6K ADDITIVE SECURES A$48 MILLION THROUGH INITIAL PUBLIC OFFERING ON THE AUSTRALIAN STOCK EXCHANGE

Highlights:

- 6K Additive, Inc. (6K Additive or the Company) commences trading on the ASX under ticker symbol ‘6KA’.

- Well-supported Initial Public Offering (IPO) which raised A$48m at an Offer Price of A$1.00 per CHESS Depositary Interest (CDIs), resulting in a market capitalisation based on the Offer Price of A$267m and an enterprise value of A$206m.

- The current Burgettstown expansion plan, as detailed under the Company’s DPA Title III Grant, is fully funded following the IPO raise, with the potential to facilitate a 5x increase in powder production, site consolidation, and the addition of ingot melt capability.

- The Company’s US$27.4m loan from the EXIM Loan in partnership with the United States Department of War approval announced last week provides flexibility for additional growth initiatives beyond the current expansion plan.

- The Company continues to experience strong demand for its premium metal powders and is supporting this growth through higher production volumes and improved operational performance.

- 6KA will host an Investor Webinar tomorrow Friday, 5 December 2025 at 11.30am Sydney time to provide an overview of the Company and discuss recent achievements.

Burgettstown, PA, December 4th, 2025 – 6K Additive, a global leader in advanced metal powders and alloy additions, today announced the successful completion of its IPO on the Australian Stock Exchange (ASX), raising A$48m at an offer price of A$1.00 per CDI (Offer Price). At the Offer Price, 6K Additive has an initial market capitalization of approximately A$267m and an enterprise value of approximately A$206m. The Company’s CDIs will trade on ASX under the ticker symbol 6KA. The IPO attracted strong support from a range of new institutional, family office and sophisticated investors in Australia and overseas, together with existing shareholders. Trusted by leading organizations across aerospace, defense, space, medical, energy, and automotive sectors, 6K Additive plans to use the newly secured capital to support its expansion plan to better serve its growing customer base and broaden its product offerings.

Expansion plan

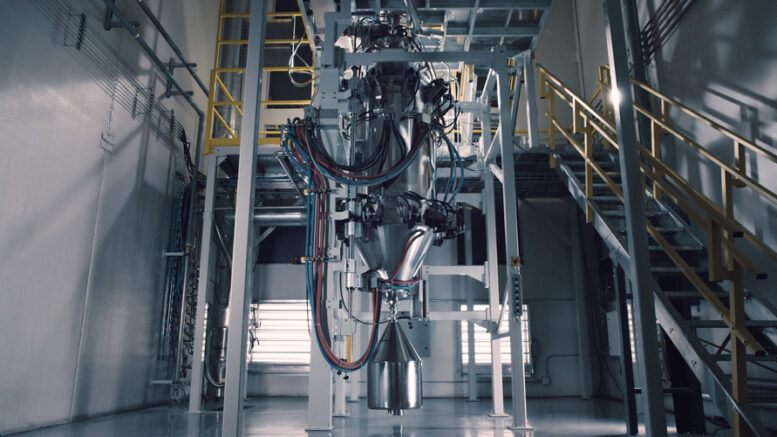

The combination of IPO proceeds and a US$23.4m grant from the US Department of War’s Defense Production Act Title III enables 6K Additive to scale its metal-powder production capacity to over five times its current output, from ~200 metric tons to 1,000 metric tons, and initiate commercial ingot production capability. Construction is already underway at the Company’s 45-acre global headquarters in Burgettstown, PA. Plans include expanding the existing powder-production operations with space for up to ten additional UniMelt® systems, adding new structures for feedstock preparation, melting operations for ingots, and building a dedicated refractory production facility.

Newly Secured EXIM Loan

The IPO comes on the heels of 6K Additive’s recent media release of the approval of a US$27.4m Export-Import Bank low-cost long-term loan facility (EXIM Loan). The EXIM Loan builds upon the DPA Title III Grant of US$23.4m to finance the construction of four new buildings and the acquisition of advanced equipment to produce titanium, nickel powders and alloy additions.

With the combination of IPO proceeds, the DPA Title III Grant, and the new EXIM Loan, 6K Additive is well-capitalised to:

- Complete its near-term capacity expansion program at its global headquarters campus in Burgettstown, PA on schedule;

- Invest in additional UniMelt® plasma systems and downstream processing equipment to significantly scale titanium and high-performance nickel alloy powder production; and

- Pursue strategic growth opportunities with key clients in the aerospace, defence, energy, and industrial sectors.

Sales Pipeline Grows to US$240m

6K Additive’s sales pipeline has expanded to US$240m as at end of November 2025, marking a US$10m increase over the past two months. This growth highlights the strong demand for 6K Additive’s premium metal powders. As demand is expected to continue to grow, 6K Additive remains committed to scaling production and optimizing operating metrics to deliver exceptional value to its customers and partners.

“The IPO and resulting capital fast-track the realization of our vision and achieve the scale with attractive unit economics and unique material breadth required by customers in defense, aerospace, energy, and medical markets,” said Frank Roberts, CEO and Managing Director of 6K Additive. “As a strategic supplier to the U.S. Department of War and its Tier-1 contractors, our products, production processes and technology have been qualified in their supply chains, reinforcing these relationships. This growth enables a domestic supply of critical materials for applications such as hypersonics, nuclear fusion, medical implants, and rocket-engine development.”

David Seldin, 6K Additive Chairman of the Board and Managing Partner of Anzu Partners commented, “As an institutional investor in 6K Additive from its inception, I witnessed this organisation grow to the leading domestic provider of metal powders and alloy additions. The breadth and quality of 6K Additive’s products, the trusted relationship with the US Department of War and the dedicated employee talent, underscores the potential this organization has in the coming 3-5 years.”

Investor webinar

6K Additive will host an investor webinar tomorrow, Friday 5 December 2025 at 11.30am Sydney time to provide an overview of the Company, its strategy and recent achievements, and to answer investor questions. Click below to register.

Source: 6K Additive

Be the first to comment on "6K ADDITIVE SECURES A$48 MILLION THROUGH INITIAL PUBLIC OFFERING"