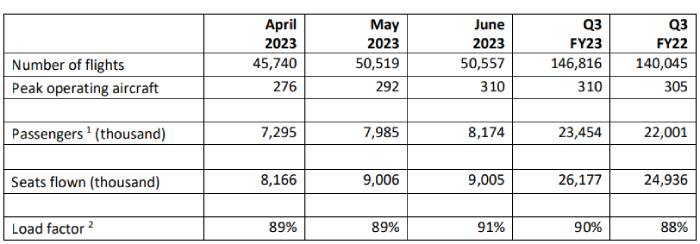

Capacity

During Q3 easyJet flew 26.2 million seats, a 5% increase on the same period last year when easyJet flew

24.9 million seats. Load factor was 90% (Q3 FY22: 88%) with load factor increasing to 91% in June.

Passenger1 numbers in the quarter increased to 23.5 million (Q3 FY22: 22.0 million).

Revenue, Cost and Liquidity

Revenue continued to benefit from strong demand for easyJet’s leading network, the continued outperformance

of ancillary products and easyJet holidays. Airline headline cost per seat ex fuel reduced 2% in the quarter due to

no wet lease aircraft being within the fleet and a much improved operational performance compared to the

same period last year.

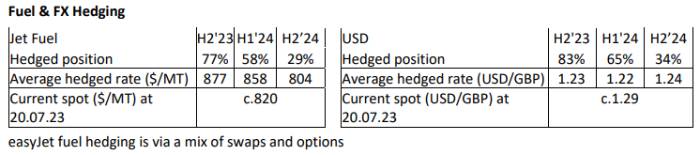

Financing costs benefitted from the strengthening of sterling versus the USD over the quarter which has driven a

non-operating, non-cash FX gain of £10 million (Q3’22: £36 million loss) from balance sheet revaluations.

During the quarter, easyJet continued to deleverage through paying down $950 million of debt under the

UKEF. This follows the 500 million Eurobond which was repaid in February 2023. The UKEF has been

replaced by a new undrawn five-year sustainability linked term loan facility of $1.75 billion, extending

easyJet’s debt maturity profile, whilst maintaining available liquidity and reducing the group net financing

costs.

Source: EasyJet

Be the first to comment on "EasyJet Trading Update for the quarter ended 30 June 2023"