7 October, 2020

Headlines such as “Airlines have enjoyed a free ride for too long – it’s time they paid the price for their role in climate destruction”1 are increasingly common in the media, and there is growing consensus on the need to tax aviation more in order to reduce emissions to achieve the goal of zero emissions by 2050.

This “Think paper” is to help in the debate, takes a careful look at how best aviation emissions could be reduced, and aims to find answers to the following questions:

- Do taxes on aviation fuel or air tickets, or equivalent measures to compensate for the environmental impact of the emissions generated by aircraft movements, which are already being applied by many states, effectively contribute to reducing aviation emissions?

- Could aviation taxes help reduce the aviation sector’s CO2 emissions in the current COVID context, given the slow economic recovery?

- To what extent could CO2 goals be met by decarbonising the aviation sector?

We seek to find answers to these questions by looking at the impact of factors such as travel restrictions, GDP, passenger demand, fuel prices and airfares. The paper analyses some of the instruments already in place that are designed to help reduce CO2 emissions, as well as the impact that using aviation taxes to decarbonise the aviation sector could have.

EU CO2 emissions in the aviation sector – Setting the scene

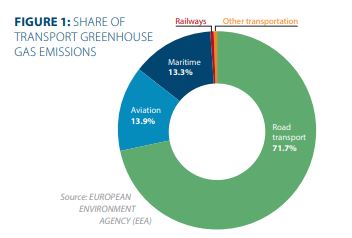

One of the key objectives of the EU Green Deal is to allow economic growth while reducing net EU carbon emissions to zero by 2050, including a 90% reduction in transport emissions2 compared with 1990. In 2016, aviation produced 3.6%3 of total EU28 greenhouse gas emissions and, as Figure 1 shows, 13.9% of emissions from transport4 .

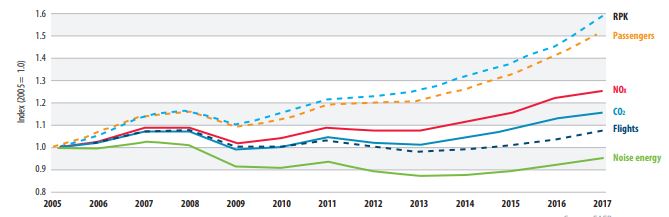

From 2009 to 2017, air transport underwent significant and steady growth, greatly contributing to economic development in Europe and globally, and providing European citizens with greater connectivity and mobility. As can be seen in Figure 2, the number of passengers increased by 40% and the number of revenue passenger kilometres (RPK) by 45%. Fortunately, thanks to fleet renewal with cleaner and more fuel-efficient aircraft, improved operations and higher load factors, CO2 emissions have risen much more slowly, by only 15%, while noise impact has stabilised (+4.0%). Although significant, the growth in CO2 emissions from aviation is therefore being contained thanks to the efforts of all its stakeholders.

KEY INDICATORS IN THE EUROPEAN AVIATION ENVIRONMENTAL REPORT (EAER) 2019

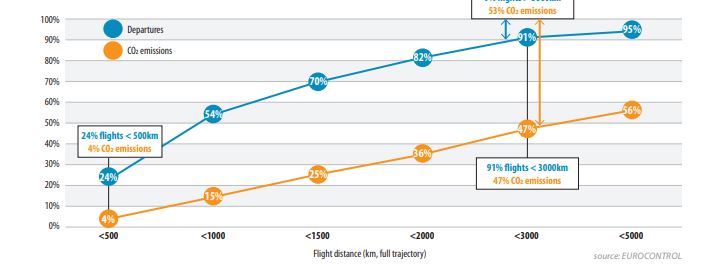

To keep pace with economic growth due to globalisation, aviation has had to adapt profoundly, in particular by increasing the frequency of direct connections between the world’s major cities. In doing so, and despite the efforts made by our industry, this has resulted in an increase in CO2 emissions. Figure 3 provides a better understanding of this phenomenon. As can be seen, flights of less than 500 km account for 24% of flights departing from the CRCO area (all EUROCONTROL Member States except Monaco and Ukraine), but are responsible for only 4% of CO2 emissions. Conversely, flights of more than 3,000 km make up only 9% of departing flights, but produce 53% of CO2 emissions.Decarbonising medium-to-long-distance flights is therefore paramount to achieving significant CO2 emission reductions in the aviation sector. For this reason, the use of sustainable aviation fuels (SAF) and other decarbonisation solutions for aviation must be accelerated, especially for these longer sectors.

FLIGHTS AND CO2 EMISSIONS – CUMULATIVE DISTRIBUTIONS BY FLIGHT DISTANCE (ALL DEPARTURES FROM CRCO AREA – 2019)

Travel restrictions, GDP and air traffic demand have a stronger influence on the number of flights than higher fuel or ticket prices

To regulate/constrain demand, some states have increased the price of flight tickets through taxes or excise duties on fuel. However, to what extent is this really effective in the aviation sector? What are the main factors influencing traffic demand and the number of flights?

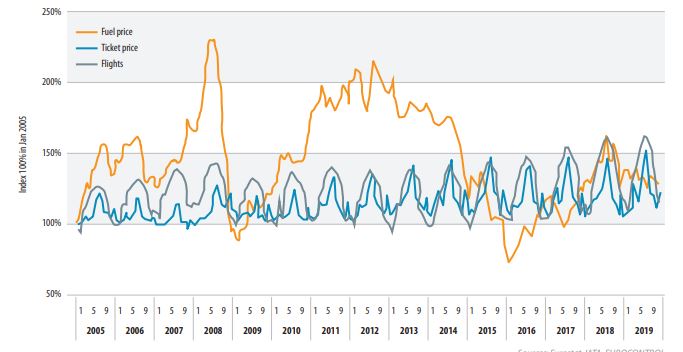

Flights vs. Ticket and Fuel prices

Figure 4 shows the evolution of the number of flights, and fuel and ticket prices between 2005 and 2019. A strong seasonal variation (±20%) can be seen in real ticket prices and the number of flights, with peaks in the summer, when demand is at its highest. Variation in opposite directions would be expected if an increase in ticket prices had a strong influence on demand and led to its decreasing. In fact, in the highly competitive European air transport market ? higher demand clearly leads to an increase in the number of flights, despite higher ticket prices.

Another surprising fact is the remarkable insensitivity of the number of flights to the strong variation in fuel price over the last 15 years, including during the oil crisis that peaked in May 2008 (+70% in 12 months ).

In the long run, economic growth remains the most important factor that influences the growth in demand for air travel. Air traffic and the number of flights are strongly influenced by Gross Domestic Product (GDP). Data shows that year-on-year demand for air travel tends to follow economic growth, with a 1% change in GDP generally resulting in a 1.5%-2% change in the number of flights.

For example, during the 2009 economic crisis, EU GDP fell by 4.3% and the number of flights fell by 6.6%.

Finally, air traffic fell by 77.2% between April and July 2020 compared to the same period in 2019 following the travel and air traffic restrictions in response to the COVID-19 pandemic, reducing CO2 emissions by 77.7% for the same period.

“Factors such as travel restrictions, GDP and air traffic demand have therefore a much stronger influence on the number of flights than any increases in fuel or ticket prices.”

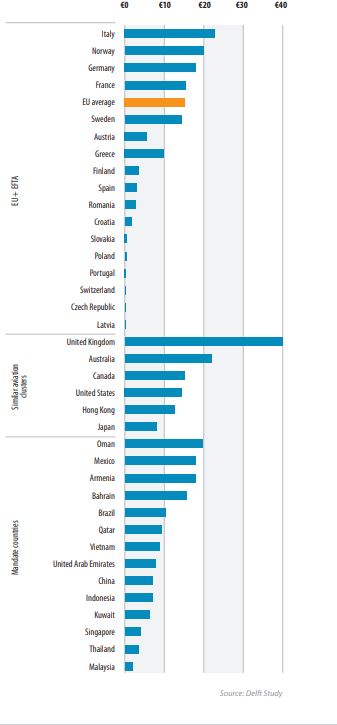

Influence of taxes on aviation CO2 emissions

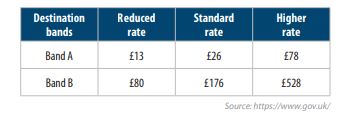

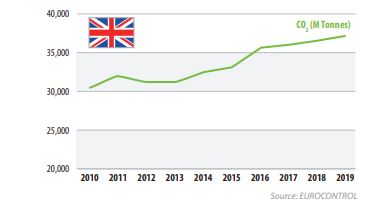

The European Commission recently published a study conducted by the University of Delft on “Taxes in the Field of Aviation and Their Impact”. Figure 6 taken from this June 2019 study shows that some European states already levy taxes on aviation, with the highest tax burden per passenger being in the UK. One way to identify the influence of taxes on aviation emissions is to observe changes in the amount of CO2 emitted following their introduction. The UK’s ticket tax is called the “UK Air-Passenger Duty” (APD), which was introduced in 1994 and is charged to all passengers departing from UK airports on aircraft with a maximum take-off weight (MTOW) of more than 5.7 tonnes6 . The following table gives the APD rates from 1 April 2020

“Despite having the highest rate of taxation on air travel in Europe, CO2 emissions continue to increase in the UK, despite a slight reduction in the number of flights that can be seen in 2018 and 2019, as Figure 5 shows”.

AVIATION CO2 EMISSIONS IN MILLION TONNES FROM UK DEPARTURES

AIR TRAVEL TAXES

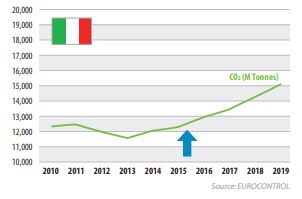

As another example: despite the introduction of a departure tax on 1 January 2011 in Germany, CO2 emissions increased by 4.2% that year, as shown in Figure 7. Similarly in Figure 8, although Italy increased departure taxes by almost 40% on 1 January 20168 , its CO2 emissions increased by 5.2% that year, while traffic from Italy fell by just 1.4%.

AVIATION CO2 EMISSIONS IN MILLION TONNES FROM GERMANY DEPARTURES

AVIATION CO2 EMISSIONS IN MILLION TONNES FROM ITALY DEPARTURES

These examples show that the influence of fuel or ticket taxes has so far had only a limited effect on the growth of air traffic, and thus on its emissions. Nevertheless, there is now an emerging consensus on the need to use aviation taxes to reduce emissions – so the question is how best to achieve the desired effect, namely to achieve a real reduction in the aviation sector’s CO2 emissions.

Aviation decarbonisation is the answer – but it requires huge investments

Decarbonisation will allow economic growth and has the potential to reduce net EU carbon emissions to zero by 2050, including a 90% reduction in transport emissions. It can be achieved by implementing the four ICAO pillars of market-based measures, disruptive technology, improved infrastructure and operations, and the uptake of Sustainable Aviation Fuels (SAF).

These pillars are global aviation solutions for a global problem which will help ensure European competitiveness in the global aviation market.

Moving short-haul passengers to another mode of transport is not a solution for achieving this 90% CO2 reduction, as it will only affect 4% of aviation’s CO2 emissions (see Figure 3) – and will have a significant negative impact on connectivity where no alternative transport solutions are available.

Market-based measures such as ICAO’s Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and the EU Emission Trading Scheme (ETS) can compensate for or reduce aviation emissions, but offsetting will not be enough to achieve the ‘Green Deal’ objective. The aircraft manufacturing industry is confident that it can develop the technology to reach carbon neutrality by 2050, but it needs massive investments in disruptive aircraft technology and SAF.

Electric, hydrogen or hybrid aircraft need further research and investment for their industrialisation and commercialisation. Initiatives such as Airbus Zero or IMOTHEP9 (Investigation and Maturation Of Technologies for Hybrid Electric Propulsion), carried out by a multidisciplinary consortium of 33 European and international partners including R&D institutes, universities and industrial partners, must be developed further.

The use of currently available SAFs can provide a net carbon emission saving of up to 80%, and advanced bio-fuels or synthetic fuels are reported to be able to save even more. Of course, this requires huge investment that can enable largescale production of SAFs and thus significantly reduce their cost. Initiatives such as the RefuelEU initiative, which aims to boost supply and demand of SAF, are essential and could greatly benefit from aviation tax revenues if these were to be kept within the aviation sector.

Source : IATA / EAER / Eurocontrol / Eurostat

https://www.eea.europa.eu/

Be the first to comment on "Does taxing aviation really reduce emissions?"