15 October 2020

Similar to the Chinese tech stocks that are slowly on the rise despite growing allegations of breach of data privacy, the Chinese airline companies are seeing an improvement post the onset of COVID-19 pandemic, says GlobalData, a leading data and analytics company.

The travel and tourism sector was one of the major sectors that suffered heavily due to the COVID-19 pandemic as several countries announced lockdowns, particularly the European countries and the US, to contain the pandemic. As a result, the airline companies posted decline in profitability owing to a drop in the number of passengers travelling, which triggered massive job losses in the sector.

Anindya Biswas, Company Profiles Analyst at GlobalData, says: “Unlike other global economies, China’s economy has been slowly on the rise and this is reflected in the Chinese airline sector as well. For the second quarter ended 30 June 2020 (Q2 2020), Chinese airline companies have shown signs of turnaround unlike their global counterparts that are suffering as a result of border shutdowns.”

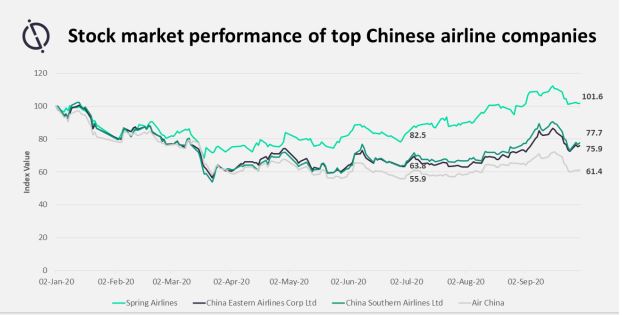

Shortly after the slight dip in the first quarter ended 31 March 2020 (Q1 2020), the top airline stocks in China have been on the rise, mainly on account of the Chinese borders opening, growing domestic demand as well as the rise of Yuan and declining oil prices.

Ms Biswas adds: “Chinese low-cost carrier Spring Airlines has been one of the notable players in the Chinese airline industry leading the resurgence.”

Spring Airlines’ share price reflected the sentiment, recording a year-to-date (YTD) return as on 30 September 2020 of 1.6%, a quarter-to-date (QTD) return of 23.2%.

On the other hand, although China Southern Airlines Co, Air China and China Eastern Airlines Corp reported negative YTD of 22.3%, 38.6% and 24.1%, respectively, they reported a positive QTD return of 21.9%, 9.7% and 19.9%, respectively Mr Biswas concludes: “Growing domestic demand within the country aided by the people’s preferences to visit domestic tourist destinations contributed significantly to the increase in the country’s GDP in the post-pandemic recovery and helped in revenue growth for these airline entities.

“With fresh cases of reinfection resurfacing both in China as well as in the rest of the world and countries extending lockdown, it remains to be seen whether the Chinese airline companies can sustain this turnaround leveraging only the domestic market demand as their sole USP.”

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

Source : GlobaData

https://www.globaldata.com/

Be the first to comment on "Top Chinese airline companies show signs of recovery, says GlobalData"