Saint-Cloud, March 4th, 2022

Saint-Cloud, on march 4th, 2022 – In a context of a new crisis related to the war between Russia and Ukraine, the Board of Directors chaired by Mr. Éric Trappier held yesterday approved the 2021 statement of accounts. The audit procedures have been completed and the audit opinion is in the process of being issued.

« Last year we mourned the death of Olivier Dassault who, like all members of his family, strongly supported the Group’s development throughout his whole life.

The Covid-19 crisis continued in 2021. The Group adapted during the year and regularly updated its prevention, employee protection and remote working measures in response to the guidance issued by the authorities. Global economic activity saw a strong rebound in 2021, particularly in the industry.

However, this rapid recovery has caused disruption to the supply chain in a background of inflationary tension. 2021 was also marked by growing environmental pressures.

For Dassault Aviation, 2021 was a good year for both civil aviation and military sectors, with an exceptional order intake of 100 aircraft (49 Rafale and 51 Falcon) and net sales of EUR 7.2 billion. In addition, the Group delivered 30 Falcon (compared with the guidance of 25) and 25 Rafale (consistent with theguidance).

In the military sector, 2021 saw: marketing efforts for the Rafale succeeding, leading to:

– the order for 49 new Rafale (Egypt 30+1, France 12, Greece 6) and 12 pre-owned Rafale (Greece). The backlog as of December 31, 2021 now includes 86 new Rafale (46 Export, 40 France),

– the signing of a contract for 80 Rafale for the United Arab Emirates, awaiting T0,

– the purchase by Croatia, following an international call for tenders, of Rafale previously in service with the French Air and Space Force. Alongside this order, Dassault Aviation signed a contract to provide associated support for the fleet ordered, the delivery of 25 Rafale to our export customers, Qatar and India, the continuation of development work on the Rafale F4 standard, the award by France of a new vertically integrated support contract (Balzac) for the support of its Mirage 2000.

The other vertically integrated contracts signed with France for the Rafale (Ravel) and the ATL2 (Ocean) are continuing, with performance exceeding the contractual targets.

For the FCAS, an area in which Dassault Aviation is the leader with the New Generation Fighterdemonstrator, the initial work phases on the demonstrators (Phase 1A) continued in 2021 and will be completed in first semester 2022. Joint Concept Studies (JCS) are ongoing. The next phase of

the work (Phase 1B) has not been awarded no agreement having been found with Airbus Defence& Space.

Rafale success has also been confirmed in early 2022 by signature of a 42 (6+36) Rafale contract for Indonesia for which the T0 is awaited and the authorization by the Greek parliament of the signature a contract for an additional 6 new Rafale.

Regarding the Eurodrone, on February 24th 2022, Airbus GmbH as prime contractor and on behalf of the 3 main contractors, Airbus Defence and Space S.A.U in Spain, Dassault Aviation in France and Leonardo S.p.A. in Italia and the Organization for Joint Armament Cooperation (OCCAR) representing the first 4 customers (Germany, France, Italy and Spain) signed the Eurodrone contract relative to the development, the production and the 5 year maintenance of 20 systems. Dassault Aviation will be in charge of flight control and mission communication systems, (with Thales).

For the multi-mission Falcon, work continued on “Albatros” (surveillance and maritime response aircraft on a Falcon 2000LXS platform) and “Archange” (electronic warfare aircraft on a Falcon 8X platform). The

sixth Falcon 2000 for the Japan Coast Guard was delivered. Furthermore, commercial prospections are ongoing.

In the civil aviation segment, 30 Falcon were delivered (for guidance of 25) and 51 Falcon were ordered in 2021. This increase in activity is due to the recovery of business aviation market and expansion of the product line with the Falcon 6X and Falcon 10X.

The year also saw:

– the maiden flight of the Falcon 6X on March 10, 2021,

– the announcement of the Falcon 10X, an ultra-long-range aircraft with the most spacious and luxurious cabin on the market,

– recognition of Falcon customer support, ranked top by AIN for the third year in a row.

The backlog as of December 31, 2021 is 55 new Falcon, compared with 34 at the end of 2020.

The “Leading Our Future” transformation plan continued in 2021. The aim of this plan is to modernize the infrastructures and processes to improve the competitiveness of the Group. In 2021, we were able to put in place the new methodological framework, collaborative platforms and modernized infrastructure and resources by relying on digital levers.

The Company also pursued its efforts to reduce the impact of its processes and products on the environment. The Falcon range is already capable of operating with 50% sustainable fuel.

In the continuity of the elapsed year, our objectives for 2022 are:

– Rafale: to perform contracts, secure the first advance on the contracts signed and continue business development

– Military developments: to continue the programs under way and prepare future Rafale standards

– Falcon: to support the market recovery and boost sales

– Falcon 6X: to ensure a successful entry into service and ramp up mass production

– Falcon 10X: to adhere to the development schedule for an entry into service in late 2025

– Civil and military aircraft support and availability: to maintain the highest standards

– Energy transition: to pursue the R&T in conception

– Make in India: to continue ramping up the activities transferred to DRAL

– New Generation Fighter: decide on Phase 1B

– Eurodrone: to perform the contract

The Guidance for 2022 is to deliver 13 Rafale and 35 Falcon. Net sales will be down compared to 2021».

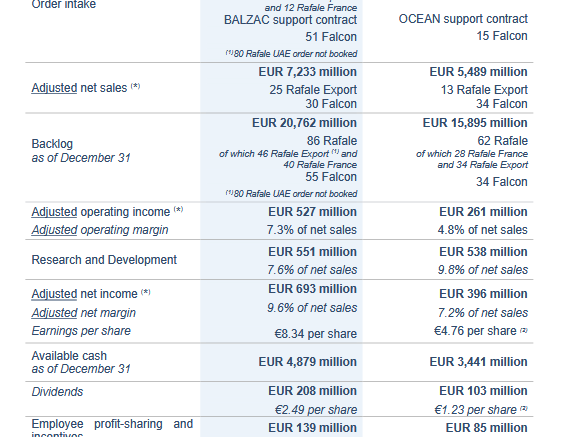

ORDER INTAKE

2021 order intake was EUR 12,080 million versus EUR 3,463 million in 2020. Export represented 74%.

In 2021, Defense order intake totaled EUR 9,165 million, compared with EUR 1,546 million in 2020.

The Defense Export figure was EUR 6,173 million in 2021, versus EUR 224 million in 2020. We recorded orders from Egypt for 30 Rafale – followed by an order for an additional aircraft to complete the original order of 2015 – from Greece for 6 new and 12 pre-owned Rafale (which we bought back from the French Air and Space Force) and a support contract for Croatia following its acquisition of 12 pre-owned Rafale directly from the French government.

The Defense France amounted to EUR 2,992 million in 2021, compared with EUR 1,322 million in 2020.

It mainly includes the order for 12 Rafale, the 14-year “Balzac” support contract for the Mirage 2000 (excluding engines), and a productibility contract for Tranche 5 of the Rafale. In 2020, it was essentially

the 10-year “Ocean” integrated support contract (excluding engines) for the ATL2 with the French Naval Air Force that was recorded.

Falcon programs

In 2021, 51 Falcon orders were recorded, compared with 15 in 2020. Order intake totaled EUR 2,915 million, versus EUR 1,917 million in 2020. The growth in orders is being driven by the recovery of the business jet market.

In 2020, the main order was for 7 Falcon 2000LXS “Albatros” maritime surveillance and response aircraft for France, plus the associated support.

ADJUSTED NET SALES

Net sales for 2021 were EUR 7,233 million versus EUR 5,489 million in 2020. Export represented 89%.

Recent year figures are as follows, in EUR million:

Defense programs

In 2021, 25 Rafale Export were delivered, in line with our forecast, versus 13 Rafale Export in 2020.

Defense net sales in 2021 were EUR 5,281 million versus EUR 3,263 million in 2020.

The Defense Export share was EUR 4,549 million versus EUR 2,699 million in 2020. The strong growth is largely due to the delivery of 25 new Rafale Export with the associated support, whereas 13 Rafale Export were delivered in 2020. In addition, 2021 net sales include the first 6 pre-owned Rafale delivered to Greece, among the 12 ordered.

The Defense France share was EUR 732 million versus EUR 564 million in 2020. As in 2020, Defense France net sales in 2021 do not include the delivery of Rafale in accordance with France’s Military Procurement Law. However, they do take into account maintenance services (for the Rafale under the Ravel contract and the ATL2 under the Ocean contract), as well as support for other aircraft in service.

Falcon programs

There were 30 Falcon delivered in 2021 (higher than the 25 guidance), versus 34 in 2020.

Falcon net sales in 2021 totaled EUR 1,952 million, versus EUR 2,226 million in 2020. The decrease is mainly due to the number of Falcon delivered (30 vs 34).

The “book-to-bill ratio” of the Group (order intake/net sales) is 1.67 for 2021.

BACKLOG

The consolidated backlog as of December 31, 2021 (determined in accordance with IFRS 15) was EUR 20,762 million, versus EUR 15,895 million as of December 31, 2020. The backlog has evolved as

follows:

2021 ADJUSTED RESULTS

Adjusted operating income

Adjusted operating income for 2021 was EUR 527 million, compared with EUR 261 million in 2020.

R&D costs totaled EUR 551 million in 2021 and accounted for 7.6% of net sales, as against EUR 538 million and 9.8% of net sales in 2020. These amounts reflect the self-funded R&D effort focused on the Falcon 6X and Falcon 10X programs.

Operating margin was 7.3%, versus 4.8% in 2020. This increase is mainly due to the reduction in the rate of self-funded R&D.

The foreign exchange hedging rate was $1.19/€ in 2021, compared with $1.18/€ in 2020.7

Adjusted financial income

2021 adjusted financial income was EUR -26 million compared to EUR -34 million in 2020. In 2021, the impact associated with the financing component recorded under long-term military contracts was less

significant due to deliveries of Rafale Export.

Adjusted net income

Adjusted net income for 2021 was up 75% at EUR 693 million compared with EUR 396 million in 2020. Thales’ contribution to the Group’s net income was EUR 336 million, versus EUR 231 million in 2020.

As a result, adjusted net margin was 9.6% in 2021, as against 7.2% in 2020. This increase is mainly due to the increase in operating income).

Net income per share for 2021 was €8.34, compared with €4.76* in 2020

* 2021 proforma following the stock split.

2021 KEY FIGURES – IFRS

Consolidated operating income (IFRS)

Consolidated operating income for 2021 was EUR 545 million, compared with EUR 246 million in 2020. R&D costs totaled EUR 551 million in 2021 and accounted for 7.6% of consolidated net sales (EUR 7,246 million), as against EUR 538 million and 9.8% of consolidated net sales in 2020. These

amounts reflect the self-funded R&D effort focused on the Falcon 6X and Falcon 10X programs.

Consolidated operating margin was 7.5%, versus 4.5% in 2020.

This increase is mainly due to the reduction of the amount of self-funded R&D.

Consolidated financial income (IFRS)

Consolidated financial income for 2021 was EUR -69 million, compared with EUR 12 million in 2020. The decline in financial income was mainly due to the negative change in the market value of hedging instruments not eligible for hedge accounting under IFRS. The market value of these instruments,

purchased because of the efficient economic hedge they offer the Group, was adversely impacted by the evolution in the dollar exchange rate ($1.1326/€ at yearend-2021, versus $1.2271/€ at yearend-2020).

The reduced impact of the financing component recognized under long-term military contracts due to Rafale Export deliveries partially offsets this decrease.

Consolidated net income

Consolidated net income for 2021 was up 100% at EUR 605 million, compared with EUR 303 million in 2020. Thales’ contribution to the Group’s net income was EUR 266 million, versus EUR 116 million in 2020.

As a result, consolidated net margin was 8.4% in 2021, as against 5.5% in 2020. This increase is mainly due to the increase in operating income.

Consolidated net income per share for 2021 was € 7.28, compared with €3.64 in 2020*

* 2021 proforma following the stock split.

AVAILABLE CASH

The Group uses a specific indicator called “Available cash”, which reflects the amount of total cash available to the Group, net of financial debts. It includes the following balance sheet items: cash and cash equivalents, current financial assets (at market value) and financial debt, excluding lease liabilities. The calculation of this indicator is detailed in the consolidated financial statements (see Note 9 of the 2021 consolidated financial statements).

The Group’s available cash stands at EUR 4,879 million, an increase of EUR 1,438 million from December 31, 2020. The increase is mainly due to operating cash flow generated during the year and the decline in working capital requirement, partially offset by investments during the year and the payment of dividends.

The decline in working capital requirement is largely due to advances and progress payments received under the Defense France and Falcon contracts. This is partially offset by the decrease in advances and progress payments under the Rafale export contracts, following the services delivered during the period.

BALANCE SHEET (IFRS)

Total equity stood at EUR 5,300 million as of December 31, 2021, versus EUR 4,560 million as of December 31, 2020.

Borrowings and financial debt stood at EUR 226 million as of December 31, 2021, compared with EUR 270 million as of December 31, 2020. Borrowings and financial debt include locked-in employees’ profit-sharing funds, for EUR 98 million, and lease liabilities, for EUR 128 million.

Inventories and work-in-progress rose to EUR 3,480 million as of December 31, 2021, compared with EUR 3,382 million as of December 31, 2020. The increase in inventories and work-in-progress relating to the performance of Defense France contracts and Falcon operations was partially offset by the decrease in inventories and work-in-progress for Defense Export following the services delivered during the period.

Advances and progress payments received on orders, net of advances and progress payments paid, rose by EUR 278 million as of December 31, 2021. This was mainly due to progress payments received on Defense France and Falcon orders, partially offset by the reversal of Rafale Export progress payments following the services delivered during the period.

Derivative financial instruments had a market value of EUR -81 million as of December 31, 2021, compared with EUR 81 million as of December 31, 2020. This change is essentially due to the change in the US dollar exchange rate between December 31, 2021 and December 31, 2020 ($1.1326/€ as of

12.31.2021 versus $1.2271/€ as of 12.31.2020).

DIVIDENDS AND PROFIT-SHARING/INCENTIVES

The Board of Directors decided to propose to the Annual General Meeting a dividend distribution, in 2022, of €2.49 per share, corresponding to a total of EUR 208 million, i.e. a payout of 30%.

For 2021, the Group will pay EUR 139 million in employee profit-sharing and incentives, including 20% correlated social tax, whereas the application of the legal formula would have resulted in a EUR 28 million payment.

Dividends per share over the five last years are outlined in Note 32 to the Parent Company Financial Statements.

This Financial Press Release may contain forward-looking statements which represent objectives and cannot be construed as forecasts regarding the Company’s results or any other performance indicator.

The actual results may differ significantly from the forward-looking statements due to various risks and uncertainties, as described in the Directors’ report

Source/ Dassault

Be the first to comment on "Dassault key figures"