FIRST HALF 2025 RESULTS

2025 OUTLOOK RAISED

•REVENUE: +10 TO 12%

•RECURRING OPERATING INCOME: €5.0 – €5.1 BILLION

•FREE CASH FLOW: €3.4 – €3.6 BILLION

Record operating margin and cash generation,

FY guidance raised

Paris, July 31, 2025

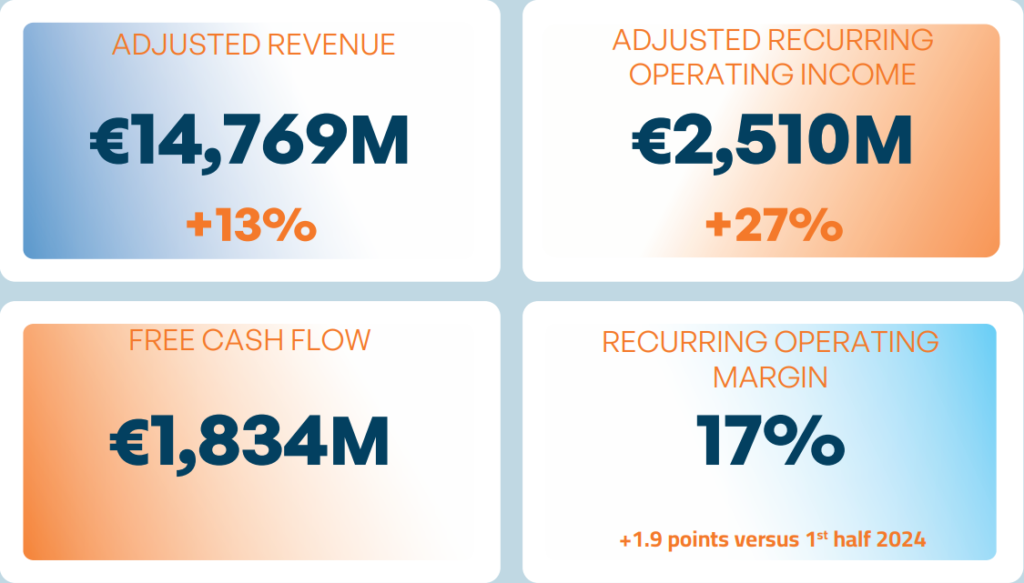

H1 2025 adjusted data

- Revenue: €14,769 million (+13.2%)

- Recurring operating income: €2,510 million (+27.2%), 17.0% of sales

- Free cash flow: €1,834 million

H1 2025 consolidated data

- Revenue: €14,865 million

- Recurring operating income: €2,468 million

- Free cash flow: €1,834 million

The Board of Directors of Safran (Euronext Paris: SAF), under the Chairmanship of Ross McInnes,

at their meeting in Paris on July 30, 2025, adopted and authorized the publication of Safran’s

financial statements and adjusted income statement for the six-month period ended June 30, 2025.

Foreword

▪ All figures in this press release represent adjusted data, except where noted. Please refer to

the definitions and reconciliation between first-half 2025 consolidated income statement and

adjusted income statement. Please refer to the definitions contained in the footnotes and in the

Notes on page 9 of this press statement.

▪ Organic variations exclude changes in scope and currency impacts for the period.

CEO Olivier Andriès said: “The Paris Air Show confirmed the sector’s underlying trends and

underscored the promising growth outlook for both civil aerospace and defense.

Reflecting this positive environment, Safran delivered excellent results in the first half of 2025

achieving a record operating margin of 17% as well as unprecedented cash generation, driven by

robust civil engine aftermarket activities. In the light of this strong performance, we are raising our

full-year guidance on all metrics and reiterate our confidence in our mid-term outlook. On the trade

front, we welcome the progress made on transatlantic tariff exemption for most aerospace products,

and remain vigilant and proactive in managing any residual exposure.

On July 21, Safran achieved a major strategic milestone with the closing of the acquisition of the

Collins Aerospace actuation and flight control business.”

Half-year 2025 results

➢ Revenue

H1 2025 revenue stood at €14,769 million, up by 13.2% compared to H1 2024 (+13.2% on an

organic basis). Change in scope was + €111 million1

. Currency impact was €(112) million, with an

average €/$ spot rate of 1.09 in H1 2025 (1.08 in H1 2024). €/$ hedge rate in H1 2025 stood at 1.12

(unchanged from H1 2024).

As for organic revenue per division:

▪ Propulsion was up by 16.9%, with aftermarket revenue up by 21.3% and OE sales up by 9.7%.

The positive momentum observed in Q1 persisted throughout the first half, with Spare parts for

civil engines increasing by 21.6% over the period (in $), driven primarily by CFM56 and with a

positive contribution from high-thrust engines and LEAP. Services for civil engines (in $) were up

by 21.1%, supported by LEAP rate per flight hour (RPFH) contracts.

LEAP engine deliveries increased by 10% to 729 units compared to 664 in H1 2024, reflecting

improved delivery performance (Q2 up 29% sequentially and up 38% year-over-year).

Military engine revenue increased year-over-year, driven by spare parts, services and a favorable

customer mix. Finally, helicopter engine revenue growth was driven by a higher level of services.

▪ Equipment & Defense was up 8.0%, driven by landing systems and defense activities.

Aftermarket services increased by 11.9%, with growth across the board, particularly in landing

systems (spare parts and services for landing gears), nacelles, avionics and electrical systems.

OE sales grew by 5.5%, led by defense activities (AASM/HammerTM, navigation & timing

systems) and higher volumes in landing gears (A320neo and 787).

▪ Aircraft Interiors saw solid 15.5% growth.

Aftermarket activities grew by 17.3%, mostly driven by Cabin (mainly spare parts).

OE sales growth of 14.4% was mainly driven by Seats, with significant increase in Business class

seat deliveries (1,238 units in H1 2025 vs 750 in H1 2024). Cabin deliveries (galleys, inserts,

etc.) also increased, though to a lesser extent.

➢ Research & Development

Total R&D, including R&D sold to customers, reached €967 million, compared with €936 million in

H1 2024.

Self-funded R&D expenses before tax credits were €649 million in H1 2025 (vs €646 million in H1

2024) including:

▪ €307 million in self-funded Research & Technology (R&T) expenses (€333 million in H1 2024),

mainly geared towards decarbonization notably through the RISE (Revolutionary Innovation for

Sustainable Engines) technology development program;

▪ €342 million in development expenses (€313 million in H1 2024).

The impact of expensed R&D on recurring operating income was €542 million (€547 million in H1

2024), representing 3.7% of revenue (4.2% of revenue in H1 2024).

1 Acquisition of Air Liquide aeronautical oxygen and nitrogen activities in February 2024, Preligens in September 2024, and

Component Repair Technologies Inc (CRT) in January 2025. Closing of Thalès Aeronautical Electrical Systems activities in

North America in October 2024. Consolidation of Safran Data Systems India and Syrlinks from January 2025.

➢ Recurring operating income

In H1 2025, recurring operating income reached €2,510 million, representing a substantial 27.2%

year-on-year increase (+26.5% organic increase) driven by revenue growth and a robust aftermarket

activity. It includes a €19 million increase in scope and a negative currency impact of €6 million.

Operating margin stood at 17.0% of revenue, up 1.9pt (15.1% in H1 2024).

Per division:

▪ Propulsion: recurring operating income reached €1,758 million, up by +37% (+36% organic).

Operating margin stood at 23.3% of revenue, up by 3.4pts, supported by strong civil aftermarket

activity benefiting from higher spare parts sales for CFM56, the start of profit recognition on

LEAP-1A RPFH contracts and an elevated LEAP spare engine ratio.

Military and helicopter activities also contributed to the overall performance.

▪ Equipment & Defense: recurring operating income stood at €703 million, up by +7% (+6%

organic). At 12.5% of revenue, the operating margin benefited mainly from aftermarket growth

notably on landing gears, carbon brakes and Aerosystems. This solid level is close to the H1

2024 operating margin, which had included a one-off effect on nacelles.

▪ Aircraft Interiors: positive recurring operating income of €27 million (compared to €10 million

in H1 2024). Profitability was driven by a strong level of activity in services, benefiting from

increased long-range aircraft traffic, notably for Cabin. OE volume also made a positive

contribution to recurring operating income, especially increased Business class seat deliveries

and, to a lesser extent, from Cabin and in-flight entertainment (IFE) product deliveries.

➢ Net income

In H1 2025, one-off items were €(37) million, resulting from impairment expenses for one program

and other costs such as transaction and restructuring expenses.

Net income (Group share) was up by 11% at €1,587 million in H1 2025 (basic and diluted EPS

of €3.80), compared with €1,432 million in H1 2024 (basic EPS of €3.37 and diluted EPS of €3.27).

This includes:

▪ Financial income of €32 million, of which €77 million of net financial interests (returns on cash

investments exceed cost of debt);

▪ Tax expense of €(851) million (34.0% apparent tax rate, including the €261 million portion of the

French corporate surtax based on 2024 and H1 2025 results).

The reconciliation of the H1 2025 consolidated income statement with the adjusted income

statement is provided and commented in the Notes on page 10.

➢ Free cash flow

Free cash flow of €1,834 million was mostly driven by the increase in cash flow from operations and

slightly offset by higher capital expenditure of €(788) million (€(757) million in H1 2024), notably

directed towards additional MRO and OE production capacities.

The negative €168 million impact of changes in working capital mainly reflects an increase in

inventories partly offset by advance customer payments (notably for Rafale).

➢ Net debt and financing

As of June 30, 2025, Safran’s balance sheet exhibits a €1,869 million net cash position (vs. €1,738

million at December 31, 2024), as a result of a strong free cash flow generation, mostly offset by a

dividend payment (of which €1,216 million to shareholders of the parent company) and share

repurchases for cancellation for a total of €713 million.

Cash and cash equivalents stood at €6,707 million (vs €6,514 million at December 31, 2024).

➢ Consolidated data (IFRS)

The consolidated revenue for H1 2025 was €14,865 million compared with €13,204 million in H1

2024, up 12.6%.

The consolidated recurring operating income for H1 2025 was €2,468 million (16.6% of revenue),

up 25.4% from €1,968 million in H1 2024 (14.9% of revenue).

The increase in sales and recurring operating income was mainly driven by revenue growth and

robust aftermarket activities as explained in the above analysis.

The consolidated financial result for H1 2025 was €4,740 million, compared with €(1,876) million in

H1 2024. It includes changes in the fair value of instruments hedging future cash flows, amounting

to €4,808 million before tax in H1 2025 compared with €(1,681) million before tax in H1 2024.

Consolidated net income (Group share) for H1 2025 was €5,045 million, compared with €57 million

in H1 2024. Net income for H1 2025 includes the tax surcharge in France of €261 million.

Consolidated basic EPS was €12.07 (diluted EPS of €12.07), compared with €0.13 in H1 2024

(diluted EPS of €0.13).

Share repurchase program

During the first half of 2025, Safran repurchased approximately 2.9 million shares for cancellation,

at a cash cost of €713 million. As of July 18, 2025, the total number of shares repurchased reached

3.4 million, representing an aggregate amount of €850 million. Additionally, in April 2025, Safran

reallocated for cancellation around 0.2 million shares that were originally acquired to be delivered

upon conversion of Safran convertible bonds, with a market value of €50 million.

Altogether, as of July 18, this amounts to roughly 3.6 million shares — a total of €900 million —

scheduled for cancellation before the end of the year.

Currency hedges

The hedging portfolio amounts to $55 billion in June 2025 ($54.1 billion in March 2025).

▪ 2025 hedge rate is $1.12, for an estimated net exposure of $14 billion.

▪ 2026, 2027 and 2028 are fully hedged: targeted hedge rate of $1.12, for an estimated net annual

exposure of $14 billion.

▪ 2029 is partially hedged: $5 billion out of an estimated net exposure of $14 billion.

Acquisition of Collins actuation and flight control activities

On July 21, Safran acquired Collins Aerospace’s flight control and actuation activities which are

mission critical systems for commercial and military aircraft, and helicopters. With this transaction,

Safran becomes a global leader in flight control and actuation systems and is well-positioned for

next-generation platforms.

This business will be consolidated within Safran Electronics & Defense starting from August 1, 2025.

In 2024, it generated revenue of around $1.55 billion and EBITDA of approximately $130 million.

The enterprise value of the acquired business amounts to $1.8 billion. The acquisition will be

accretive to Safran’s earnings per share from year one and is expected to generate approximately

$50 million in annual pre-tax run-rate cost synergies by 2028.

In line with regulatory requirements, Safran simultaneously completed the sale of its North American

electro-mechanical actuation activities, which generated revenue of around $65 million in 2024, to

Woodward.

The impact of both transactions on Group revenue is estimated to be between €600 and €700 million over

the last five months of 2025.

Full-year 2025 outlook

Safran upgrades its full-year 2025 outlook, at constant scope, which excludes the contribution of

Collins Aerospace’s actuation & flight controls business as well as any potential impact of tariffs:

▪ Revenue growth: up low-teens (versus around 10%);

▪ Recurring operating income: €5.0 – €5.1 billion (versus €4.8 – €4.9 billion);

▪ Free Cash Flow: €3.4 – €3.6 billion (versus €3.0 – €3.2 billion), of which €(380) – €(400) million

estimated impact from the French corporate surtax and subject to payment schedule of some

advance payments and the rhythm of payments by state-clients.

This outlook is based notably, but not exclusively, on the following assumptions:

▪ LEAP engine deliveries: up 15% to 20% compared to 2024;

▪ “Spare parts” revenue (in USD): up mid to high-teens (versus low-teens);

▪ “Services” revenue (in USD): up mid to high teens (versus mid-teens);

▪ €/$ spot rate of 1.10;

▪ €/$ hedge rate of 1.12.

The main risk factor is the supply chain production capability.

Key figures

1. Adjusted income statement, balance sheet and cash flow

| Adjusted income statement (In Euro million) | H1 2024 | H1 2025 | % change |

| Revenue | 13,047 | 14,769 | 13% |

| Other recurring operating income and expenses | (11,135) | (12,335) | |

| Share in profit from joint ventures | 62 | 76 | |

| Recurring operating income | 1,974 | 2,510 | 27% |

| % of revenue | 15.1% | 17.0% | 1.9pt |

| Other non-recurring operating income and expenses | (24) | (37) | |

| Profit from operations | 1,950 | 2,473 | 27% |

| % of revenue | 14.9% | 16.7% | 1.8pt |

| Net financial income (expense) | (34) | 32 | |

| Income tax expense | (435) | (851) | |

| Profit for the period | 1,481 | 1,654 | 12% |

| Profit (loss) for the period attributable to non-controlling interests | (49) | (67) | |

| Profit for the period attributable to owners of the parent | 1,432 | 1,587 | 11% |

| Earnings per share attributable to owners of the parent (basic in €) | 3.37(1) | 3.80(2) | 13% |

| Earnings per share attributable to owners of the parent (diluted in €) | 3.27(3) | 3.80(4) | 16% |

- Based on the weighted average number of shares of 424,913,983 as of June 30, 2024

- Based on the weighted average number of shares of 417,934,731 as of June 30, 2025

- Based on the weighted average number of shares after dilution of 437,780,170 as of June 30, 2024

- Based on the weighted average number of shares after dilution of 417,934,731 as of June 30, 2025

| Balance sheet – Assets (In Euro million) Dec. 31, 2024 June 30, 2025 Goodwill 4,937 4,864 Tangible & Intangible assets 12,576 12,600 Investments in joint ventures and associates 1,894 1,861 Right-of-use assets 653 728 Other non-current assets 3,429 1,065 Derivatives assets 952 1,406 Inventories and work-in-progress 9,491 10,329 Contracts costs 884 935 Trade and other receivables 10,572 11,621 Contracts assets 2,503 2,743 Cash and cash equivalents 6,514 6,707 Other current assets 607 1,232 Total Assets 55,012 56,091 | Balance sheet – Liabilities (In Euro million) Dec. 31, 2024 June 30, 2025 Equity 10,725 13,778 Provisions 3,008 2,831 Borrowings subject to sp. conditions 287 276 Interest bearing liabilities 4,776 4,838 Derivatives liabilities 8,818 4,514 Other non-current liabilities 922 179 Trade and other payables 9,802 10,637 Contracts liabilities 16,421 18,031 Other current liabilities 253 1,007 Total Equity & Liabilities 55,012 56,091 |

| Cash Flow Highlights (In Euro million) | H1 2024 | FY 2024 | H1 2025 |

| Recurring operating income | 1,974 | 4,119 | 2,510 |

| One-off items | (24) | 6 | (37) |

| Depreciation, amortization, provisions (excluding financial) | 571 | 1,292 | 686 |

| EBITDA | 2,521 | 5,417 | 3,159 |

| Income tax and non-cash items | (161) | (692) | (369) |

| Cash flow from operations | 2,360 | 4,725 | 2,790 |

| Changes in working capital | (140) | 7 | (168) |

| Capex (tangible assets) | (512) | (1,043) | (525) |

| Capex (intangible assets) | (93) | (172) | (103) |

| Capitalization of R&D expenditure | (152) | (328) | (160) |

| Free cash flow | 1,463 | 3,189 | 1,834 |

| Dividends paid | (965) | (970) | (1,269) |

| Divestments/acquisitions and others | 23 | (855) | (434) |

| Net change in cash and cash equivalents | 521 | 1,364 | 131 |

| Net cash / (Net debt) at beginning of period | 374 | 374 | 1,738 |

| Net cash / (Net debt) at end of period | 895 | 1,738 | 1,869 |

- Segment breakdown

| Segment breakdown of adjusted revenue (In Euro million) | H1 2024 | H1 2025 | % change | % change in scope | % change currency | % change organic |

| Propulsion | 6,461 | 7,541 | +16.7% | +0.8% | (1.0)% | +16.9% |

| Equipment & Defense | 5,170 | 5,609 | +8.5% | +1.2% | (0.7)% | +8.0% |

| Aircraft Interiors | 1,411 | 1,616 | +14.5% | – | (1.0)% | +15.5% |

| Holding company & Others | 5 | 3 | (31.0)% | – | – | (31.0)% |

| Total Group | 13,047 | 14,769 | +13.2% | +0.9% | (0.9)% | +13.2% |

| OE / Services adjusted revenue breakdown (In Euro million) | H1 2024 | H1 2025 | ||

| OE | Services | OE | Services | |

| Propulsion | 2,431 | 4,030 | 2,623 | 4,918 |

| % of revenue | 37,6% | 62,4% | 34,8% | 65,2% |

| Equipment & Defense | 3,152 | 2,018 | 3,364 | 2,245 |

| % of revenue | 61.0% | 39.0% | 60.0% | 40.0% |

| Aircraft Interiors[1] | 880 | 531 | 1,000 | 616 |

| % of revenue | 62.4% | 37.6% | 61.9% | 38.1% |

| Segment breakdown of adjusted revenue (In Euro million) | Q2 2024 | Q2 2025 | % change | % change in scope | % change currency | % change organic |

| Propulsion | 3,364 | 3,857 | +14.7% | +1.5% | (8.1)% | +21.3% |

| Equipment & Defense | 2,726 | 2,826 | +3.7% | +1.0% | (5.5)% | +8.2% |

| Aircraft Interiors | 735 | 828 | +12.6% | – | (8.9)% | +21.5% |

| Holding company & Others | 2 | 2 | (22.6)% | – | (3.0)% | (19.6)% |

| Total Group | 6,827 | 7,512 | +10.0% | +1.2% | (7.3)% | +16.1% |

| 2024 revenue by quarter (In Euro million) | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | FY 2024 |

| Propulsion | 3,097 | 3,364 | 3,339 | 3,852 | 13,652 |

| Equipment & Defense | 2,444 | 2,726 | 2,527 | 2,921 | 10,618 |

| Aircraft Interiors | 676 | 735 | 771 | 855 | 3,037 |

| Holding company & Others | 3 | 2 | 2 | 3 | 10 |

| Total Group | 6,220 | 6,827 | 6,639 | 7,631 | 27,317 |

| 2025 revenue by quarter (In Euro million) | Q1 2025 | Q2 2025 | H1 2025 |

| Propulsion | 3,684 | 3,857 | 7,541 |

| Equipment & Defense | 2,783 | 2,826 | 5,609 |

| Aircraft Interiors | 788 | 828 | 1,616 |

| Holding company & Others | 2 | 2 | 4 |

| Total Group | 7,257 | 7,512 | 14,769 |

| Segment breakdown of recurring operating income (In Euro million) | H1 2024 | H1 2025 | % change |

| Propulsion | 1,285 | 1,758 | 36.8% |

| % of revenue | 19.9% | 23.3% | |

| Equipment & Defense | 657 | 703 | 7.0% |

| % of revenue | 12.7% | 12.5% | |

| Aircraft Interiors | 10 | 27 | 170.0% |

| % of revenue | 0.7% | 1.7% | |

| Holding company & Others | 22 | 22 | – |

| Total Group | 1,974 | 2,510 | 27.2% |

| % of revenue | 15.1% | 17.0% |

| One-off items (In Euro million) | H1 2024 | H1 2025 |

| Adjusted recurring operating income | 1,974 | 2,510 |

| % of revenue | 15.1% | 17.0% |

| Total one-off items | (24) | (37) |

| Capital gain (loss) on asset disposal | – | – |

| Impairment reversal (charge) | (10) | (21) |

| Other infrequent & material non-operational items | (14) | (16) |

| Adjusted profit from operations | 1,950 | 2,473 |

| % of revenue | 14.9% | 16.7% |

| Euro/USD rate | H1 2024 | FY 2024 | H1 2025 |

| Average spot rate | 1.08 | 1.08 | 1.09 |

| Spot rate (end of period) | 1.07 | 1.04 | 1.17 |

| Hedge rate | 1.12 | 1.12 | 1.12 |

- Number of products delivered on major aerospace programs

| Number of units delivered | H1 2024 | H1 2025 | Change in units | Change in % |

| LEAP engines | 664 | 729 | 65 | 10% |

| CFM56 engines | 28 | 26 | (2) | (7)% |

| High thrust engines | 91 | 107 | 16 | 18% |

| Helicopter turbines | 305 | 328 | 23 | 8% |

| M88 engines | 14 | 10 | (4) | (29)% |

| A320neo nacelles | 297 | 307 | 10 | 3% |

| A320 landing gear sets | 304 | 320 | 16 | 5% |

| A320 emergency slides | 1,962 | 2,132 | 170 | 9% |

| A330neo nacelles | 29 | 36 | 7 | 24% |

| A350 landing gear sets | 26 | 23 | (3) | (12)% |

| A350 lavatories | 193 | 163 | (30) | (16)% |

| 787 landing gear sets | 20 | 30 | 10 | 50% |

| 787 primary power distribution systems | 169 | 193 | 24 | 14% |

| Small nacelles (business & regional jets) | 396 | 361 | (35) | (9)% |

| Business class seats | 750 | 1,238 | 488 | 65% |

4. Research & Development

| Research & Development (In Euro million) | H1 2024 | H1 2025 | change |

| Total R&D | (936) | (967) | (31) |

| R&D sold to customers | 290 | 318 | 28 |

| R&D expenditure | (646) | (649) | (3) |

| as a % of revenue | 5.0% | 4.4% | (0.6)pt |

| Tax credit | 88 | 92 | 4 |

| R&D expenditure after tax credit | (558) | (557) | 1 |

| Gross capitalized R&D | 151 | 159 | 8 |

| Amortization and depreciation of R&D | (140) | (144) | (4) |

| R&D in recurring operating income (P&L impact) | (547) | (542) | 5 |

| as a % of revenue | 4.2% | 3.7% | (0.5)pt |

5. Civil aftermarket indicators

| (y/y USD revenue growth) | Q1 2025 | Q2 2025 | H1 2025 |

| Spare parts | +25.1% | +18.6% | +21.6% |

| Services | +17.6% | +24.6% | +21.1% |

Notes

Adjusted data:

To reflect the Group’s actual economic performance and enable it to be monitored and benchmarked against competitors, Safran prepares an adjusted income statement in addition to its consolidated financial statements.

Readers are reminded that Safran:

- is the result of the May 11, 2005 merger of Sagem SA and Snecma, accounted for in accordance with IFRS 3, “Business Combinations” in its consolidated financial statements;

- recognizes, as of July 1, 2005, all changes in the fair value of its foreign currency derivatives in “Financial income (loss)”, in accordance with the provisions of IFRS 9 applicable to transactions not qualifying for hedge accounting (see 3.1 Note 2.1.2 of the 2024 Universal Registration Document).

Safran’s consolidated income statement has been adjusted for the impact of:

- purchase price allocations with respect to business combinations. Since 2005, this restatement concerns the amortization charged against intangible assets relating to aircraft programs remeasured at the time of the Sagem-Snecma merger. With effect from the first half 2010 interim financial statements, the Group decided to restate:

- the impact of purchase price allocations for business combinations, particularly amortization and depreciation charged against intangible assets and property, plant and equipment recognized or remeasured at the time of the transaction and amortized or depreciated over extended periods due to the length of the Group’s business cycles, and the impact of remeasuring inventories, as well as

- gains on remeasuring any previously held equity interests in the event of step acquisitions or asset contributions to joint ventures;

- the mark-to-market of foreign currency derivatives, in order to better reflect the economic substance of the Group’s overall foreign currency risk hedging strategy:

- revenue net of purchases denominated in foreign currencies is measured using the hedged rate, resulting from the exchange rate effectively obtained over the year under hedging strategies, including premiums on settled options, and,

- all mark-to-market changes on instruments hedging future cash flows are neutralized.

The resulting changes in deferred tax have also been adjusted.

Reconciliation of the H1 2025 consolidated income statement with the adjusted H1 2025 consolidated income statement:

| H1 2025 | Consolidated data | Currency hedging | Business combinations | Adjusted data | ||

| (In Euro million) | Remeasurement of revenue (1) | Deferred hedging gain / loss (2) | Amortization of intangible assets -Sagem- Snecma merger (3) | PPA impacts – other business combinations (4) | ||

| Revenue | 14,865 | (96) | – | – | – | 14,769 |

| Other operating income and expenses | (12,462) | (4) | (18) | 12 | 137 | (12,335) |

| Share in profit from joint ventures | 65 | – | – | – | 11 | 76 |

| Recurring operating income | 2,468 | (100) | (18) | 12 | 148 | 2,510 |

| Other non-recurring operating income and expenses | (37) | – | – | – | – | (37) |

| Profit (loss) from operations | 2,431 | (100) | (18) | 12 | 148 | 2,473 |

| Cost of debt | 77 | – | – | – | – | 77 |

| Foreign exchange gains / losses | 4,628 | 100 | (4,808) | – | – | (80) |

| Other financial income and expense | 35 | – | – | – | – | 35 |

| Financial income (loss) | 4,740 | 100 | (4,808) | – | – | 32 |

| Income tax expense | (2,059) | – | 1,245 | (3) | (34) | (851) |

| Profit (loss) from continuing operations | 5,112 | – | (3,581) | 9 | 114 | 1,654 |

| Attributable to non-controlling interests | (67) | – | – | – | – | (67) |

| Attributable to owners of the parent | 5,045 | – | (3,581) | 9 | 114 | 1,587 |

- Remeasurement of foreign-currency denominated revenue net of purchases (by currency) at the hedged rate (exchange rate effectively obtained over the year under hedging strategies, including premiums on settled options) through the reclassification of gains/losses recognized in profit or loss on unwinding the hedging relationship.

- Changes in the fair value of instruments hedging future cash flows that will be recognized in profit or loss in future periods (a negative €4,808 million excluding tax), and the impact of taking into account hedges when measuring provisions for losses on completion (a negative €18 million at June 30, 2025).

- Cancellation of amortization/impairment of intangible assets relating to the remeasurement of aircraft programs resulting from the application of IFRS 3 to the Sagem SA-Snecma merger.

- Cancellation of the impact of remeasuring assets at the time of the Zodiac Aerospace acquisition for €89 million excluding deferred tax and cancellation of amortization/impairment of assets identified during other business combinations.

Readers are reminded that the condensed interim consolidated financial statements are subject to review by the Group’s Statutory Auditors. The condensed interim consolidated financial statements include the revenue and profit from operations indicators set out in the adjusted data in Note 4, “Segment information and adjusted data”.

Adjusted financial data other than the data provided in Note 4, “Segment information and adjusted data” are subject to the verification procedures applicable to all of the information provided in the interim financial report.

Source: Safran

Be the first to comment on "Safran reports its first-half 2025 results"