Paris, September 5, 2019

Adjusted data

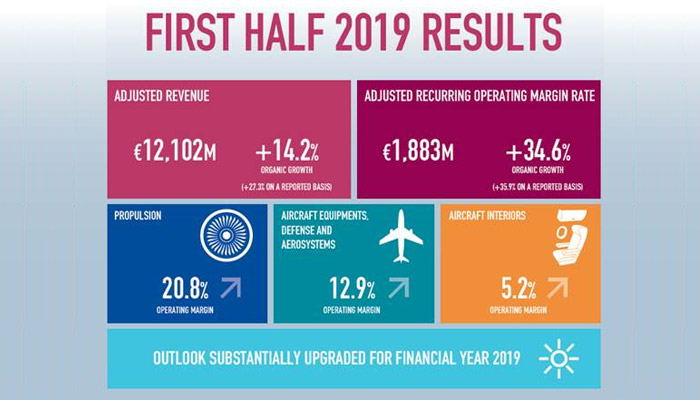

- Revenue at Euro 12,102 million, up 27.3% on a reported basis and up 14.2% on an organic basis

- Recurring operating income at Euro 1,883 million up 35.9% on a reported basis and up 34.6% on an organic basis

- Operating margin improvements across all divisions, 20.8% (+180bp)

in Propulsion, 12.9% (+100bp) in Aircraft Equipment, Defense and

Aerosystems and 5.2% (+190bp) in Aircraft Interiors. As a result, Group

operating margin improvement, 15.6% (+100bp)

- Free cash flow generation at Euro 1,177 million, 63% of recurring operating income despite the Boeing 737MAX grounding

- Upgraded 2019 revenue and recurring operating income outlook. Based

on an assumption of return to service for Boeing 737MAX in Q4, free cash

flow to recurring operating income is expected to be in the range 50%

to 55%

- Governance – CEO’s succession plan:

- Process to select in the coming months a future Chief Executive Officer launched by the Board of Directors.

- Philippe Petitcolin’s CEO term of office extended until 31 December 2020 in order to favour a smooth transition.

Consolidated data

- Consolidated revenue was Euro 12,315 million

- Consolidated recurring operating income at Euro 1,877 million

- Consolidated profit from operations at Euro 1,909 million

- Consolidated profit for the period attributable to owners of the parent at Euro 1,432 million

- Free cash flow at Euro 1,177 million

The Board of Directors of Safran (Euronext Paris: SAF), under the Chairmanship of Ross McInnes, at their meeting in Paris on September 4, 2019, adopted and authorised the publication of Safran’s financial statements and adjusted income statement for the six-month period ended June 30, 2019.

Executive commentary

CEO Philippe Petitcolin commented:

“H1 results have confirmed the trajectory of vigorous growth

observed in Q1, with very strong revenue and profitability increase

trending above initial full-year guidance across all divisions.

The CFM56/LEAP transition is well on track despite an uncertain context.

We target to manufacture around 1,800 LEAP engines at the end of 2019,

with LEAP-1B deliveries depending on our client needs. The impact of the

737MAX grounding on Safran free cash flow is a timing issue and should

reverse in the following quarters”.

Foreword

- All figures in this press release represent adjusted[1] data and

continuing operations, except where noted. Please refer to the

definitions and reconciliation between H1 2019 consolidated income

statement and adjusted income statement. Comparisons are established

against 2018 figures for continuing operations. Please refer to

definitions contained in the Notes on page 13 and following of this

press statement.

- Zodiac Aerospace is fully consolidated in Safran’s financial statements starting March 1, 2018.

- Organic variations exclude the changes in scope (notably the

two-month contribution of Zodiac Aerospace) and the currency impacts for

the period.

- Safran disclosed a new presentation of segment information as of June 30, 2019 (cf. press release July 1st, 2019).

- 2019 outlook is established considering the full application of the new IFRS16 standard. As reminder IFRS16 main impacts are:

- Euro (529) million impact of liabilities that are included in net debt position and that represent discounted future lease payments on the 2019 opening balance sheet;

- Euro 47 million impact on cash from operations in H1 2019 and Euro (47) million impact on cash from financing activities in H1 2019;

- No impact on the cash situation of the Group.

Key figures for first-half 2019

- Adjusted revenue was Euro 12,102 million, an

increase of 27,3% on a reported basis, including a scope impact of Euro

840 million (Euro 781 million of the two month contribution from Zodiac

Aerospace former activities and Euro 59 million from ElectroMechanical

Systems activities acquired from Collins Aerospace) and Euro 410 million

of currency impacts. On an organic basis, adjusted revenue grew 14.2%.

- Adjusted recurring operating income[2] was Euro 1,883 million

(15.6% of revenue), an increase of 35.9% on a reported basis compared

to Euro 1,386 million (14.6% of sales) in H1 2018. H1 2019 recurring

operating income included a scope impact of Euro 35 million and Euro

(18) million of currency impacts.

- Adjusted net income – Group share was Euro 1,353 million (basic adjusted EPS of Euro 3.13 and diluted adjusted EPS of Euro 3.09). In H1 2018, adjusted net income – Group share amounted to Euro 932 million.

- Free cash flow[3] generation amounted to Euro 1,177 million,

representing an increase of 44% compared with Euro 820 million in the

year-ago period. The growth was driven by higher cash from operating

activities, partially offset by an increase in working capital. H1 2019

free cash flow amounted to 63% of adjusted recurring operating income.

- Net debt position was Euro 3,970 million as of June 30, 2019, including the 2018 dividend of Euro 785 million.

- H1 2019 civil aftermarket [4] was up 10.2% in USD

terms (same as in Q1 2019) driven by spare parts sales for latest

generation CFM56 engines. Support was stable compared with H1 2018.

- Safran updates its outlook for 2019 to take into account the strong momentum in all activities and the Boeing 737MAX situation.

- Safran raises its revenue and recurring operating income outlook:

- At an estimated average spot rate of $1.13 to the Euro in 2019, adjusted revenue is expected to grow by around 15% in 2019 compared with 2018 (previously in the range 7% to 9%). On an organic basis, based on Safran’s assumption of LEAP-1B deliveries to Boeing, adjusted revenue is expected to grow by around 10% (previously by around 5%);

- Adjusted recurring operating income is expected to grow comfortably above 20% (previously in the low teens), at a hedged rate of USD 1.18 to the Euro.

- Safran refines its free cash flow outlook:

- Based on an assumption of return to service for Boeing 737MAX in Q4, free cash flow is expected to be in the range 50% to 55% of adjusted recurring operating income (previously around 55%) as recurring operating income outlook is raised.

- Safran raises its revenue and recurring operating income outlook:

Key business highlights

1 – Propulsion

CFM commercial success

During the 2019 Paris Air Show, CFM International announced orders and

commitments for more than 1,150 LEAP engines along with long-term

services agreements, for a total value of $50.2 billion U.S. at list

price.

Following the air show, at July 31, 2019, the LEAP order book stands at 15,997 engines (orders and commitments).

Continuing growth of narrowbody engines deliveries

Combined deliveries of CFM engines (LEAP and CFM56) increased by 8.7% in H1 2019 to 1,119 units, from 1,029 units in H1 2018.

CFM56 program

As planned, CFM56 deliveries decreased by 333 units to 258 units

delivered in H1 2019 compared with 591 units in H1 2018, in line with

customers’ demand.

CFM56 fleet established a new world record by becoming the first

aircraft engine family in aviation history to achieve one billion engine

flight hours.

LEAP program

The ramp-up of LEAP production continues. LEAP deliveries almost doubled

in H1 2019 to 861 engines compared with 438 engines in H1 2018. CFM

International plans to manufacture around 1,800 LEAP engines in 2019 and

will adapt its LEAP-1B delivery plan depending on Boeing’s orders.

- LEAP-1A: 44 airlines are operating 454 aircraft powered by LEAP-1A engines totalling over 3.3 million flight hours so far.

- LEAP-1B: 54 airlines were operating 389 aircraft powered by LEAP-1B engines totalling over 1.7 million flight hours until March 13, 2019.

- LEAP-1C: CFM International is supporting the flights of the tests aircraft.

Helicopter turbines

Safran received EASA (European Aviation Safety Agency) engine type

certification for its Arrano-1A engine powering the Airbus Helicopters

H160 and the validation of type certification from the CAAC (Civil

Aviation Administration of China) for Arriel 2H engine powering the Avic

AC312E.

2 – Aircraft Equipment, Defense and Aerosystems

Nacelles

Safran delivered its 1,000th nacelle system that equips the Airbus A320neo aircraft to TAP Air Portugal.

Landing systems

Safran and Michelin announced the successful flight tests of the first

connected aircraft tire, PresSense, on June 13, using a Dassault

Aviation Falcon 2000S. These flight tests mark the latest phase in the

development of PresSense by Michelin and Safran Landing Systems and pave

the way for an entry into service towards 2020.

Electrical systems

Safran signed several contracts including electrical wiring contract for

Airbus Helicopters H160 and electrical harnesses contract for the

Boeing 777X and renewed collaboration on the 787 Dreamliner.

Safran’s Auxiliary Power System has been chosen by Saab for the Boeing T-X military training aircraft.

Defense

The Patroller tactical drone, developed and produced by Safran

Electronics & Defense, has started the final phase of the industrial

qualification at the French defense procurement agency flight test

center.

Safran was also selected to support services for the Royal Australian Navy’s Infrared Search and Track (IRST) VAMPIR systems.

3 – Aircraft Interiors

Cabin

Safran recorded new contracts and was selected notably by:

- A US private jet company to supply their 175 Cessna Longitude aircraft with ovens;

- A major Middle East airline to equip their Boeing 787 and A320 with inserts;

- Mitsubishi SpaceJet Family to incorporate full scale integrated interiors (galleys, lavatories, overhead bins, passenger service units, sidewalls, ceiling panels).

A350 Lavatories deliveries increased to 400 in H1 2019 from 241 in H1 2018 (March to June).

Seats

- First delivery of a “Cirrus NG” business seat order for 12 A350 in April;

- First delivery of a “S-Lounge” business seat order for 75 Boeing 777X in May;

- First delivery of a “Fusio” business seat order for 12 Boeing 777-300ER in May;

- First delivery of an “Optima Prime” business seat order for 10 A350 in July.

Business class seats deliveries increased to 2 537 in H1 2019 from 1 495 in H1 2018 (March to June).

Passenger Solutions

Safran was selected for its first 787 IFE contract for Line Fit

installation from a major Middle East airline. Since then, two other

Rave IFE 787 Line Fit contracts were secured from two different

customers. Safran delivered its first A350 Rave IFE system to a Chinese

airline.

Passenger Solutions sales were supported by a sustained aftermarket

business of Air Management’s Health Monitoring products and Water &

Waste sales to the Military.

First half 2019 results

First-half 2019 revenue amounted to Euro 12,102 million. This represents an increase of 27,3%, or Euro 2,596 million, compared to the year ago period which included the four-month contribution of Euro 1,516 million from former Zodiac Aerospace activities. At constant scope, revenue grew 18.5%. The net impact of currency variations was Euro 410 million, reflecting a positive translation effect on non-Euro revenues, principally USD. The average EUR/USD spot rate was 1.13 to the Euro in the first-half of 2019, compared to 1.21 in the year-ago period. The Group’s hedge rate was stable at USD 1.18 to the Euro between H1 2019 and H1 2018.

On an organic basis, revenue increased 14.2% as all operational activities contributed positively.

| Euros millions | Aerospace Propulsion | Aircraft Equipment, Defense and Aerosystems | Aircraft Interiors | Holding company & Others | Safran |

|---|---|---|---|---|---|

| H1 2018 | 4,805 | 3,711 | 980 | 10 | 9,506 |

| H1 2019 | 5,902 | 4,553 | 1,640 | 7 | 12,102 |

| Reported growth | 22.8% | 22.7% | 67.3% | na | 27.3% |

| Impact of changes in scope | – | 9.6% | 49.4% | na | 8.8% |

| Currency impact | 3.8% | 4.5% | 6.0% | na | 4.3% |

| Organic growth | 19.0% | 8.6% | 11.9% | na | 14.2% |

First-half recurring operating income reached Euro 1,883 million, up 35.9% compared to Euro 1,386 million in the first-half 2018. This increase includes scope changes of Euro 35 million as well as a negative currency impact of Euro (18) million. The organic growth (+34.6%) mainly comes from civil aftermarket and military activities. Recurring operating income margin stood at 15.6% of sales compared with 14.6% in the year ago period. As expected, the profitability increased strongly in all activities.

One-off items, mainly related to capital gains from the sale of a building, totalled Euro 32 million during first-half 2019:

| In Euro million | H1 2018 | H1 2019 |

|---|---|---|

| Adjusted recurring operating income | 1,386 | 1,883 |

| % of revenue | 14.6% | 15.6% |

| Total one-off items | (26) | 32 |

| Capital gain (loss) on disposals | 5 | 34 |

| Impairment reversal (charge) | 1 | – |

| Other infrequent & material non-operational items | (32) | (2) |

| Adjusted profit from operations | 1,360 | 1,915 |

| % of revenue | 14.3% | 15.8% |

Adjusted net income – Group share was Euro 1,353 million (basic EPS of Euro 3.13 and diluted EPS of Euro 3.09) compared with Euro 932 million in H1 2018 (Basic EPS of Euro 2.17 and diluted EPS of Euro 2.11). It includes:

- Net adjusted financial income of Euro (32) million, including cost of debt of Euro (21) million.

- An adjusted tax expense of Euro (496) million (26.3% apparent tax rate).

The reconciliation between H1 2019 consolidated income statement and adjusted income statement is provided and commented in the Notes on page 14.

Cash flow and net debt

Operations generated Euro 1,177 million of free cash flow. Free cash flow generation was driven by cash from operations of Euro 2,594 million (including H1-19 regularisations on tax paid in H2-18 in France), devoted principally to tangible and intangible investments (at Euro 554 million net of a building disposal) and to an increase of Euro 863 million in working capital in the context of the rise of inventories and trade receivables.

As regards to the Boeing 737MAX situation the free cash flow has been

impacted in Q2 for an amount of around Euro (200) million in line with

previous announcements.

2018 annual dividend

A dividend of Euro 1.82 per share was approved by the shareholders at

the Annual General Meeting of May 23, 2019 and was entirely paid in May

2019 impacting cash in the total amount of Euro 785 million.

Update on the share buyback program

In May 2017, Safran announced its intention to implement a Euro 2.3

billion ordinary share buyback program to run over the two years

following the completion of the tender offer for Zodiac Aerospace

shares. At December 31, 2018, Safran contributed 11.4 million shares to

this program for a total of Euro 1.22 billion. Following up on the

decision of the Board of Directors, these 11.4 million treasury shares

were cancelled on December 17, 2018. From January 1 up to August 30,

2019, Safran repurchased an additional 7.0 million shares for a total

amount of Euro 858 million (including 3.9 million shares for a total

amount of Euro 458 million in H1 2019).

To date, the program is therefore executed for a total of Euro 2.08 billion.

Net Debt

The net debt position was Euro 3,970 million as of June 30, 2019

compared to a net debt position of Euro 3,269 million as of December 31,

2018, including notably the implementation IFRS16 for Euro (529)

million.

Research & Development

Total R&D expenditures, including R&D sold to customers,

reached Euro (851) million, compared with Euro (726) million in H1 2018.

The increase of R&D spending between H1 2019 and H1 2018 is notably

due to the consolidation of the former Zodiac Aeropsace R&D

activities.

The R&D expenses before research tax credit was Euro (651) million, compared with Euro (565) million for first-half 2018.

Capitalised R&D was Euro 152 million compared with Euro 139 million for H1 2018.

Amortisation and depreciation of capitalised R&D was Euro (144) million compared with Euro (104) million for H1 2018.

The impact on recurring operating income of expensed R&D was Euro

(560) million compared with Euro (458) million in the year ago period.

This increase is notably driven by the consolidation of Zodiac Aerospace

(6 months in 2019 vs 4 months in 2018).

Financing

Safran repaid two borrowings that matured during the first semester 2019: the USD 155 million 7-year tranche of the USD 1.2 billion 2012 US private placement was repaid in February 2019 and the EUR 500 million two-year floating rate notes issued in June 2017 was repaid in June 2019.

Currency hedges

Safran’s hedging portfolio totalled USD 28.9 billion at August, 23, 2019. The Group net exposure is estimated at USD 9.4 billion in 2019 and should reach USD 10.0 billion in 2022 due to the growth outlook for the businesses with USD denominated revenue.

- 2019: the net exposure of USD 9.4 billion is fully hedged at a targeted hedge rate of USD 1.18 (unchanged)

- 2020: the firm coverage of the estimated net exposure increased to USD 9.3 billion (compared with USD 6.5 billion in April 2019). No change in the range of the targeted hedge rate of USD 1.16 to USD 1.18.

- 2021: the firm coverage of the estimated net exposure increased to USD 8.9 billion (compared with USD 8.0 billion in April 2019). No change in the range of the targeted hedge rate of USD 1.15 to USD 1.18.

- 2022: the firm coverage of the estimated net exposure increased to USD 6.0 billion (compared with USD 3.5 billion in April 2019). No change in the range of the targeted hedge rate of USD 1.15 to USD 1.18.

Full-year 2019 outlook update

Safran raises its FY 2019 revenue and recurring operating income outlook:

- At an estimated average spot rate of $1.13 to the Euro in 2019, adjusted revenue is expected to grow by around 15% in 2019 compared with 2018 (previously in the range 7% to 9%). On an organic basis, based on Safran’s assumption of LEAP-1B deliveries to Boeing, adjusted revenue is expected to grow by around 10% (previously by around 5%);

- Adjusted recurring operating income is expected to grow comfortably

above 20% (previously in the low teens) at a hedged rate of USD 1.18 to

the Euro.

Safran refines its free cash flow outlook:

- From June 30, 2019, Safran revises the free cash flow impact of the Boeing 737MAX situation to approximately €(300)M per quarter to reflect the decrease of pre-payments for future deliveries;

- Based on an assumption of return to service for Boeing 737MAX in Q4, free cash flow is expected to be in the range 50% to 55% of adjusted recurring operating income (previously around 55%) as recurring operating income outlook is raised;

- In case of a grounding of the Boeing 737MAX until the end of 2019,

free cash flow to adjusted recurring operating income should be below

50%. Current Boeing 737MAX grounding’s impact on Safran free cash flow

and any extension in 2019 is a deferral in cash collection and should

reverse in the following quarters.

The outlook is based notably on the following assumptions:

- Increase in aerospace OE deliveries and notably of military engines;

- Civil aftermarket growth around 10% (previously in the high single digits);

- Transition CFM56 – LEAP: overall negative impact on Propulsion

adjusted recurring operating income variation in the range Euro 50 to

100 million:

- Lower CFM56 OE volumes;

- Negative margin on LEAP deliveries.

- Aircraft Interiors: 2019 to show stronger organic revenue growth. Continuing improvement of recurring operating income margin;

- Increase of R&D expenses in the range of Euro 150 to 200 million. Negative impact on recurring operating income after activation and amortisation of capitalized R&D;

- Increase in tangible investments.

Governance – CEO’s succession plan

The Board of Directors has launched the selection process of a Chief Executive Officer to succeed Philippe Petitcolin.

The Board of Directors has tasked its Chairman, Ross McInnes, and the Appointments and Compensation Committee to conduct the relevant process with the target to select the future Chief Executive Officer in the coming months.

The Board of Directors has also decided to extend Philippe Petitcolin’s the term as Chief Executive Officer until 31 December 2020 in order to implement, throughout the year 2020, a smooth and orderly transition at the head of the Group.

Ross McInnes, Chairman of Safran’s Board of Directors declared: “On behalf of the Board of Directors, I thank Philippe for agreeing to extend his term of office beyond the term initially set. This overlap period will allow a seamless and efficient transition between Philippe and his future successor. On this basis, the Board of Directors has begun with confidence the process of appointing a new Chief Executive Officer.“

Philippe Petitcolin, Safran’s CEO, declared: “I thank the Board of Directors for its trust and look forward to accompanying my successor in the course of the year 2020. I am deeply committed to the success of Safran and will make every effort to give its future Chief Executive Officer all means for a smooth succession in the perspective of my departure at the end of 2020.“

Business commentary for first-half 2019

Aerospace Propulsion

First-half 2019 revenue was Euro 5,902 million, up 22.8% compared to Euro 4,805 million in the year-ago period. On an organic basis, revenue grew 19.0%, driven by civil aftermarket, military engines activities and narrowbody engines programs.

OE revenue grew 20.0% in H1 2019 compared with H1 2018, thanks to higher sales of narrowbody and military engines. The total number of narrowbody aircraft engines deliveries increased 8.7% from 1,029 to 1,119 engines. As planned, LEAP production ramp up more than offset the ramp down of CFM56: LEAP shipments grew by 423 units to 861 engines in H1 2019 (from 438 in H1 2018) while CFM56 volumes dropped by 333 units to 258 deliveries in H1 2019 (from 591 in H1 2018). M88 engines deliveries amounted to 22 units in H1 2019 compared with 4 in H1 2018.

Service revenue was up 25.0% and represented a 57.8% share of H1 2019

sales. Organic growth was driven by civil aftermarket, military

services and helicopter turbines maintenance activities.

Civil aftermarket revenue grew 10.2% in USD terms in H1 2019 (same as in

Q1 2019) thanks to higher spare parts sales for the latest generation

of CFM56 engines. Support was stable compared with H1 2018.

On the basis of H1 2019 growth and of the continuing momentum in spare

parts sales, Safran upgrades its civil aftermarket growth assumption for

FY 2019 by around 10%.

Recurring operating income was Euro 1,227 million, an increase of 34.1% compared with

Euro 915 million in first-half 2018. Recurring operating margin grew from 19.0% to 20.8%.

The profitability benefitted from the civil aftermarket growth, the

higher contribution of military activities and the helicopter turbines

maintenance activities.

The CFM56-LEAP transition was a headwind of €107M to recurring operating income growth in

H1 2019 compared with H1 2018. CFM56 deliveries, which have a profitable

contribution, didn’t offset the increased volumes of LEAP deliveries

with negative margins and the LEAP non-recurring costs. The impact of

the CFM56-LEAP transition should be positive in H2-2019 thanks to lower

costs, driving the assumption of an overall negative impact on

Propulsion adjusted recurring operating income variation in the range

Euro 50 to 100 million in 2019.

Aircraft Equipment, Defense and Aerosystems

First-half 2019 revenue amounted to Euro 4,553 million compared to Euro 3,711 million in the year-ago period. On an organic basis, revenue was up 8.6%.

OE revenue grew 21.8%, mainly driven by increased volumes of

nacelles. Deliveries of nacelles for LEAP-1A powered A320neo grew by 108

units to 280 nacelles in H1 2019.

Continuing ramp up of A330neo nacelles deliveries: +51 units (none in H1

2018). A380 nacelle shipments decreased by 8 units, to 12 nacelles.

The growth has also been supported by the ramp up of the wiring and

landing gear activities on the Boeing 787 program, higher volumes of

sighting systems as well as by portable optronics, and electronics

(FADEC for LEAP). Sales in Aerosystems (mainly arresting systems) also

contributed to the growth.

Service revenue was up 24.5%, mainly driven by nacelles as well as landing gear support activities and the growing contribution of carbon brakes. Defense and Aerosytems support activities (mainly Safety Systems and Fluid Management) contributed positively to the growth.

Recurring operating income was Euro 588 million, an increase of 33.0% compared to Euro 442 million in the year-ago period. Recurring operating margin increased from 11.9% to 12.9%. The growth in profitability was driven by higher volumes (notably in services) and by the benefits of cost reduction and productivity actions, only partially offset by higher R&D impact on P&L.

Aircraft Interiors

First-half 2019 revenue amounted to Euro 1,640 million compared to Euro 980 million in the year-ago period. On an organic basis, revenue grew 11.9%.

OE revenue grew 10.2% organically, across all the divisions (Cabin,

Seats and Passenger Solutions). Business seats programs, toilets and

floor to floor activities for Cabin and Connected Cabin for Passenger

Solutions were the main contributors.

Service revenue was up 16.8% organically, driven by Seats aftermarket activities.

Recurring operating income increased of Euro 56 million on an organic bases and was Euro 85 million (compared with Euro 32 million in first-half 2018). Recurring operating margin grew from 3.3% to 5.2%. The profitability increased in all businesses with a stronger contribution from Cabin.

Holding and others

The reporting segment “Holding and others” includes costs of general

management as well as transverse services provided for the Group and its

subsidiaries including central finance, tax and foreign currency

management, Group legal, communication and human resources.

In addition, the holding invoices subsidiaries for shared services

including administrative service centres (payroll, recruitment, IT,

transaction accounting), a centralised training organisation and

Safran’s R&T centre.

Holding and others impact on Safran recurring operating income was Euro (17) million in first-half 2019 compared with Euro (3) million in the year ago period. This variation is mainly driven by an increase in R&T as well as the acquisition and integration of Zodiac Aerospace.

Agenda

- Q3 2019 revenue : October 31, 2019

- FY 2019 results : February 27, 2020

* * * * *

Safran will host today a conference call open to analysts, investors

and media at 8:30 am CET which can be accessed at +33 (0)1 72 72 74 03

(France), +44 (0) 207 194 3759 (UK) and +1 844 286 0643 (US) (access

code for all countries : 34998454#).

Please ask for the “Safran” conference and state your name. We advise

you to dial in 10 minutes before the start of the conference.

The webcast will be available via Safran’s website after registration using the following link: https://event.onlineseminarsolutions.com/wcc/r/20155351/9D7DC54DD0417941EDBD2B9765FD0EC6

Participants will have access to the webcast 15 minutes before the start of the conference.

A replay of the conference call will be available until December 4, 2019 at +33 (0)1 70 71 01 60, +44 (0) 203 364 5147 and +1 646 722 4969 (access code for all countries : 418855620#).

The press release, presentation and consolidated financial statements are available on the website at www.safran-group.com (Finance section).

* * * * *

Key figures

1 – Adjusted income statement, balance sheet and cash flow

| Adjusted income statement (In Euro million) | H1 2018 | H1 2019 | % change |

|---|---|---|---|

| Revenue | 9,506 | 12,102 | 27.3% |

| Other recurring operating income and expenses | (8,202) | (10,303) | |

| Share in profit from joint ventures | 82 | 84 | |

| Recurring operating income | 1,386 | 1,883 | 35.9% |

| % of revenue | 14.6% | 15.6% | 1.0 pt |

| Other non-recurring operating income and expenses | (26) | 32 | |

| Profit from operations | 1,360 | 1,915 | 40.8% |

| % of revenue | 14.3% | 15.8% | 1.5pt |

| Net financial income (expense) | (114) | (32) | |

| Income tax expense | (272) | (496) | |

| Profit for the period | 974 | 1,387 | 42.4% |

| Profit for the period to non-controlling interests | (42) | (34) | |

| Profit for the period attributable to owners of the parent | 932 | 1,353 | 45.2% |

| Earnings per share attributable to owners of parent (basic in €) | 2.17* | 3.13** | 44.2% |

| Earnings per share attributable to owners of parent (diluted in €) | 2.11*** | 3.09**** | 46.4% |

*Based on the weighted average number of shares of 428,935,570 as of June 30, 2018

**Based on the weighted average number of shares of 432,218,259 as of June 30, 2019

*** Based on the weighted average number of shares after dilution of 441,222,853 as of June 30, 2018

**** Based on the weighted average number of shares after dilution of 437,834,002 as of June 30, 2019

| Balance sheet – Assets (In Euro million) | Dec. 31, 2018 | June. 30, 2019 |

|---|---|---|

| Goodwill | 5,173 | 5,182 |

| Tangible & Intangible assets | 14,211 | 13,884 |

| Investments in joint ventures and associates | 2,253 | 2,253 |

| Right of use | – | 727 |

| Other non-current assets | 811 | 736 |

| Derivatives assets | 753 | 798 |

| Inventories and WIP | 5,558 | 6,247 |

| Contracts costs | 470 | 483 |

| Trade and other receivables | 6,580 | 7,138 |

| Contracts assets | 1,544 | 1,662 |

| Cash and cash equivalents | 2,330 | 2,470 |

| Other current assets | 937 | 600 |

| Total Assets | 40,620 | 42,180 |

| Balance sheet – Liabilities (In Euro million) | Dec. 31, 2018 | June. 30, 2019 |

|---|---|---|

| Equity | 12,301 | 12,463 |

| Provisions | 2,777 | 2,875 |

| Borrowings subject to sp. conditions | 585 | 517 |

| Interest bearing liabilities | 5,605 | 6,476 |

| Derivatives liabilities | 1,262 | 970 |

| Other non-current liabilities | 1,664 | 1,626 |

| Trade and other payables | 5,650 | 5,838 |

| Contracts Liabilities | 10,453 | 10,718 |

| Other current liabilities | 323 | 697 |

| Total Equity & Liabilities | 40,620 | 42,180 |

| Cash Flow Highlights (In Euro million) | H1 2018 | FY 2018 | H1 2019 |

|---|---|---|---|

| Recuring operating income | 1,386 | 3,023 | 1,883 |

| One-off items | (26) | (115) | 32 |

| Depreciation, amortization, provisions (excluding financial) | 449 | 838 | 517 |

| EBITDA | 1,809 | 3,746 | 2,432 |

| Income tax and non-cash items | (90) | (648) | 162 |

| Cash flow from operations | 1,719 | 3,098 | 2,594 |

| Changes in working capital | (299) | (27) | (863) |

| Capex (tangible assets) | (387) | (780) | (332) |

| Capex (intangible assets) | (69) | (183) | (65) |

| Capitalisation of R&D | (144) | (327) | (157) |

| Free cash flow | 820 | 1,781 | 1,177 |

| Dividends paid | (721) | (721) | (815) |

| Divestments/acquisitions and others | (3,926) | (4,623) | (534) |

| Net change in cash and cash equivalents | (3,827) | (3,563) | (172) |

| Net cash / (Net debt) at beginning of period | 294 | 294 | (3,798)* |

| Net cash / (Net debt) at end of period | (3,533) | (3,269) | (3,970) |

* IFRS 16 impact at the beginning of period of Euro (529) million

2 – Segment breakdowns

As a reminder the press release on the new presentation of segment information has been published on July 1, 2019.

| Segment breakdown of adjusted revenue (In Euro million) | H1 2018 | H1 2019 | % change | % change organic |

|---|---|---|---|---|

| Aerospace Propulsion | 4,805 | 5,902 | 22.8% | 19.0% |

| Aircraft Equipment, Defense and Aerosystems | 3,711 | 4,553 | 22.7% | 8.6% |

| Aircraft Interiors | 980 | 1,640 | 67.3% | 11.9% |

| Holding company & Others | 10 | 7 | na | na |

| Total Group | 9,506 | 12,102 | 27.3% | 14.2% |

| Segment breakdown of recurring operating income (in Euro million) | H1 2018 | H1 2019 | % change |

|---|---|---|---|

| Aerospace Propulsion % of revenue | 915 19.0% | 1,227 20.8% | 34.1% |

| Aircraft Equipment, Defense and Aerosystems % of revenue | 442 11.9% | 588 12.9% | 33.0% |

| Aircraft Interiors % of revenue | 32 3.3% | 85 5.2% | 165.6% |

| Holding company & Others | (3) | (17) | na |

| Total Group % of revenue | 1,386 14.6 % | 1,883 15.6 % | 35.9% |

| 2018 adjusted revenue by quarter (in Euro million) | Q1 2018 | Q2 2018 | Q3 2018 | Q4 2018 | FY 2018 |

|---|---|---|---|---|---|

| Aerospace Propulsion | 2,319 | 2,486 | 2,524 | 3,250 | 10,579 |

| Aircraft Equipment, Defense and Aerosystems | 1,641 | 2,070 | 2,052 | 2,179 | 7,942 |

| Aircraft Interiors | 256 | 724 | 769 | 762 | 2,511 |

| Holding company & Others | 6 | 4 | 3 | 5 | 18 |

| Total revenue | 4,222 | 5,284 | 5,348 | 6,196 | 21,050 |

| 2019 adjusted revenue by quarter (in Euro million) | Q1 2019 | Q2 2019 | H1 2019 |

|---|---|---|---|

| Aerospace Propulsion | 2,771 | 3,131 | 5,902 |

| Aircraft Equipment, Defense and Aerosystems | 2,201 | 2,352 | 4,553 |

| Aircraft Interiors | 806 | 834 | 1,640 |

| Holding company & Others | 3 | 4 | 7 |

| Total revenue | 5,781 | 6,321 | 12,102 |

| Euro/USD rate | H1 2018 | FY 2018 | H1 2019 |

|---|---|---|---|

| Average spot rate | 1.21 | 1.18 | 1.13 |

| Spot rate (end of period) | 1.17 | 1.15 | 1.14 |

| Hedged rate | 1.18 | 1.18 | 1.18 |

Notes

[1] Adjusted data

To reflect the Group’s actual economic performance and enable it to be monitored and benchmarked against competitors, Safran prepares an adjusted income statement alongside its consolidated financial statements.

Safran’s consolidated income statement has been adjusted for the impact of:

- purchase price allocations with respect to business

combinations. Since 2005, this restatement concerns the amortization

charged against intangible assets relating to aircraft programs revalued

at the time of the Sagem-Snecma merger. With effect from the

first‑half 2010 interim financial statements, the Group decided to

restate:

- the impact of purchase price allocations for business combinations, particularly amortization charged against intangible assets recognized at the time of the transaction and amortized over extended periods due to the length of the Group’s business cycles and the impact of remeasuring inventories, as well as

- gains on remeasuring any previously held equity interests in the event of step acquisitions or asset contributions to joint ventures;

Safran has also applied these restatements to the acquisition of Zodiac Aerospace with effect from 2018.

- the mark-to-market of foreign currency derivatives, in order to

better reflect the economic substance of the Group’s overall foreign

currency risk hedging strategy:

- revenue net of purchases denominated in foreign currencies is measured using the effective hedged rate, i.e., including the costs of the hedging strategy,

- all mark-to-market changes on instruments hedging future cash flows are neutralized.

The resulting changes in deferred tax have also been adjusted.

[2] Recurring operating income

Operating income before capital gains or losses on disposals /impact of changes de contrôle, impairment charges, transaction and integration costs and other items.

[3] Free cash flow

This non-accounting indicator (non-audited) is equal to cash flow from operating activities less working capital and acquisitions of property, plant and equipment and intangible assets.

[4] Civil aftermarket (expressed in USD)

This non-accounting indicator (non-audited) comprises spares and MRO (Maintenance, Repair & Overhaul) revenue for all civil aircraft engines for Safran Aircraft Engines and its subsidiaries and reflects the Group’s performance in civil aircraft engines aftermarket compared to the market.

H1 2019 reconciliation between consolidated income statement and adjusted consolidated income statement:

| H1 2019 (in Euro million) | Consolidated data | Currency hedging | Business combinations | Adjusted data | ||

|---|---|---|---|---|---|---|

| Remeasurement of revenue (1) | Deferred hedging gain / loss (2) | Amortization of intangible assets – Sagem-Snecma merger (3) | PPA impacts – other business combinations (4) | |||

| Revenue | 12,315 | (213) | – | – | – | 12,102 |

| Other operating income and expenses | (10,502) | (2) | – | 25 | 176 | (10,303) |

| Share in profit from joint ventures | 64 | – | – | – | 20 | 84 |

| Recurring operating income | 1,877 | (215) | – | 25 | 196 | 1,883 |

| Other non-recurring operating income and expenses | 32 | – | – | – | – | 32 |

| Profit (loss) from operations | 1,909 | (215) | 0 | 25 | 196 | 1,915 |

| Cost of debt | (21) | – | – | – | – | (21) |

| Foreign exchange gains (losses) | 150 | 215 | (353) | – | – | 12 |

| Other financial income and expense | (23) | – | – | – | – | (23) |

| Financial income (loss) | 106 | 215 | (353) | – | – | 12 |

| Income tax expense | (550) | – | 113 | (8) | (51) | (496) |

| Profit (loss) from continuing operations | 1,465 | – | (240) | 17 | 145 | 1,387 |

| Attributable to non-controlling interests | (33) | – | – | (1) | – | (34) |

| Attributable to owners of the parent | 1,432 | – | (240) | 16 | 145 | 1,353 |

(1) Remeasurement of foreign-currency denominated revenue net of purchases (by currency) at the hedged rate (including premiums on unwound options) through the reclassification of changes in the fair value of instruments hedging cash flows recognized in profit or loss for the period.

(2) Changes in the fair value of instruments hedging future cash flows that will be recognized in profit or loss in future periods (negative €353 million excluding tax), and the impact of taking into account hedges when measuring provisions for losses on completion (zero at June 30, 2019).

(3) Cancelation of amortization/impairment of intangible assets relating to the remeasurement of aircraft programs resulting from the application of IFRS 3 to the Sagem-Snecma merger.

(4) Cancellation of the impact of remeasuring assets at the time of the Zodiac Aerospace acquisition for €156 million excluding deferred tax and cancellation of amortization/impairment of assets identified during other business combinations.

(1) Remeasurement of foreign-currency denominated revenue net of purchases (by currency) at the hedged rate (including premiums on unwound options) through the reclassification of changes in the fair value of instruments hedging cash flows recognized in profit or loss for the period.

(2) Changes in the fair value of instruments hedging future cash flows that will be recognized in profit or loss in future periods (negative €353 million excluding tax), and the impact of taking into account hedges when measuring provisions for losses on completion (zero at June 30, 2019).

(3) Cancelation of amortization/impairment of intangible assets relating to the remeasurement of aircraft programs resulting from the application of IFRS 3 to the Sagem-Snecma merger.

(4) Cancellation of the impact of remeasuring assets at the time of the Zodiac Aerospace acquisition for €156 million excluding deferred tax and cancellation of amortization/impairment of assets identified during other business combinations.

Readers are reminded that only the consolidated financial statements are reviewed by the Group’s statutory auditors. The consolidated financial statements include revenue and operating profit indicators set out in the adjusted data in Note 5, “Segment information” of the half-year consolidated financial statements.

Adjusted financial data other than the data provided in Note 5, “Segment information” of the consolidated financial statements, are subject to verification procedures applicable to all of the information provided in the half-year financial report.

Be the first to comment on "Safran : 2019 first-half results"