Safran reports first quarter 2023 revenue

Strong start of the year in commercial engines

Paris, April 26, 2023

Foreword

All figures in this press release represent adjusted data, except where noted. Please refer to the definitions and reconciliation between Q1 2023 consolidated revenue and adjusted revenue. Please refer to the definitions contained in the footnotes and in the Notes on page 6 of this press statement.

Organic variations exclude changes in scope and currency impacts for the period.

CEO Olivier Andriès said: “Safran had a strong start of the year, especially in civil aftermarket which is benefiting from the recovery in narrowbody traffic to pre-crisis levels and from airlines’ readiness plan for the summer season. Our deliveries of LEAP engines have stepped up as planned, an encouraging performance in a context of persistent difficulties in the global supply chain. We are committed to meeting our customer commitments and remain both vigilant and fully confident in our efforts to offset inflation and to deliver our financial performance for the year.”

Q1 2023 revenue

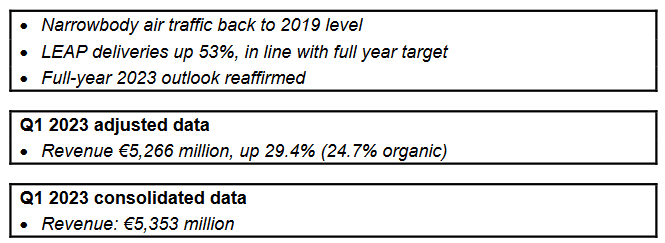

The global narrowbody capacity is back to 2019 level in Q1 2023 buoyed by a rebound in Chinese domestic air traffic after the lift of travel restrictions in December 2022. In the first three months of 2023, narrowbody ASK were at 100% (on average) of 2019.

Q1 2023 revenue increased by 29.4% at €5,266 million compared to Q1 2022. Growth was mainly fueled by Propulsion and Aircraft Interiors activities. Change in scope was €15 million1. Currency impact of €175 million reflects a positive translation impact of USD revenues, with an average €/$ spot rate of 1.07 in Q1 2023 (1.12 in Q1 2022). €/$ hedge rate was at 1.13 (1.15 in Q1 2022).

On an organic basis, Q1 2023 revenue increased by 24.7%:

Propulsion increased by 34.9% driven by a strong civil aftermarket activity (+38.1% in $) supported by a high level of spare parts sales for CFM56 and higher than expected revenue of LEAP RPFH2 contracts3. High thrust engines spare parts sales displayed a decent growth during the quarter. In Q1 2023, LEAP deliveries stepped up by 53%, reaching 366 units compared with 239 in Q1 2022, a sequential increase of 13% from 324 units in Q4 2022 and are in line with full year target. Military engine activities were up mainly due to higher M88 deliveries. Helicopter

turbine activities increased slightly both for OE and services;

Equipment & Defense was up 10.3% driven by strong aftermarket services in all division. OE

sales were constrained by industry-wide supply chain difficulties and by downwards revised demand. Aftermarket activities have been particularly strong for carbon brakes, nacelles and aerosystems activities. Electronics & Defense activities were flattish;

Aircraft Interiors revenue increased by 37.7% driven by spare parts deliveries both for Seats and Cabin. OE activities increased to a lesser extent mainly for Cabin. Business class seats deliveries were down at 324 in Q1 2023 compared to 346 in Q1 2022.

Currency hedges

The hedge book amounts to $53.7 billion in April 2023, compared to $52.6 billion in January 2023. 2023 is hedged: targeted hedge rate of $1.13, for an estimated net exposure of $10.0 billion.

2024 is hedged: targeted hedge rate between $1.13 and 1.15, for an estimated net exposure of $11.0 billion.

2025 and 2026 are hedged: targeted hedge rate between $1.12 and 1.14, for a respective estimated net exposure of $12.0 billion and $13.0 billion.

2027 is partially hedged: $10.2 billion hedged out of an estimated net exposure of $14.0 billion.

Liability management transaction (2027 OCEANEs)

Purchase of up to 9.4 million shares announced on October 28, 2022 in order to hedge the potential dilution of 2027 convertible bonds4:

As at March 31, 2023, Safran already repurchased 6.9 million shares;

On April 7, 2023, Safran has entered into an agreement for the implementation of a new tranche

of this repurchase. According to this agreement, Safran will acquire up to Euro 350 million worth

of ordinary shares from April 11, 2023 and no later than June 9, 2023.

Those shares will be delivered to 2027 OCEANEs’ holders if and when they exercise their conversion right.

Portfolio management

Cargo and catering activities (within Safran Cabin perimeter) closing is expected in Q2 2023.

Aubert & Duval share purchase agreement signed with Airbus and Tikehau Capital on June 21st, 2022. Closing expected at the end of April 2023 and the first consolidation (equity method) within Safran Propulsion division will start from May 1st, 2023.

Thales electrical systems activities closing is expected in H2 2023.

Full-year 2023 outlook reaffirmed

Safran expects to achieve for full-year 2023 (at current perimeter, adjusted data, €/$ spot rate of 1.05 and hedge rate of 1.13):

Revenue of at least €23.0 billion;

Recurring operating income of c.€3.0 billion;

Free Cash Flow of at least €2.5 billion, subject to payment schedule of some advance payments.

This outlook is based notably, but not exclusively, on the following assumptions:

No further disruption to the world economy;

Air traffic: narrowbody ASK back to 2019 level in the course of 2023;

LEAP engine deliveries: increase by c.50%;

Civil aftermarket revenue: up in the low twenties (in USD).

The main risk factor remains the supply chain production capabilities.

Safran will host today a webcast for analysts and investors at 8.30 am CET.

1) If you only want to follow the webcast and listen the conference call, please register

using the following link: https://edge.media-server.com/mmc/p/eyrgz4hw

Use this same link for the replay which will be available 2 hours after the event concludes

and remains accessible for 90 days.

2) If you want to participate in the Q&A session at the end of the conference, please pre-

register using the link below in order to receive by email the connection details (dial-in numbers and personal passcode):

https://services.choruscall.it/DiamondPassRegistration/register?confirmationNumber=259 0745&linkSecurityString=387ab1b7c

Registration links are also available on Safran’s website under the Finance home page as well as

in the “Publications and Results” and “Calendar” sub-sections.

Press release and presentation are available on Safran’s website at www.safran-group.com (Finance section).

Key figures

Notes

Adjusted revenue:

To reflect the Group’s actual economic performance and enable it to be monitored and benchmarked against competitors, Safran prepares an adjusted income statement in addition to its consolidated financial statements.

Safran’s consolidated revenue has been adjusted for the impact of:

the mark-to-market of foreign currency derivatives, in order to better reflect the economic

substance of the Group’s overall foreign currency risk hedging strategy:

– revenue net of purchases denominated in foreign currencies is measured using the effective hedged rate, i.e., including the costs of the hedging strategy,

– all mark-to-market changes on instruments hedging future cash flows are neutralized.

The resulting changes in deferred tax have also been adjusted.

First-quarter 2023 reconciliation between consolidated revenue and adjusted revenue:

Source : SAFRAN Service Presse

Be the first to comment on "Safran Q1 2023 revenue"