Constellium announces its results for the first quarter of 2023 and raises its year-end forecast

Constellium Reports First Quarter 2023 Results

Paris, April 26, 2023 – Constellium SE (NYSE: CSTM) today reported results for the first

quarter ended March 31, 2023.

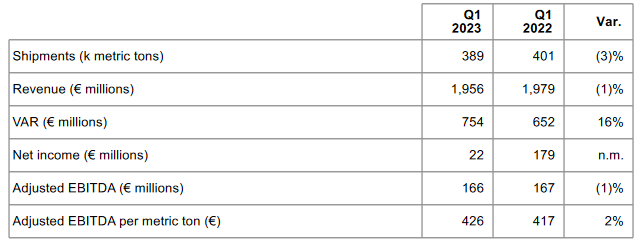

First quarter 2023 highlights:

• Shipments of 389 thousand metric tons, down 3% compared to Q1 2022

• Revenue of €2.0 billion, down 1% compared to Q1 2022

• Value-Added Revenue (VAR) of €754 million, up 16% compared to Q1 2022

• Net income of €22 million compared to net income of €179 million in Q1 2022

• Adjusted EBITDA of €166 million, down 1% compared to Q1 2022

• Cash from Operations of €34 million and Free Cash Flow of €(34) million

• Net debt / LTM Adjusted EBITDA of 2.8x at March 31, 2023

Jean-Marc Germain, Constellium’s Chief Executive Officer said, “Our team delivered solid first quarter results on strong demand across several end markets and solid execution despite significant inflationary pressures. A&T delivered record quarterly Adjusted EBITDA, and AS&I delivered record first quarter Adjusted EBITDA. Looking across our end markets, the recovery in aerospace continued with shipments up over 50% compared to last year. Automotive demand also continued to improve with higher shipments in both rolled and extruded products. Packaging shipments were down in the quarter as demand softened, and we continued to experience weakness in certain industrial markets. Lastly, Free Cash Flow was in line with our expectations at negative €34 million and we maintained our leverage at 2.8x.”

Mr. Germain concluded, “While uncertainties persist on the macroeconomic and geopolitical fronts, we like our end market positioning and we are optimistic about our prospects for the remainder of this year and beyond. Based on our current outlook, we are raising our guidance and expect Adjusted EBITDA in the range of €650 million to €680 million and Free Cash Flow in excess of €125 million in 2023. We also remain confident in our ability to deliver on our long-

term target of Adjusted EBITDA over €800 million in 2025. Our focus is on executing our strategy, driving operational performance, generating Free Cash Flow, achieving our ESG objectives and increasing shareholder value.”

Group Summary

For the first quarter of 2023, shipments of 389 thousand metric tons decreased 3% compared to the first quarter of 2022 mostly due to lower shipments in the P&ARP segment. Revenue of €2.0 billion decreased 1% compared to the first quarter of the prior year primarily due to lower metal prices mostly offset by improved price and mix. VAR of €754 million increased 16% compared to the first quarter of the prior year primarily due to improved price and mix, partially offset by unfavorable metal costs due to inflation. Net income of €22 million decreased €157 million compared to net income of €179 million in the first quarter of 2022. Adjusted EBITDA of €166 million decreased 1% compared to the first quarter of last year as stronger results in our A&T and AS&I segments were more than offset by weaker results in our P&ARP segment.

Results by Segment

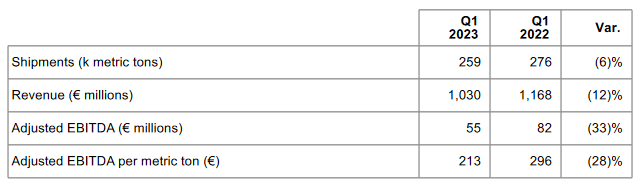

Packaging & Automotive Rolled Products (P&ARP)

For the first quarter of 2023, Adjusted EBITDA decreased 33% compared to the first quarter of 2022 as a result of lower shipments and higher operating costs mainly due to inflation, operating challenges at our Muscle Shoals facility and unfavorable metal costs, partially offset by improved price and mix. Shipments of 259 thousand metric tons decreased 6% compared to the first quarter of the prior year due to lower shipments of packaging and specialty rolled products,

partially offset by higher shipments of automotive rolled products. Revenue of €1.0 billion decreased 12% compared to the first quarter of 2022 primarily due to lower shipments and lower metal prices, partially offset by improved price and mix.

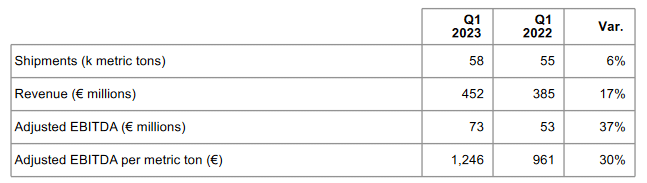

Aerospace & Transportation (A&T)

For the first quarter of 2023, Adjusted EBITDA increased 37% compared to the first quarter of 2022 primarily due to higher shipments and improved price and mix, partially offset by higher operating costs mainly due to inflation and production increases. Shipments of 58 thousand metric tons increased 6% compared to the first quarter of the prior year on higher shipments of aerospace rolled products, partially offset by lower shipments of transportation, industry and

defense (TID) rolled products. Revenue of €452 million increased 17% compared to the first quarter of 2022 primarily due to higher shipments and improved price and mix, partially offset by lower metal prices.

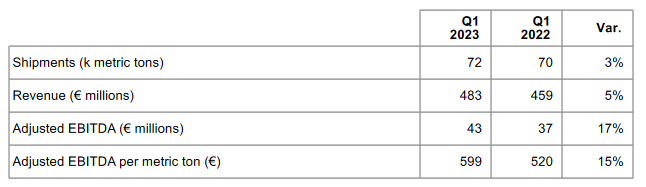

Automotive Structures & Industry (AS&I)

For the first quarter of 2023, Adjusted EBITDA increased 17% compared to the first quarter of 2022 primarily due to improved price and mix partially offset by higher operating costs mainly due to inflation. Shipments of 72 thousand metric tons increased 3% compared to the first quarter of the prior year due to higher shipments of automotive extruded products, partially offset by lower other extruded product shipments. Revenue of €483 million increased 5%

compared to the first quarter of 2022 primarily due to improved price and mix, partially offset by lower metal prices.

Net Income

For the first quarter of 2023, net income of €22 million compares to net income of €179 million in the first quarter of the prior year. The decrease in net income is primarily related to unfavorable changes in gains and losses on derivatives mostly related to our metal hedging positions and lower gross profit, partially offset by lower tax expense.

Cash Flow

Free Cash Flow was €(34) million in the first quarter of 2023 compared to €26 million in first quarter of 2022. The change was primarily due to increased capital expenditures and an unfavorable change in working capital.

Cash flows from operating activities were €34 million for the first quarter of 2023 compared to cash flows from operating activities of €58 million in the first quarter of the prior year. Constellium decreased derecognized factored receivables by €4 million for the first quarter of 2023 compared to an increase of €5 million in the prior year.

Cash flows used in investing activities were €68 million for the first quarter of 2023 compared to cash flows used in investing activities of €32 million in the prior year. Cash flows from financing activities were €61 million for the first quarter of 2023 compared to cash flows used in financing activities of €14 million in the prior year.

Liquidity and Net Debt Liquidity at March 31, 2023 was €688 million, comprised of €193 million of cash and cash equivalents and €495 million available under our committed lending facilities and factoring arrangements. Net debt was €1,907 million at March 31, 2023 compared to €1,891 million at December 31, 2022.

Outlook

Based on our current outlook, we expect Adjusted EBITDA in the range of €650 million to €680 million in 2023.

We are not able to provide a reconciliation of this Adjusted EBITDA guidance to net income, the comparable GAAP measure, because certain items that are excluded from Adjusted EBITDA cannot be reasonably predicted or are not in our control. In particular, we are unable to forecast the timing or magnitude of realized and unrealized gains and losses on derivative instruments, metal lag, impairment or restructuring charges, or taxes without unreasonable efforts, and these items could significantly impact, either individually or in the aggregate, net income in the future.

Source : CONSTELLIUM – CLAI

Be the first to comment on "Constellium announces results"