Paris, July 26, 2023 – Constellium SE (NYSE: CSTM) today reported results for the second quarter ended June 30, 2023.

Second quarter 2023 highlights:

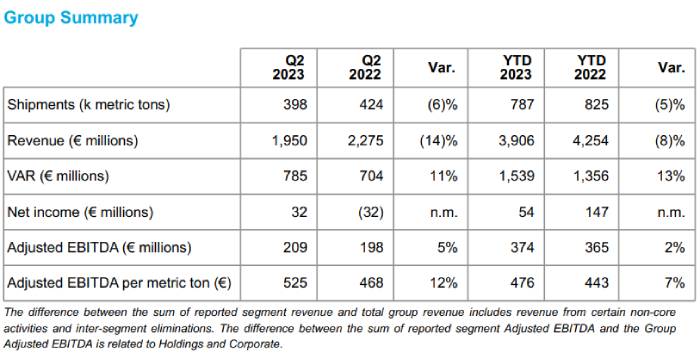

• Shipments of 398 thousand metric tons, down 6% compared to Q2 2022

• Revenue of €2.0 billion, down 14% compared to Q2 2022

• Value-Added Revenue (VAR) of €785 million, up 11% compared to Q2 2022

• Net income of €32 million compared to a net loss of €32 million in Q2 2022

• Adjusted EBITDA of €209 million, up 5% compared to Q2 2022

• Cash from Operations of €133 million and Free Cash Flow of €68 million

First half 2023 highlights:

• Shipments of 787 thousand metric tons, down 5% compared to H1 2022

• Revenue of €3.9 billion, down 8% compared to H1 2022

• VAR of €1.5 billion, up 13% compared to H1 2022

• Net income of €54 million compared to net income of €147 million in H1 2022

• Adjusted EBITDA of €374 million, up 2% compared to H1 2022

• Cash from Operations of €167 million and Free Cash Flow of €34 million

• Net debt / LTM Adjusted EBITDA of 2.7x at June 30, 2023

Jean-Marc Germain, Constellium’s Chief Executive Officer said, “I am very pleased with the results our team delivered in the second quarter, including record VAR and record Adjusted EBITDA. Demand remained strong across several end markets during the quarter, and our team continued to execute very well despite significant inflationary pressures. A&T reported record quarterly Adjusted EBITDA supported by continued strength in aerospace demand. The recovery in automotive continued with higher shipments in both rolled and extruded products. Packaging shipments were down in the quarter as demand remained below prior year levels, and we continued to experience weakness in most industrial markets, especially in Europe. Free Cash Flow generation in the second quarter was strong at €68 million and we reduced our leverage to 2.7x.”

“We announced in June and recently completed the redemption of $50 million of our 2026 Senior Notes, which further strengthens our balance sheet. Also, in July we announced the sale of our soft alloy extrusion business in Germany for a total cash consideration of €48.8 million,” Mr. Germain continued.

Mr. Germain concluded, “Based on our strong performance in the first half of this year and our current outlook for the second half, which assumes no major deterioration on the macroeconomic or geopolitical fronts, we are raising our guidance and now expect Adjusted EBITDA of €700 million to €720 million and Free Cash Flow in excess of €150 million in 2023. We also remain confident in our ability to deliver on our long-term target of Adjusted EBITDA

over €800 million in 2025. Our focus is on executing our strategy, driving operational performance, generating Free Cash Flow, achieving our ESG objectives and increasing shareholder value.”

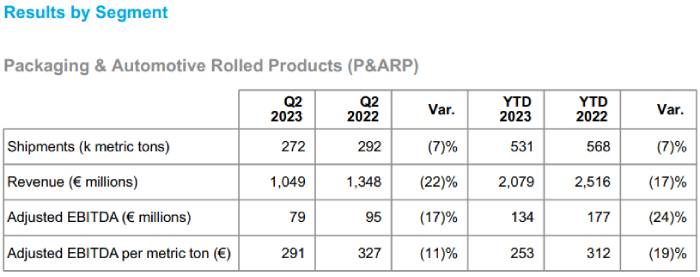

For the second quarter of 2023, shipments of 398 thousand metric tons decreased 6% compared to the second quarter of last year due to lower shipments in the P&ARP and AS&I segments. Revenue of €2.0 billion decreased 14% compared to the second quarter of the prior year primarily due to lower shipments and lower metal prices, partially offset by improved price and mix. VAR of €785 million increased 11% compared to the second quarter of the prior year

primarily due to improved price and mix, partially offset by lower shipments and unfavorable metal costs. Net income of €32 million increased €64 million compared to a net loss of €32 million in the second quarter of 2022. Adjusted EBITDA of €209 million increased 5% compared to the second quarter of last year due to stronger results in our A&T segment, partially offset by weaker results in our P&ARP and AS&I segments.

For the first half of 2023, shipments of 787 thousand metric tons decreased 5% compared to the first half of 2022 mostly due to lower shipments in the P&ARP segment. Revenue of €3.9 billion decreased 8% compared to the first half of 2022 primarily due to lower shipments and lower metal prices, partially offset by improved price and mix. VAR of €1.5 billion increased 13% compared to the first half of 2022 primarily due to improved price and mix, partially offset by lower shipments and unfavorable metal costs. Net income of €54 million decreased €93 million compared to net income of €147 million in the first half of 2022. Adjusted EBITDA of €374 million increased 2% compared to the first half of 2022 as stronger results in our A&T segment were partially offset by weaker results in our P&ARP segment.

Source : Constellium

Be the first to comment on "Constellium Reports Second Quarter and First Half 2023 Results"