easyJet Trading Update for the six months ended 31 March 2023

easyJet improves its first half performance by >£120 million year on year and expects to exceed FY23 market expectations 1, driven by network transformation, improved revenue capability and strong demand. Easter saw a robust operational performance with booking momentum continuing into summer

● Continued revenue growth through Q2

o Passengers 2 +35% YoY

o RPS +43% YoY

▪ Load factor +10 ppts YoY

▪ Ticket yield +31% YoY

▪ Ancillary yield +16% YoY

● Robust Easter operations

o Around 1,600 flights per day

o 99.8% of planned flights operated despite impact from French ATC strikes

● Strong bookings continue into summer 2023

o Q3 Airline RPS expected to be around +20% YoY

o easyJet holidays further upgrades growth expectations to c. 60% YoY

● Capacity

o H2 c.56m seats, c.9% increase YoY

▪ Q3 Capacity c.26m – +7% YoY

▪ Q4 capacity around pre-pandemic levels – network capacity +8% vs pre pandemic excluding Berlin rightsizing

● [Whilst we remain mindful of the uncertain macroeconomic outlook across the globe, based on current high levels of demand and strong bookings, easyJet anticipates exceeding current market profit expectations of £260 million for FY23]

Summary

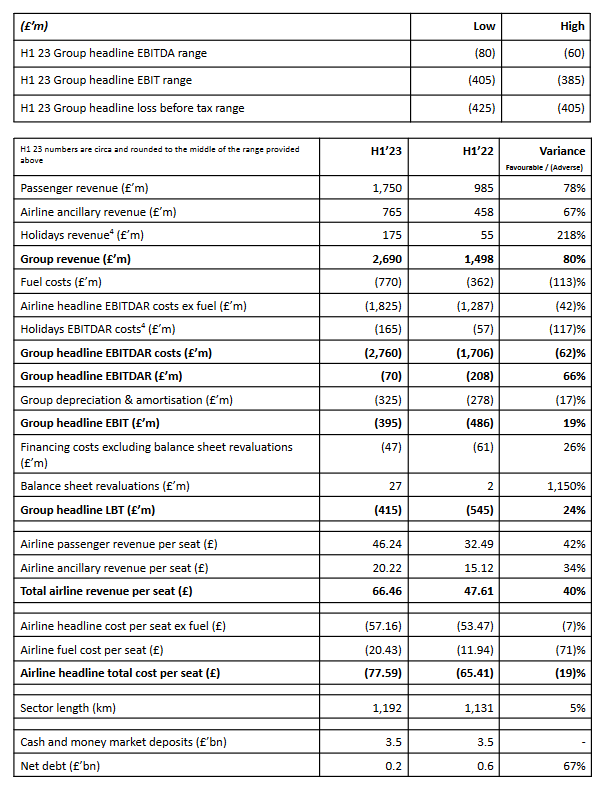

easyJet reduced its first half “seasonal” losses significantly year on year, driven by self-help measures including network optimisation, improved ancillary products, and a continued cost focus which allow us to fully benefit from strong levels of demand. Headline loss before tax for the first half is expected to be between £405 and £425 million. This result is despite challenges from elevated fuel prices, market wide inflation and costs associated with building resilience into the operation ahead of summer 2023.

easyJet has ramped up capacity throughout the quarter, growing 40% from January to March. This growth will continue into peak summer where easyJet will be back to around pre-pandemic levels of capacity, with the network seeing growth of around 8% when excluding the Berlin rightsizing. easyJet is fully resourced ahead of this ramp up after successfully completing its largest ever crew onboarding campaign. The attractiveness of easyJet’s brand continues to be a differentiator, with applications received being over 8 times the number of roles recruited.

Easter demand has been strong with around 1,600 flights operating on average per day with robust operational performance achieved. Capacity over Easter, in the UK, was back around pre pandemic levels, with strong demand and positive yield growth compared to Easter 2019. Disruption from French ATC strikes continued to be seen through April, though easyJet’s investment into resilience will help mitigate its impact.

easyJet holidays continues to benefit from strong UK demand, further upgrading its growth expectations to c.60%

year on year (previously 50%). easyJet holidays is currently 80% sold for this summer.

Johan Lundgren, CEO of easyJet, said:

“Demand for easyJet’s flights and holidays has continued to grow in the half, resulting in more than a £120 million pound improvement in our performance as well as a billion pound revenue improvement year on year. This is further enhanced by our transformed network of popular destinations and improved revenue capability.

“We see continued strong booking momentum into summer as customers prioritise spending on travel and choose airlines like easyJet offering the best value and destination mix, as well as easyJet holidays which is continuing its steep growth trajectory as the fastest growing holidays company in the UK.

“All of this means easyJet expects to outperform FY23 market expectations.”

Capacity

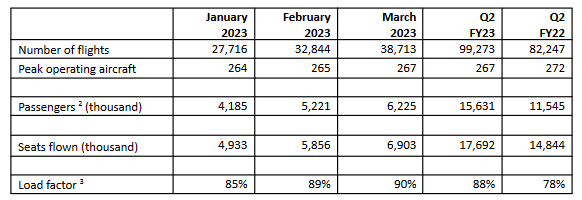

During Q2 easyJet flew 17.7 million seats, in line with guidance, a significant increase on the same period last year when easyJet flew 14.8 million seats. Load factor was 88% (Q2 FY22: 78%), due to increased customer demand coupled with restriction-free travel.

Passenger 2 numbers in the quarter increased to 15.6 million (Q2 FY22: 11.5 million).

Revenue, Cost and Liquidity

Total group revenue and headline costs for the first half are expected to be around £2,690 million and around £3,105 million respectively. Pricing remained strong during the first half for both ticket and ancillary revenue, demonstrating the continued success of easyJet’s network optimisation and ancillary products. Significant fuel price increases year on year and the strengthened USD have resulted in sterling fuel cost per seat being +71% (+£8.49) vs the same period last year. One-off costs were incurred during the first half as 15 wet leased aircraft utilised in summer 22 only left the fleet at the end of October.

easyJet continues to have one of the strongest, investment grade, balance sheets in european aviation. As at 31 March 2023 our net debt position was c.£0.2 billion (31 December 2022: £1.1 billion). During February 2023, a €500 million bond was repaid upon maturity.

Financing costs benefitted from the strengthening of sterling versus the USD over the quarter which has driven a non-operating, non-cash FX gain of circa £27 million (H1 22: £2 million gain) from balance sheet revaluations.

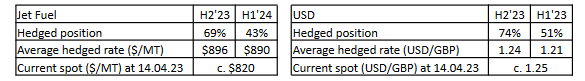

Fuel & FX Hedging (as at 14.04.23)

Source : easyJet plc

Be the first to comment on "easyJet Trading Update"