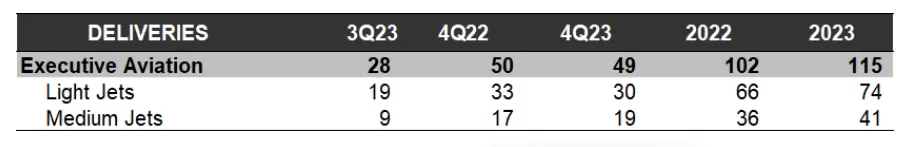

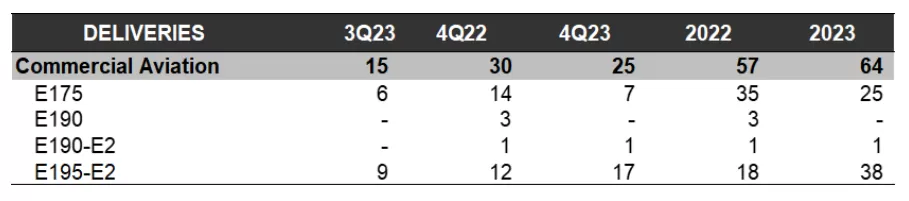

- Embraer delivered 75 jets in 4Q23, of which 25 were commercial aircraft, 49 were executive jets (30 light and 19 medium) and 1 was a military C-390. In 2023, the company delivered a total of 181 jets, of which 64 were commercial aircraft, 115 were executive jets (74 light and 41 medium) and 2 were military C-390. Embraer’s deliveries increased 13% year-on-year (yoy) when compared to the 160 jets in 2022. The company continues to face supply chain delays which have negatively impacted 2023 results.

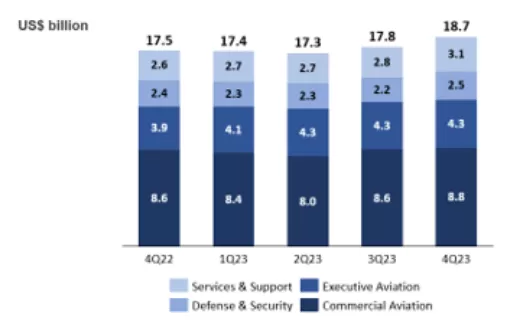

- Firm order backlog ended 4Q23 at US$18.7 billion, the highest number recorded over the past 6 years. Executive and Commercial Aviation registered book-to-bill in excess of 1:1. Meanwhile, Services & Support backlog reached US$3.1 billion – the highest ever registered.

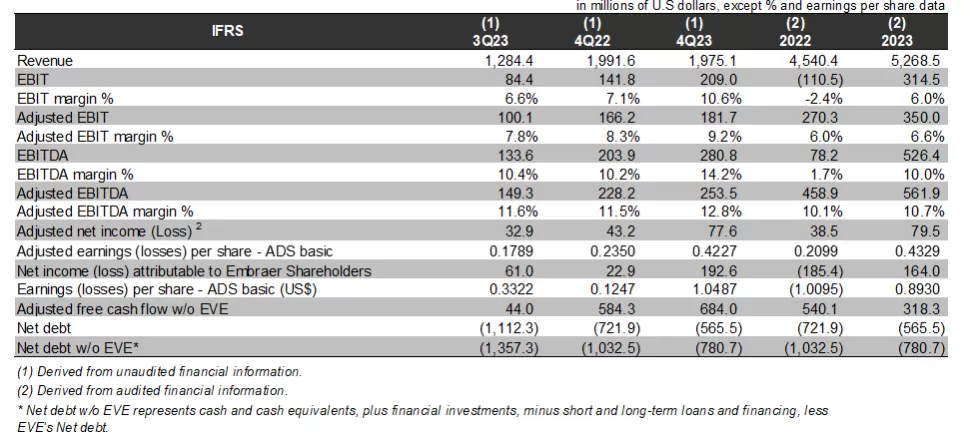

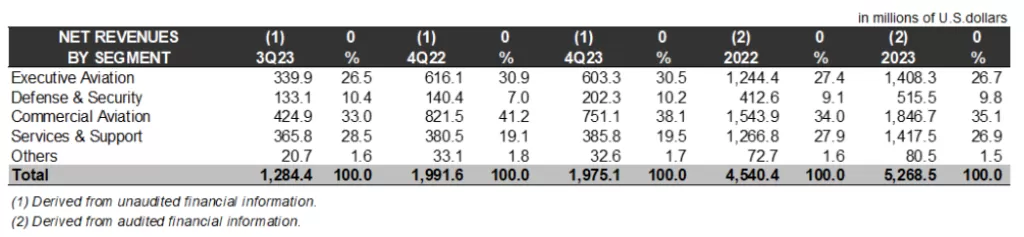

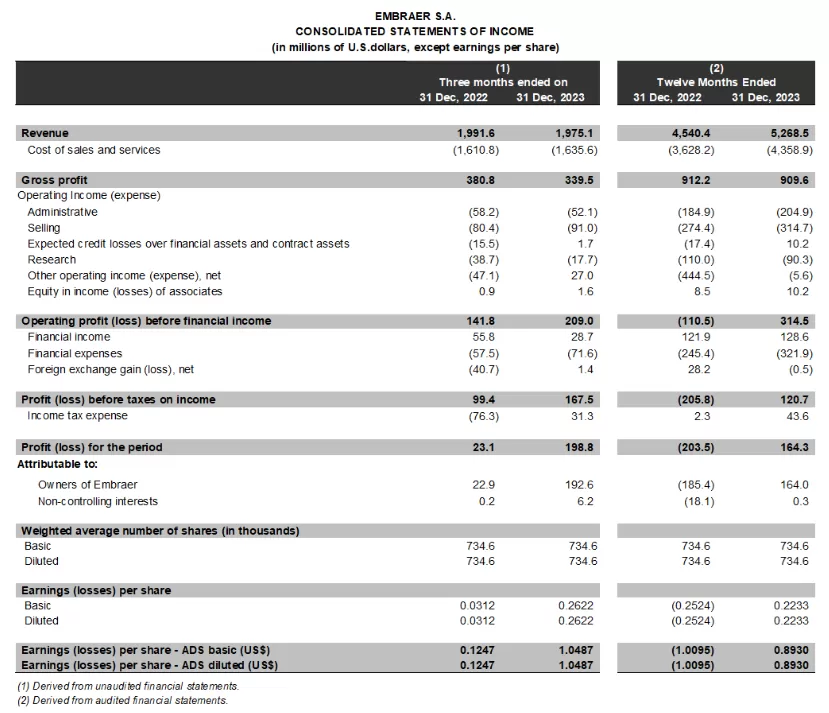

- Revenues totaled US$1,975 million in 4Q23 and US$5,269 million in 2023, in line with company guidance and 16% higher than in 2022. All business units had double digit revenues and volumes growth yoy; Defense which posted 25% growth was the highlight, followed closely by Commercial Aviation with 20%.

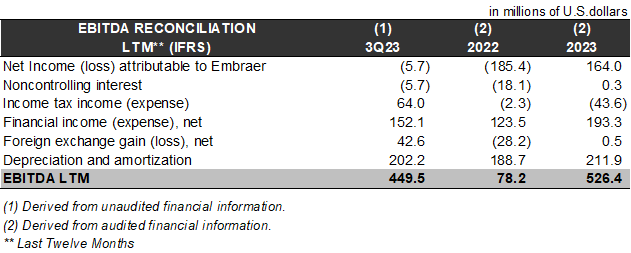

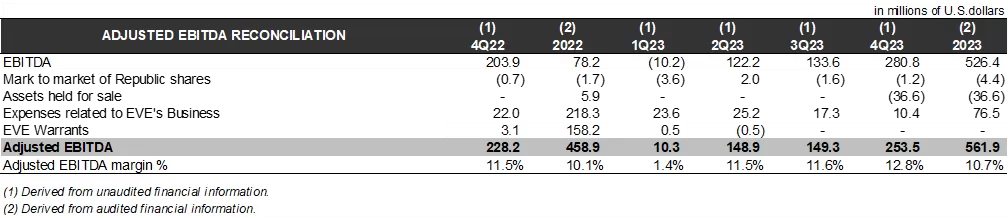

- Adjusted EBIT reached US$181.7 million in 4Q23, with adjusted EBIT and EBITDA margins of 9.2% and 12.8%, respectively. In 2023, the company reported adjusted EBIT of US$350.0 million, with adjusted EBIT and EBITDA margins of 6.6% and 10.7%, meeting guidance for the year driven by volume, enterprise and tax efficiencies.

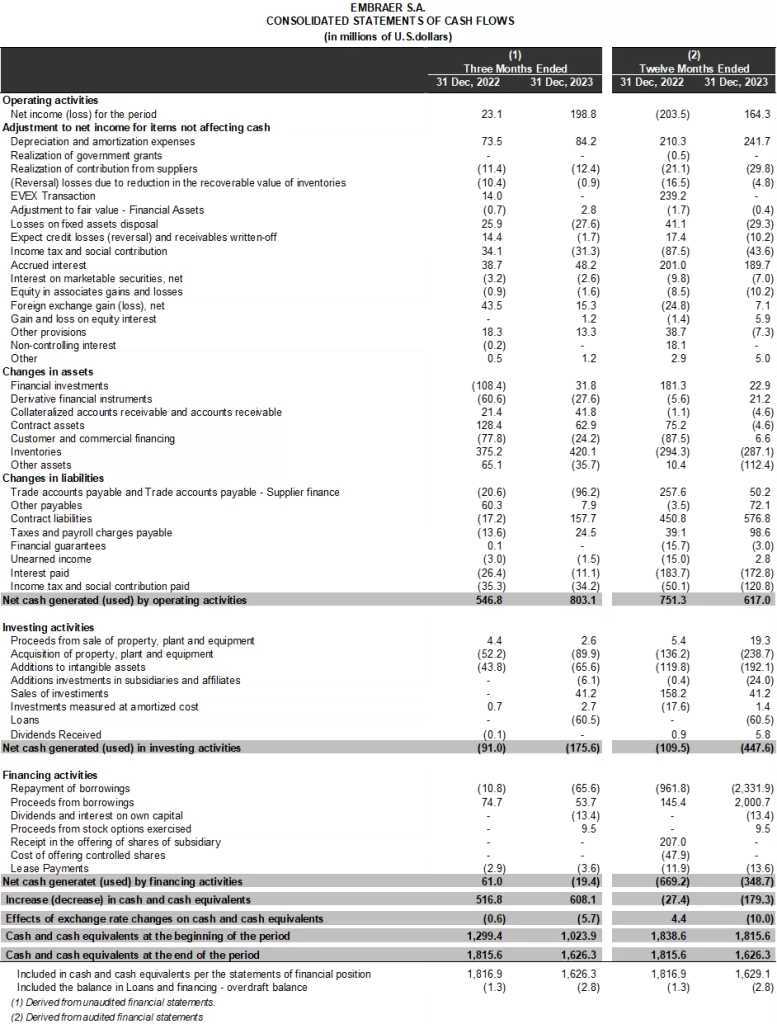

- Adjusted free cash flow w/o EVE (FCF) in 4Q23 was US$684.0 million, and propped full year FCF to US$318.3 million, which surpassed guidance driven by strong sales pre-down payments (PDPs).

- S&P Global Ratings raised Embraer to investment grade (IG) while Moody’s upgraded to Ba1 (one notch below IG). Meanwhile, Fitch, which rates the company BB+ (one notch below IG), revised the company´s outlook to positive.

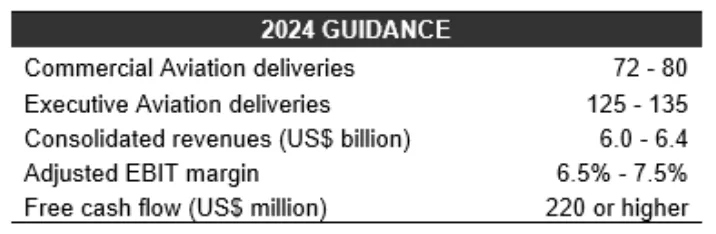

- Guidance for 2024: Commercial Aviation deliveries between 72 and 80 aircraft, and Executive Aviation deliveries between 125 and 135 aircraft. Total company revenues in a US$6.0 to US$6.4 billion range, adjusted EBIT margin between 6.5% and 7.5%, and adjusted free cash flow of US$220 million or higher for the year.

MAIN FINANCIAL RESULTS

São Paulo, Brazil, March 18, 2024 – (B3: EMBR3, NYSE: ERJ). The company’s operating and financial information is presented, except where otherwise stated, on a consolidated basis in United States dollars (US$) in accordance with IFRS. The financial data presented in this document as of and for the quarters ended December 31, 2023 (4Q23), September 30, 2023 (3Q23), and December 31, 2022 (4Q22), are derived from the unaudited financial statements, except annual financial data and where otherwise stated.

2024 GUIDANCE (does not consider EVE)

REVENUE AND GROSS MARGIN

Consolidated revenue of US$5,269 million in 2023 represented an increase of 16% yoy, and it was explained by Defense & Security (25%), Commercial Aviation (20%), Executive Aviation (13%) and Services & Support (12%). Total revenues were within the US$5.2 to US$5.7 billion guidance range for the year.

- Executive Aviation revenues reached US$1,408 million, 13% higher yoy mainly explained by an increase in volumes. The gross margin dropped from 23.4% to 19.4% yoy because of product mix (proportionally more medium rather than light jets) and one-time tax benefits.

- Defense & Security revenues were US$516 million, 25% higher yoy driven by higher C-390 volumes. Reported gross margin of 20.8% in 2022 versus 16.6% in 2023 was due to product mix and baseline adjustments of current contracts in accordance with the percentage of completion calculation methodology.

- Commercial Aviation revenues totaled US$1,847 million, 20% higher yoy because of higher deliveries and product mix. Reported gross margin decreased from 10.5% in 2022 to 8.0% in 2023 due to product mix, higher freight (E2 airframes ramp-up) and one-time tax benefits.

- Services & Support revenues equaled US$1,418 million, 12% higher yoy because of market growth. Reported gross margin of 28.0% in 2022 declined to 26.7% in 2023 due to services mix (more contribution from MRO and services) and one-time tax benefits.

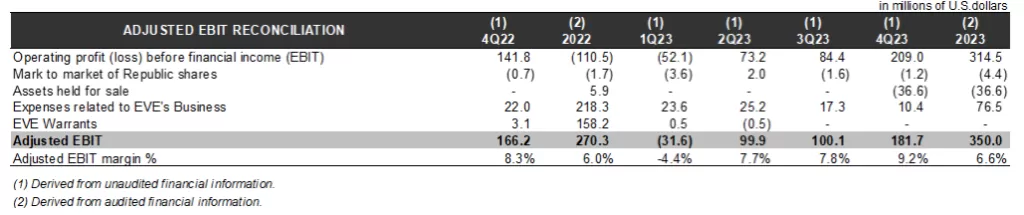

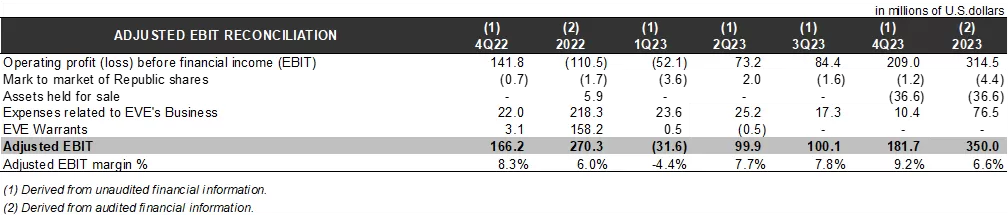

ADJUSTED EBIT

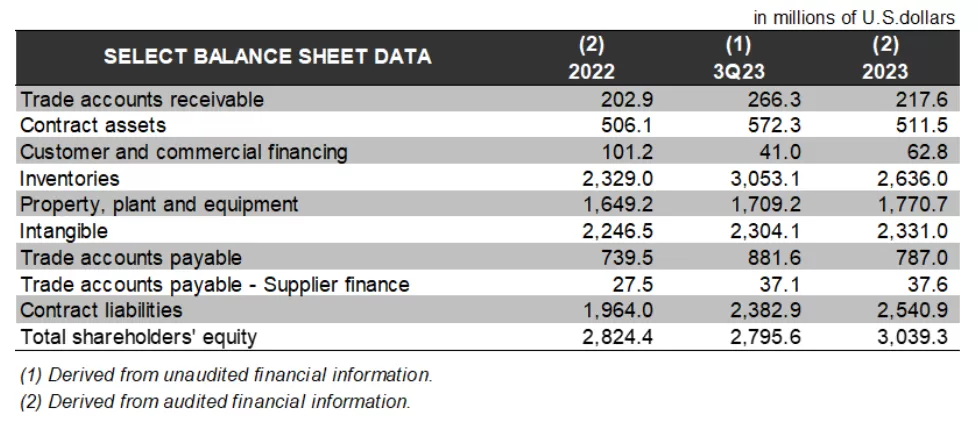

The company’s reported results for 2023 are summarized in the table below.

In 4Q23, adjusted EBIT was US$181.7 million while adjusted EBIT margin was 9.2% if we exclude the above special items. Meanwhile, in 2023, adjusted EBIT was US$350.0 million and adjusted EBIT margin was 6.6%, and increase of US$79.7 million yoy because of higher volumes across all business units and other operational income (taxes efficiencies in 2023 and higher corporate expenditures in 2022).

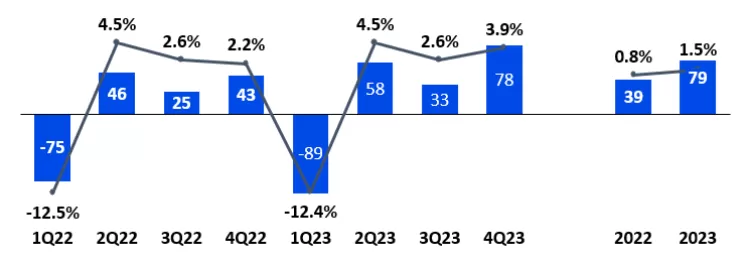

NET INCOME (LOSS)

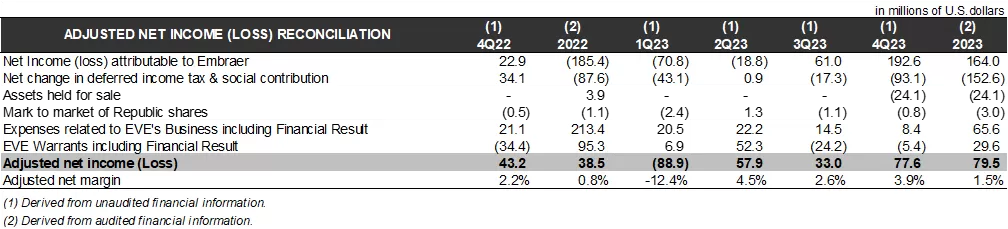

Net income (loss) attributable to Embraer shareholders and income (loss) per ADS were US$192.6 million and US$1.0487 per share in 4Q23, compared to US$22.9 million and US$0.1247 in 4Q22. If we exclude extraordinary effects, adjusted net income was US$77.6 million for the quarter compared to US$43.2 million a year ago, and represented an 80% increase. In 3Q23, EVE development costs began to be capitalized as intangible assets as the program reached sufficient maturity.

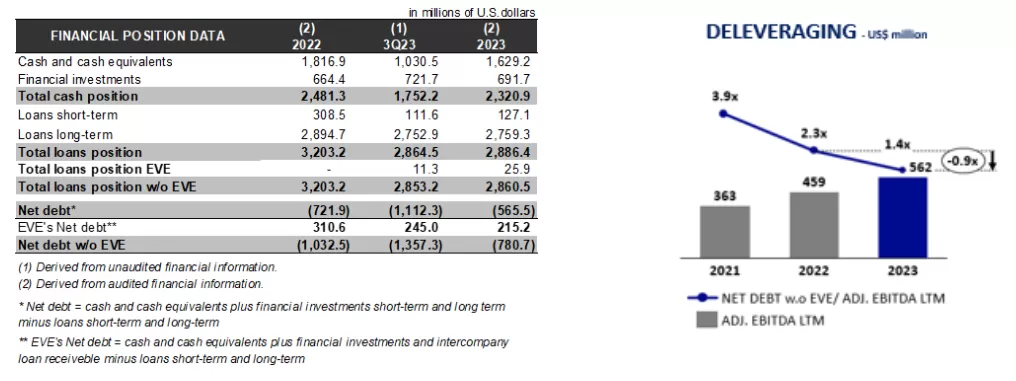

DEBT & LIABILITY MANAGEMENT

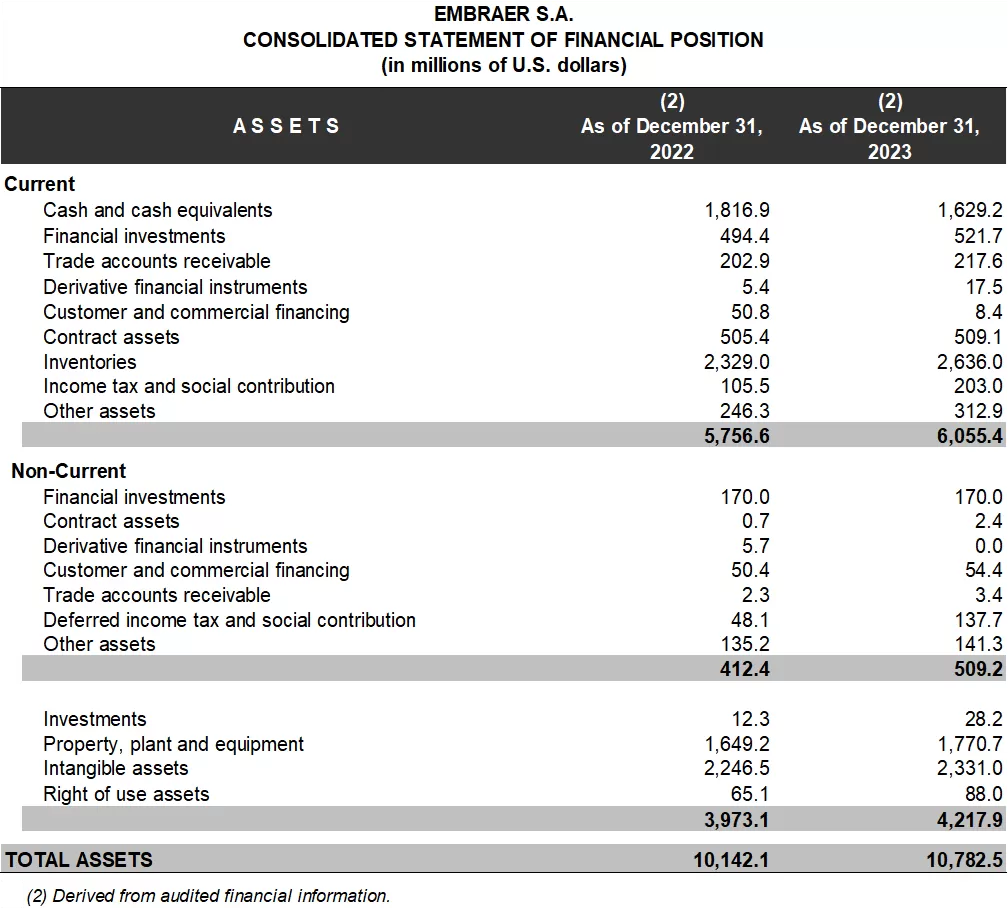

Embraer net debt without EVE declined to US$781 million in 4Q23, compared to US$1,357 million qoq and US$1,033 million yoy. The significant positive free cash flow generated in the quarter helps explain the sequential improvement in the company’s net debt position, as explained below.

The average loan maturity increased to 4.6 years in 4Q23, compared to 3.4 years yoy. The term structure of loans was 96% in long-term contracts and only 4% in short-term ones. The cost of United States dollar-denominated loans was 6.33% p.a. in 4Q23, or the same as in 3Q23, while the cost of Brazilian real-denominated loans decreased to 7.11% p.a. in the quarter, compared to 10.85% in the previous one.

2Maturities = Do not consider accrued interest and deferred costs

*All numbers from EVE are IFRS

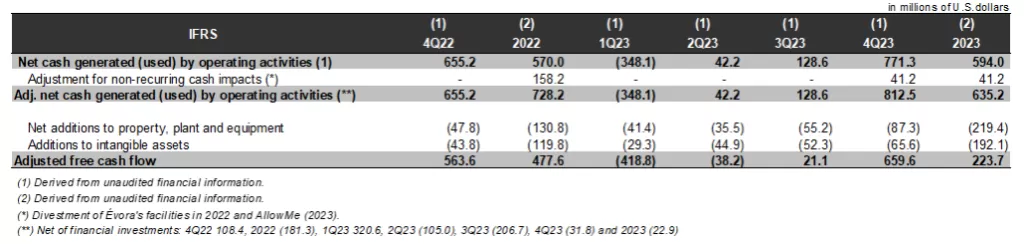

FREE CASH FLOW

Adjusted free cash flow totaled US$318 million during 2023, and it surpassed the guidance for the year because of strong sales pre-down payments (PDPs) in 4Q23.

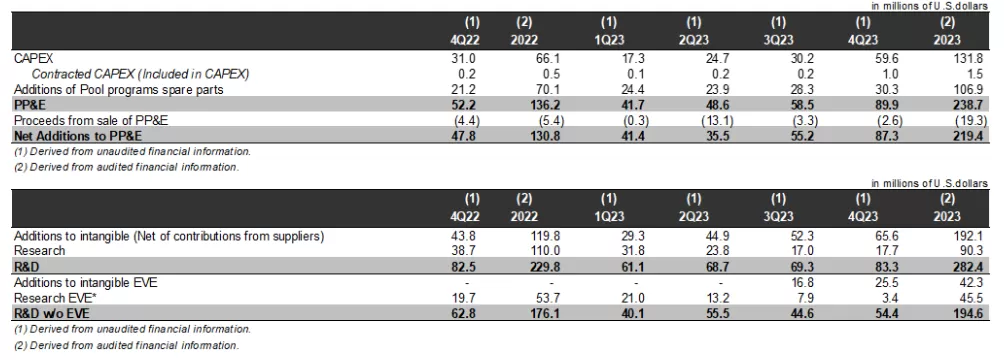

CAPEX

Net additions to total PP&E were US$87.3 million in 4Q23, versus US$47.8 million in 4Q22. Of the quarterly total, CAPEX amounted to US$59.6 million, while additions of pool program spare parts reached US$30.3 million, and were partially offset by US$2.6 million of PP&E sales proceeds. The sequential increase in PP&E is related to growth in services training, maintenance and Executive Aviation. In 2023, the company invested a total of US$219.4 million in net additions to PP&E and US$194.6 million in R&D without EVE. In 3Q23, EVE development costs began to be capitalized as intangible assets as the program reached sufficient maturity.

WORKING CAPITAL

Work-in-progress inventory decreased US$417.1 million qoq because of the greater number of 4Q23 deliveries, which was partially mitigated by growing contract liabilities (PDPs and deferred revenue), and supported solid cash flow generation towards year-end.

TOTAL BACKLOG

The company’s backlog rose by US$1.2 billion yoy and reached a US$18.7 billion total in 2023 – the highest number recorded over the past 6 years. Services & Support were the highlight with a US$3.1 billion backlog, or US$400 million higher yoy and the highest level ever recorded. Meanwhile, Executive Aviation ended the year with a book-to-bill in excess of 1.3:1 and a US$4.3 billion backlog, or US$400 million higher yoy. In Defense & Security, South Korea was in the spotlight with the victory of the C-390 Millennium. Last, but not least, Commercial Aviation ended the year with a book-to-bill in excess of 1.1:1.

Embraer delivered 75 jets in 4Q23, with 49 executive jets (30 light and 19 medium), 25 commercial jets and 1 military C-390. In 2023, Embraer supplied 181 aircraft, an increase of 13% yoy when the company delivered 160 units. The company continues to face supply chain delays which have negatively impacted 2023 deliveries.

EXECUTIVE JETS

Executive Aviation delivered 30 light and 19 medium jets, totaling 49 aircraft in 4Q23 and 115 in 2023, an increase of 13% compared to the same period in 2022, when 102 jets were delivered.

The business unit continued its positive sales momentum with sustained demand across its entire product portfolio and strong customer acceptance in both retail and fleet markets. The Phenom 300 was the most delivered light jet for the 12th consecutive year and the most delivered twin-jet for the 4th consecutive year.

Embraer announced a Praetor 600, equipped with the capabilities to undertake a wide range of flight inspection tasks, was delivered to South Korea’s Flight Inspection Services Center. This is the first Praetor 600 in the country.

DEFENSE & SECURITY

In Asia, South Korea announced Embraer’s C-390 Millennium as the winner of the Large Transport Aircraft (LTA) II public tender to provide new military transport aircraft. The country is the C-390 Millennium’s 7th customer and the 1st in the region. The contract includes an undisclosed number of aircraft, as well as a services & support package that includes training, ground support equipment and spare parts.

In the Middle East, the MoU between Embraer and SAMI is geared towards expanding the operational footprint of both companies in the Kingdom of Saudi Arabia, with a focus on promoting the capabilities of the C-390 Millennium aircraft and delivering support to the kingdom’s Ministry of Defense. SAMI and Embraer will work to establish several capabilities in the country including maintenance, aircraft final assembly, mission system integration and training activities.

In Europe, Embraer and the Netherlands Industries for Defence & Security (NIDV) signed a Memorandum of Understanding (MoU) with the aim of jointly exploring opportunities in line with the Netherlands Defense Industry Strategy, with a primary focus on the C-390 Millennium and the A-29N Super Tucano.

Finally, in October, the 1st KC-390 Millennium of the Portuguese Air Force (FAP) entered service. The aircraft includes standard NATO (North Atlantic Treaty Organization) equipment, and since then it has demonstrated the same exceptional level of productivity as recorded by the Brazilian Air Force’s fleet.

COMMERCIAL AVIATION

Embraer delivered 25 commercial jets in 4Q23, and 64 aircraft in 2023, or 12% higher than in the previous year.

In North America, Porter Airlines exercised its purchase rights to place a firm order for 25 Embraer E195-E2 passenger jets, which added to its 50 existing firm orders. Porter will use the new aircraft to extend its award-winning service to destinations throughout the continent. The deal, valued at US$2.1 billion at list price, entered our backlog in 4Q23, and increased the airline’s firm orders with Embraer to 75 aircraft, with 25 purchase rights remaining.

In Asia, Embraer’s E190-E2 and E195-E2 attained type certification from the Civil Aviation Authority of Singapore (CAAS). The aircraft are the world’s quietest and most fuel-efficient single-aisle aircraft. Scoot, the low-cost subsidiary of Singapore Airlines, should begin to operate the E190-E2 in 2024.

Last, but not least, in Europe, the E195-E2 received certification for Steep Approach into London City Airport from EASA (European Aviation Safety Agency). This achievement is a significant development, which allows airlines to operate the E195-E2 at London City Airport (LCY), known for its challenging approach and short runway. Together with the E190-E2, which received Steep Approach certification in 2021, both members of the E2 family are now approved for operations from LCY.

SERVICES & SUPPORT

Services & Support reached a significant milestone in the Commercial Aviation segment in 4Q23 with the advancement of the program to convert passenger aircraft to freighters, which marked the beginning of a new phase with the unveiling of the new livery and the start of ground testing.

The business unit continued to accelerate its expansion and it has doubled the capacity for executive jet maintenance services in the United States. The expansion will support the continuous growth of its customer base through the addition of 3 Executive Aviation Maintenance, Repair, and Overhaul (MRO) facilities in Dallas Love Field, TX, Cleveland, OH, and Sanford, FL.

Embraer-CAE Training Services (ECTS) announced a strategic expansion of its training capacity with the introduction of 2 Phenom 300 flight simulators. The main objective of our joint venture remains to meet the growing demand for executive jet training in the North American and European markets, and reinforces our commitment to our Executive Aviation customers.

RECONCILIATION OF IFRS AND “NON-GAAP” INFORMATION

We define free cash flow as operating cash flow less Additions to property, plant and equipment, Additions to intangible assets, Financial investments and Other assets. Free cash flow is not an accounting measure under IFRS. Free cash flow is presented because it is used internally as a measure for the evaluation of certain aspects of our business. The company also believes some investors find it to be a useful tool for measuring Embraer’s cash position. Free cash flow should not be considered as a measure of the company’s liquidity or as a measure of its cash flow as reported under IFRS. In addition, free cash flow should not be interpreted as a measure of residual cash flow available to the company for discretionary expenditures, since the company may have mandatory debt service requirements or other nondiscretionary expenditures that are not deducted from this measure. Other companies in the industry may calculate free cash flow differently from Embraer for purposes of their earnings releases, which thus limits its usefulness for comparison between Embraer and other companies in the industry.

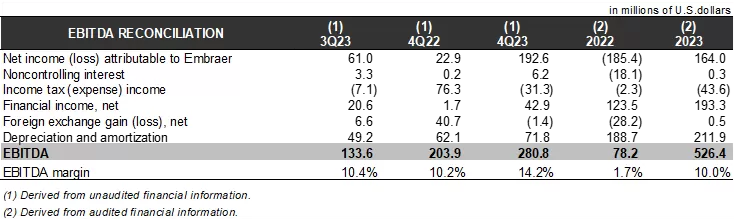

EBITDA LTM represents earnings before interest, taxation, depreciation, and amortization accumulated over a period of the last 12 months. It is not a financial measure of the company’s financial performance under IFRS. EBIT, as mentioned in this press release, refers to earnings before interest and taxes, and for the purpose of reporting is the same as reported on the Income Statement as Operating Profit before Financial Income.

EBIT and EBITDA are presented because they are used internally as measures to evaluate certain aspects of the business. The company also believes some investors find them to be useful tools for measuring a company’s financial performance. EBIT and EBITDA should not be considered as alternatives to, in isolation from, or as substitutes for, analysis of the company’s financial condition or results of operations, as reported under IFRS. Other companies in the industry may calculate EBIT and EBITDA differently from Embraer for the purpose of their earnings releases, which limits EBIT and EBITDA’s usefulness as comparative measures.

Adjusted EBIT and Adjusted EBITDA are non-GAAP measures, and both exclude the impact of several non-recurring items, as described in the tables below.

Adjusted net income is a non-GAAP measure, calculated by adding Net Income attributable to Embraer Shareholders plus Deferred Income tax and social contribution for the period, as well as removing the impact of non-recurring items. Furthermore, under IFRS, for purposes of the calculation of Embraer’s Income Tax benefits (expenses), the company is required to record taxes resulting from gains or losses due to the impact of the changes in the Brazilian real to the US dollar exchange rate over non-monetary assets (primarily Inventories, Intangibles, and PP&E). It is important to note taxes which results from gains or losses over non-monetary assets are considered deferred taxes and are accounted for in the company’s consolidated Cash Flow statement, under Deferred income tax and social contribution.

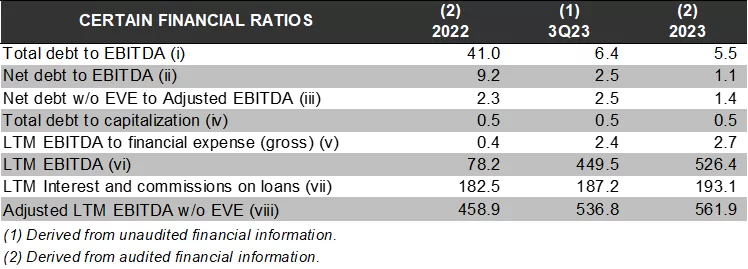

RATIOS BASED ON “NON-GAAP” INFORMATION

ABOUT EMBRAER

A global aerospace company headquartered in Brazil, Embraer has businesses in Commercial and Executive Aviation, Defense & Security and Agricultural Aviation. The company designs, develops, manufactures and markets aircraft and systems, providing after-sales service and support to customers.

Since it was founded in 1969, Embraer has delivered more than 8,000 aircraft. On average, every 10 seconds an aircraft manufactured by Embraer takes off somewhere in the world, transporting more than 145 million passengers a year.

Embraer is the main manufacturer of commercial jets with up to 150 seats and the main exporter of high value-added goods in Brazil. The company maintains industrial units, offices, service centers and parts distribution, among other activities, in the Americas, Africa, Asia and Europe.

Be the first to comment on "EMBRAER EARNINGS RESULTS 4th QUARTER 2023 and FISCAL YEAR 2023"