The evolving nature of warfare and threat perceptions in the Asia-Pacific region has increased the demand for robust maintenance, repair, and overhaul (MRO) practices substantially. Disciplined MRO practices ensure higher operational availability rates of military platforms such as fixed-wing aircrafts, helicopters, naval vessels, and land vehicles. Against this backdrop, the cumulative maintenance cost burden of the military platform fleet of Asia-Pacific countries is estimated to be about $44 billion in 2025, reveals GlobalData, a leading data and analytics company.

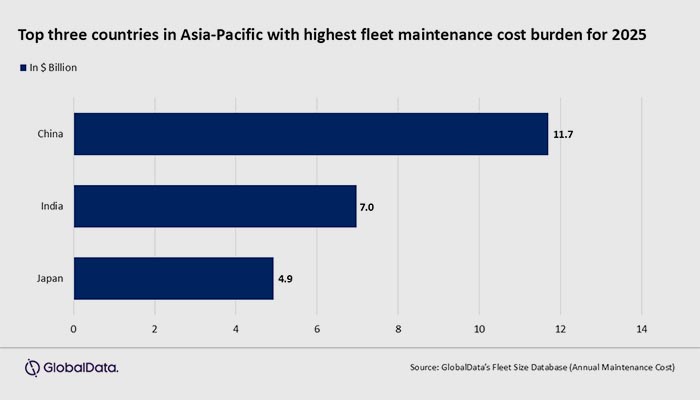

GlobalData’s dashboard on Annual Maintenance Cost (part of the Fleet Size database) reveals that, with 28% share of the total addressable market (TAM), the Asia-Pacific region will provide most number of opportunities for maintenance service providers throughout this decade. Within Asia-Pacific, China, India, and Japan are the top three countries with highest maintenance cost burden owing to their large fleet of in-service defense platforms as of January 2025.

Harsh Deshmukh, Aerospace & Defense Analyst at GlobalData, comments: “The governments in the Asia-Pacific region have the highest maintenance cost burden on the Military Land Vehicles segment, which is estimated to be about $15 billion for 2025. This cost is further aggravated due to the large inventory of aging Soviet-origin main battle tanks, armored personnel carriers, and tactical trucks. Leading Asia-Pacific companies catering to this market segment include China North Industries Group Corp Ltd (Norinco), Dongfeng Motor Corporation Ltd, Poly Technologies, Armoured Vehicles Nigam Ltd, Tata Advanced Systems Ltd, Mitsubishi Heavy Industries Ltd, and LIG NEX1 Co.”

The annual maintenance cost burden on Asia-Pacific’s Military Fixed Wing Aircraft fleets is estimated to be about $13 billion for 2025. As countries in the region try to address the perennial issues related to the low availability rate of their Fixed Wing Aircraft fleet, significant opportunities exist for global primes and subcontractors.

Deshmukh concludes: “Growing tension and territorial disputes across the Asia-Pacific, especially in the South China Sea, will not just drive the countries to procure new defense platforms but will also compel policymakers to pay more attention to the maintenance of their in-service fleet. India, China, and Pakistan have seen several border skirmishes in recent years, which have necessitated the respective governments to increase their spending on maintenance activities. The efforts made towards the improvement of the defense readiness levels by these countries will continue to pave the way for maintenance contracts to both domestic and international companies with relevant product portfolios.”

Source : GlobalData

Be the first to comment on "Need for mission readiness to drive maintenance expenditure on in-service military platforms in Asia-Pacific in 2025, says GlobalData"